- Sweden

- /

- Healthtech

- /

- OM:SECT B

Swedish Growth Stocks With Strong Insider Confidence For October 2024

Reviewed by Simply Wall St

As global markets respond to China's robust stimulus measures and European hopes for interest rate cuts, Sweden's central bank has also cut its policy rate, reflecting a broader trend of easing monetary policies. In this context, growth companies with high insider ownership can be particularly appealing as they often indicate strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Truecaller (OM:TRUE B) | 29.6% | 21.6% |

| Fortnox (OM:FNOX) | 19.1% | 22.2% |

| Biovica International (OM:BIOVIC B) | 17.6% | 78.5% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| BioArctic (OM:BIOA B) | 34% | 98.4% |

| Yubico (OM:YUBICO) | 37.5% | 42.3% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| InCoax Networks (OM:INCOAX) | 19.5% | 115.5% |

| OrganoClick (OM:ORGC) | 23.1% | 109.0% |

Let's review some notable picks from our screened stocks.

Humble Group (OM:HUMBLE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Humble Group AB (publ) refines, develops, and distributes fast-moving consumer products in Sweden and internationally, with a market cap of SEK5.52 billion.

Operations: The company's revenue segments include Future Snacking at SEK950 million, Sustainable Care at SEK2.30 billion, Quality Nutrition at SEK1.53 billion, and Nordic Distribution at SEK2.67 billion.

Insider Ownership: 15.8%

Humble Group has been added to the OMX Nordic All-Share Index, reflecting its growing market presence. Recent earnings show a positive turnaround with SEK 55 million net income for the first half of 2024, compared to a loss last year. Insider activity is strong, with substantial buying in recent months. The company trades below its estimated fair value and is expected to grow revenue at 11.5% annually, although return on equity remains low at 8.7%.

- Navigate through the intricacies of Humble Group with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Humble Group's share price might be on the cheaper side.

AB Sagax (OM:SAGA A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AB Sagax (publ) is a property company operating in Sweden, Finland, France, Benelux, Spain, Germany, and other European countries with a market cap of SEK102.57 billion.

Operations: The company's revenue is primarily derived from its Real Estate - Rental segment, amounting to SEK4.63 billion.

Insider Ownership: 28.6%

AB Sagax has demonstrated robust growth, with earnings surging by 196.5% over the past year and expected to grow significantly at 29.1% annually, outpacing the Swedish market's forecasted growth. The company reported strong financials for the first half of 2024, with net income reaching SEK 2.06 billion compared to a loss previously. Despite shareholder dilution in the past year and debt coverage concerns, insider ownership remains high, aligning management interests with shareholders'.

- Click here and access our complete growth analysis report to understand the dynamics of AB Sagax.

- The valuation report we've compiled suggests that AB Sagax's current price could be inflated.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) offers solutions in medical IT and cybersecurity across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market cap of approximately SEK54.60 billion.

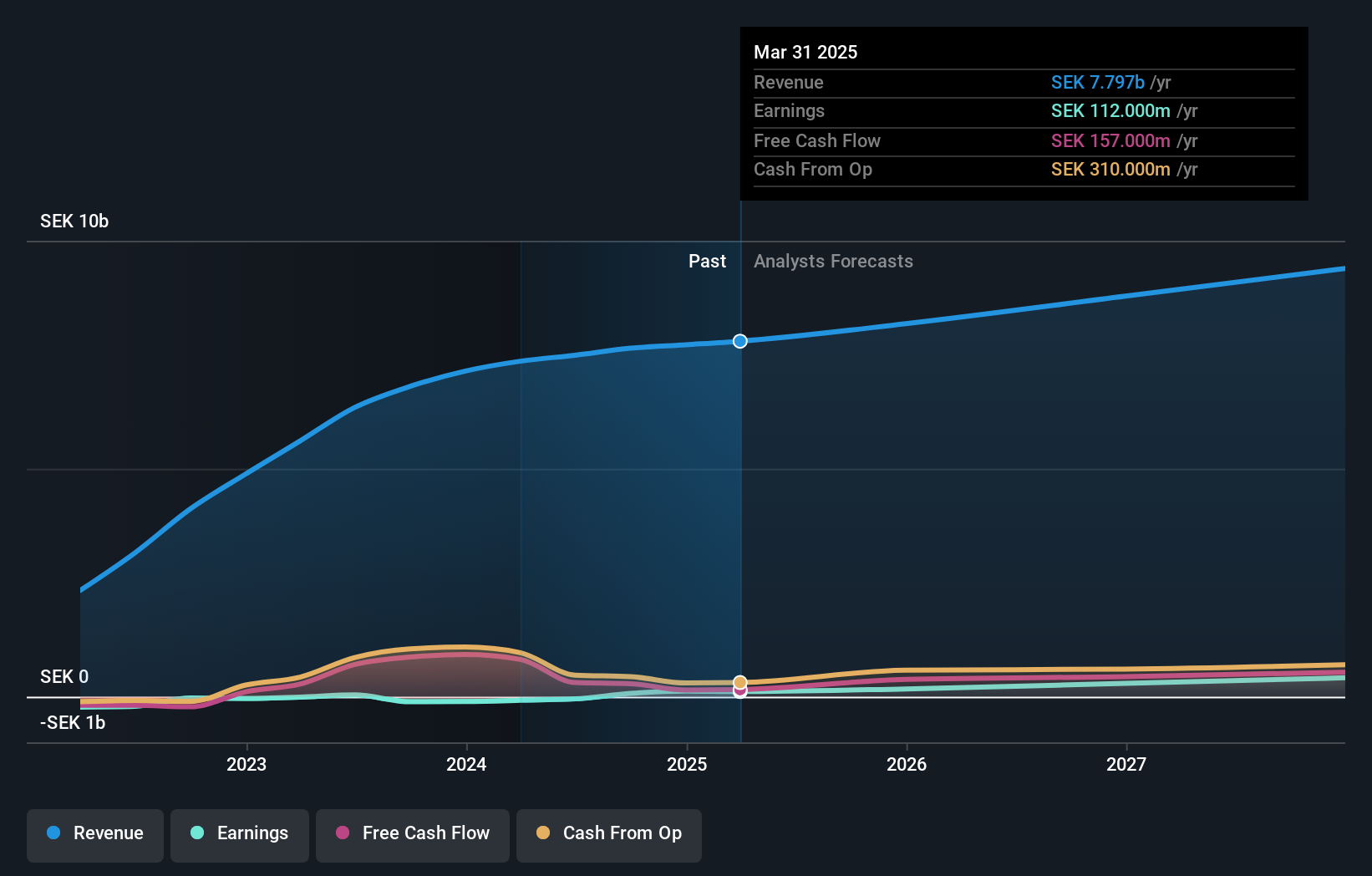

Operations: The company's revenue is primarily derived from Imaging IT Solutions, which generated SEK2.67 billion, and Secure Communications, contributing SEK388.55 million.

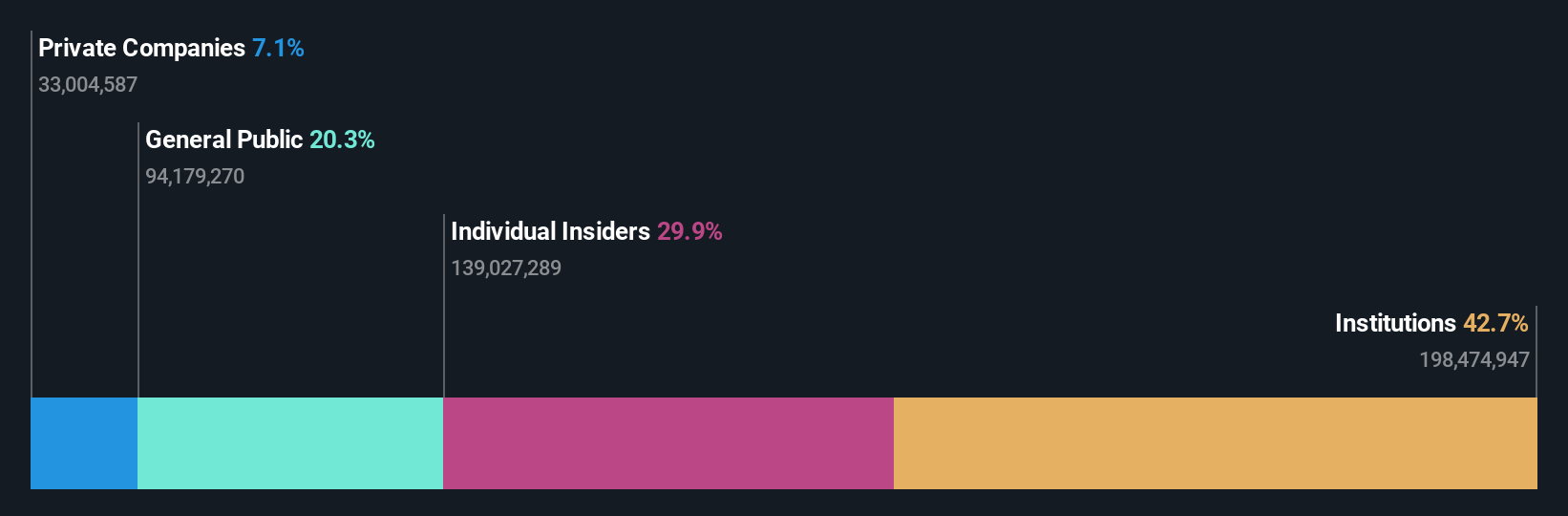

Insider Ownership: 30.3%

Sectra AB's earnings are projected to grow significantly at 21.2% annually, surpassing the Swedish market's growth rate. Recent earnings for Q1 2024 showed a revenue increase to SEK 739.48 million from SEK 603.03 million year-on-year, with net income rising to SEK 80.4 million from SEK 61.56 million, indicating strong performance momentum. Despite no substantial insider trading activity recently, high insider ownership aligns management interests with shareholders', enhancing confidence in its growth trajectory.

- Get an in-depth perspective on Sectra's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Sectra shares in the market.

Where To Now?

- Investigate our full lineup of 80 Fast Growing Swedish Companies With High Insider Ownership right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SECT B

Sectra

Provides solutions for medical IT and cybersecurity sectors in Sweden, the United Kingdom, the Netherlands, and rest of Europe.

Flawless balance sheet with high growth potential.