- Sweden

- /

- Healthtech

- /

- OM:SECT B

The CEO Of Sectra AB (publ) (STO:SECT B) Might See A Pay Rise On The Horizon

Key Insights

- Sectra will host its Annual General Meeting on 10th of September

- Total pay for CEO Torbjörn Kronander includes kr5.28m salary

- The overall pay is 84% below the industry average

- Sectra's total shareholder return over the past three years was 25% while its EPS grew by 16% over the past three years

Shareholders will be pleased by the robust performance of Sectra AB (publ) (STO:SECT B) recently and this will be kept in mind in the upcoming AGM on 10th of September. The focus will probably be on the future strategic initiatives that the board and management will put in place to improve the business rather than executive remuneration when they cast their votes on company resolutions. Here is our take on why we think CEO compensation is fair and may even warrant a raise.

Check out our latest analysis for Sectra

How Does Total Compensation For Torbjörn Kronander Compare With Other Companies In The Industry?

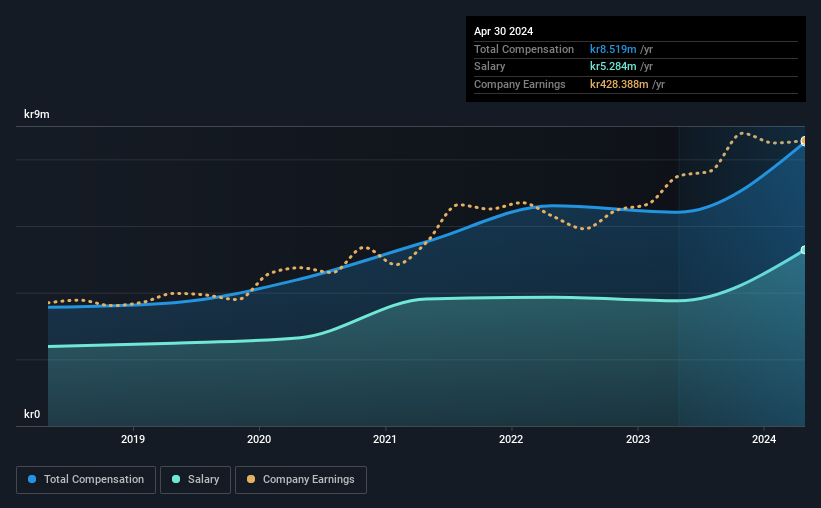

Our data indicates that Sectra AB (publ) has a market capitalization of kr46b, and total annual CEO compensation was reported as kr8.5m for the year to April 2024. That's a notable increase of 33% on last year. We note that the salary portion, which stands at kr5.28m constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the Swedish Healthcare Services industry with market capitalizations between kr21b and kr66b, we discovered that the median CEO total compensation of that group was kr54m. That is to say, Torbjörn Kronander is paid under the industry median. What's more, Torbjörn Kronander holds kr3.0b worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | kr5.3m | kr3.8m | 62% |

| Other | kr3.2m | kr2.7m | 38% |

| Total Compensation | kr8.5m | kr6.4m | 100% |

On an industry level, roughly 66% of total compensation represents salary and 34% is other remuneration. Our data reveals that Sectra allocates salary more or less in line with the wider market. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Sectra AB (publ)'s Growth Numbers

Over the past three years, Sectra AB (publ) has seen its earnings per share (EPS) grow by 16% per year. In the last year, its revenue is up 26%.

Shareholders would be glad to know that the company has improved itself over the last few years. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Sectra AB (publ) Been A Good Investment?

Sectra AB (publ) has generated a total shareholder return of 25% over three years, so most shareholders would be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

Overall, the company hasn't done too poorly performance-wise, but we would like to see some improvement. If it manages to keep up the current streak, CEO remuneration could well be one of shareholders' least concerns. Rather, investors would more likely want to engage on discussions related to key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Sectra that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SECT B

Sectra

Provides solutions for medical IT and cybersecurity sectors in Sweden, the United Kingdom, the Netherlands, and rest of Europe.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives