- China

- /

- Trade Distributors

- /

- SZSE:002072

SpectraCure Leads The Pack Of 3 Promising Penny Stocks

Reviewed by Simply Wall St

Global markets have been experiencing a turbulent start to the year, with U.S. equities declining amid inflation concerns and political uncertainty, while small-cap stocks underperformed their larger counterparts. In such choppy conditions, investors often seek opportunities in less conventional areas of the market, such as penny stocks. Although the term "penny stocks" might seem outdated, these smaller or newer companies can offer unique value propositions and growth potential when backed by strong financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$142.2M | ★★★★☆☆ |

| MGB Berhad (KLSE:MGB) | MYR0.76 | MYR449.66M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.60 | £412.43M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £1.89 | £712.18M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.44 | THB2.66B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.56 | A$67.4M | ★★★★★★ |

| Starflex (SET:SFLEX) | THB2.60 | THB2.02B | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.32M | ★★★★☆☆ |

Click here to see the full list of 5,728 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

SpectraCure (OM:SPEC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: SpectraCure AB (publ) focuses on developing cancer treatment systems and has a market cap of SEK309.85 million.

Operations: SpectraCure AB (publ) has not reported any revenue segments.

Market Cap: SEK309.85M

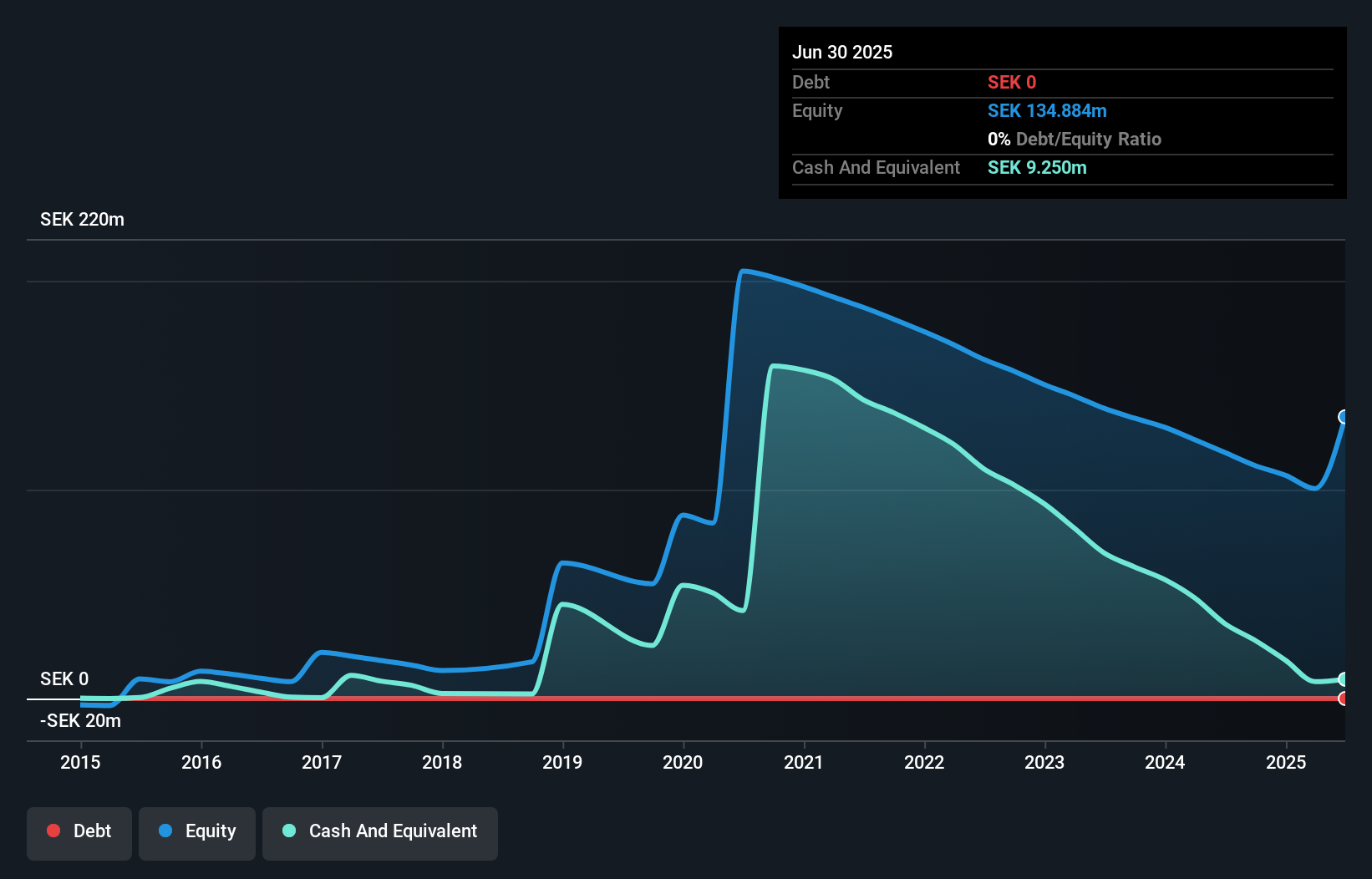

SpectraCure AB (publ) is pre-revenue, generating less than US$1 million annually, with recent quarterly revenue dropping to SEK 0.138 million. Despite being debt-free for five years and having short-term assets of SEK 31.2 million covering both short- and long-term liabilities, the company faces financial challenges with a cash runway of less than a year if current cash flow trends persist. The management team is experienced, though the board's average tenure suggests inexperience. Shareholders have not faced dilution recently; however, increased volatility highlights market uncertainty surrounding its prospects.

- Navigate through the intricacies of SpectraCure with our comprehensive balance sheet health report here.

- Assess SpectraCure's previous results with our detailed historical performance reports.

Guizhou Zhongyida (SHSE:600610)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Guizhou Zhongyida Co., Ltd is engaged in the production and sale of fine chemical products in China, with a market cap of CN¥3.44 billion.

Operations: Guizhou Zhongyida Co., Ltd has not reported specific revenue segments.

Market Cap: CN¥3.44B

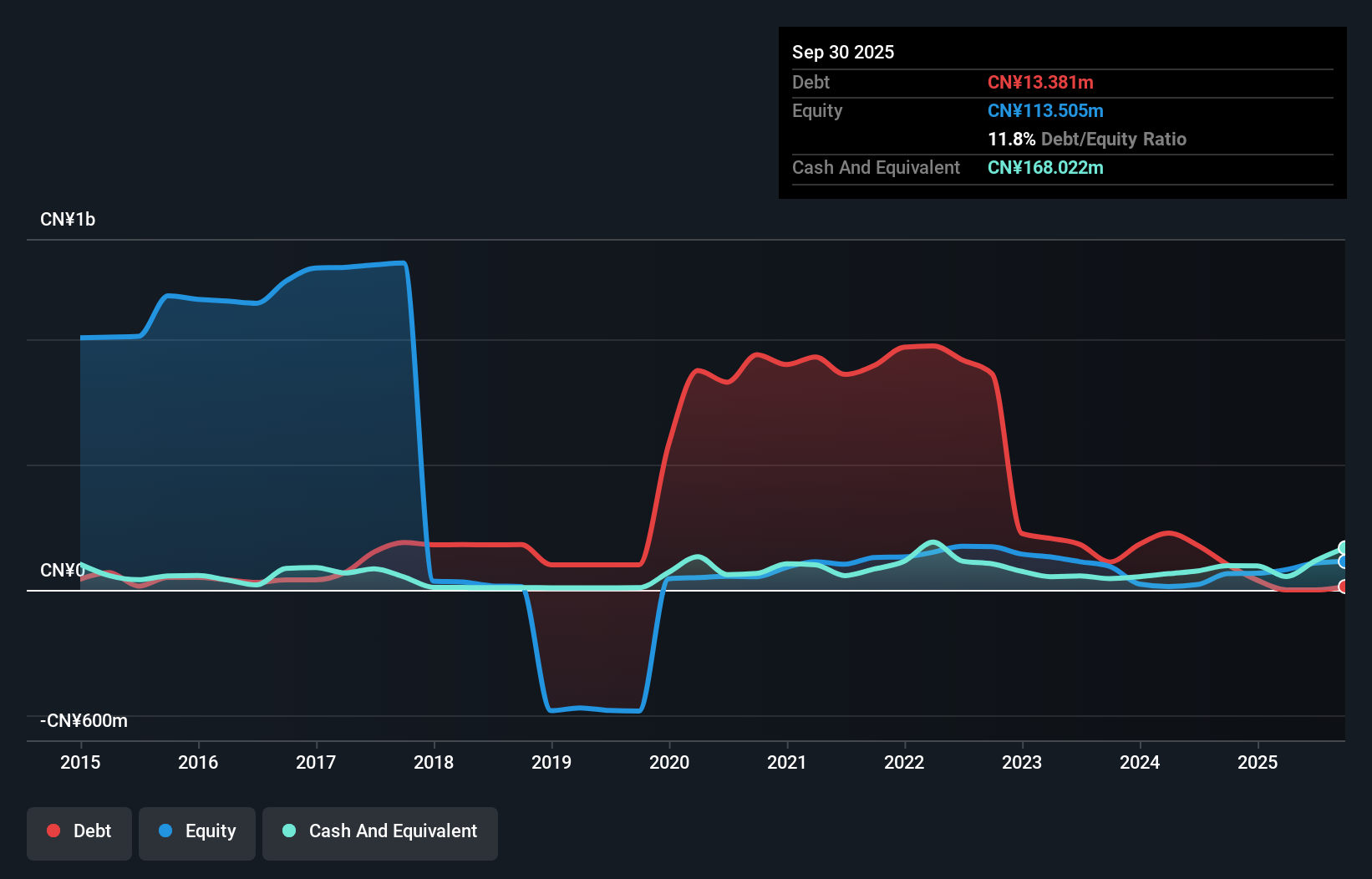

Guizhou Zhongyida Co., Ltd reported sales of CN¥810.87 million for the nine months ending September 2024, down from CN¥903.72 million the previous year, with a reduced net loss of CN¥15.08 million compared to CN¥50.29 million a year ago. Despite being unprofitable, it has over three years of cash runway due to positive free cash flow and satisfactory debt levels with a net debt to equity ratio of 5.8%. The company’s short-term assets exceed its short-term liabilities but fall short against long-term liabilities, indicating some financial constraints amidst management inexperience and recent index exclusion events.

- Click to explore a detailed breakdown of our findings in Guizhou Zhongyida's financial health report.

- Examine Guizhou Zhongyida's past performance report to understand how it has performed in prior years.

Kairuide HoldingLtd (SZSE:002072)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kairuide Holding Co., Ltd. is involved in the coal trading industry in China and has a market capitalization of CN¥1.49 billion.

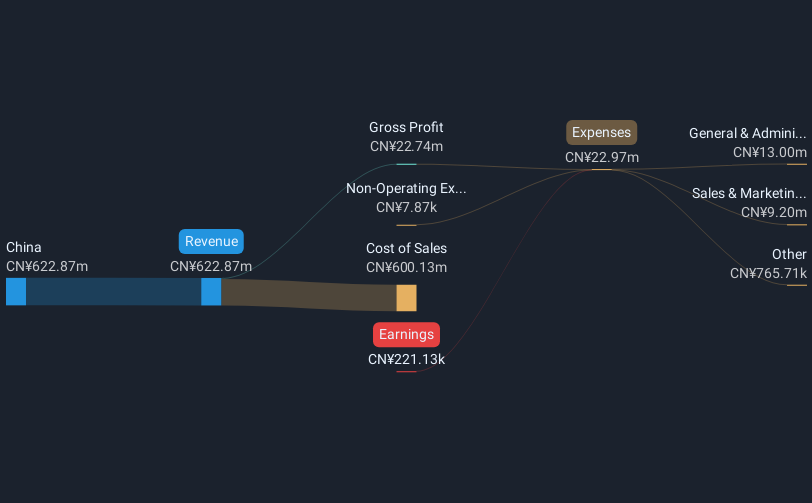

Operations: The company generates its revenue of CN¥622.87 million from operations within China.

Market Cap: CN¥1.49B

Kairuide Holding Co., Ltd. operates within China's coal trading sector, reporting sales of CN¥501.78 million for the nine months ending September 2024, a significant increase from CN¥215.34 million the previous year, though it remains unprofitable with a net loss of CN¥2.53 million. Despite this, the company benefits from being debt-free and maintains a strong cash runway exceeding three years due to positive free cash flow, which has been shrinking by 8.1% annually. Its short-term assets surpass both short-term and long-term liabilities significantly, providing some financial stability amidst ongoing profitability challenges.

- Get an in-depth perspective on Kairuide HoldingLtd's performance by reading our balance sheet health report here.

- Gain insights into Kairuide HoldingLtd's past trends and performance with our report on the company's historical track record.

Key Takeaways

- Explore the 5,728 names from our Penny Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kairuide HoldingLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002072

Adequate balance sheet minimal.

Market Insights

Community Narratives