- Sweden

- /

- Industrials

- /

- OM:NOLA B

Swedish Growth Stocks With High Insider Ownership In May 2024

Reviewed by Simply Wall St

As of May 2024, the Swedish market, like many global counterparts, exhibits a mix of challenges and opportunities amidst fluctuating economic indicators and varying performance across major indices. In such a landscape, growth companies with high insider ownership in Sweden may offer unique appeal as these insiders potentially have a vested interest in the company's long-term success, aligning their goals closely with those of external investors.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 21.6% |

| Spago Nanomedical (OM:SPAGO) | 16.1% | 52.1% |

| BioArctic (OM:BIOA B) | 35.1% | 50.5% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 50.4% |

| Sileon (OM:SILEON) | 33.3% | 109.3% |

| InCoax Networks (OM:INCOAX) | 18.9% | 104.9% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Egetis Therapeutics (OM:EGTX) | 17.6% | 98.2% |

| Yubico (OM:YUBICO) | 37.5% | 42.5% |

| SaveLend Group (OM:YIELD) | 24.9% | 106.8% |

Here we highlight a subset of our preferred stocks from the screener.

BioArctic (OM:BIOA B)

Simply Wall St Growth Rating: ★★★★★★

Overview: BioArctic AB (ticker: OM:BIOA B) is a Swedish biopharmaceutical company focused on developing biological drugs for central nervous system disorders, with a market capitalization of approximately SEK 21.06 billion.

Operations: The company generates its revenue from the development of biological drugs targeting central nervous system disorders.

Insider Ownership: 35.1%

BioArctic, a Swedish biopharmaceutical company, is trading at SEK 64% below its estimated fair value with expectations of significant revenue growth (40.7% annually) outpacing the market. Analyst consensus suggests a potential price increase of 54.4%. The company's forecast to turn profitable within three years reflects robust profit growth projections. Recent strategic alliances and product approvals, including the groundbreaking Alzheimer's treatment Leqembi® in South Korea, underscore its innovative trajectory and market expansion efforts.

- Take a closer look at BioArctic's potential here in our earnings growth report.

- The analysis detailed in our BioArctic valuation report hints at an deflated share price compared to its estimated value.

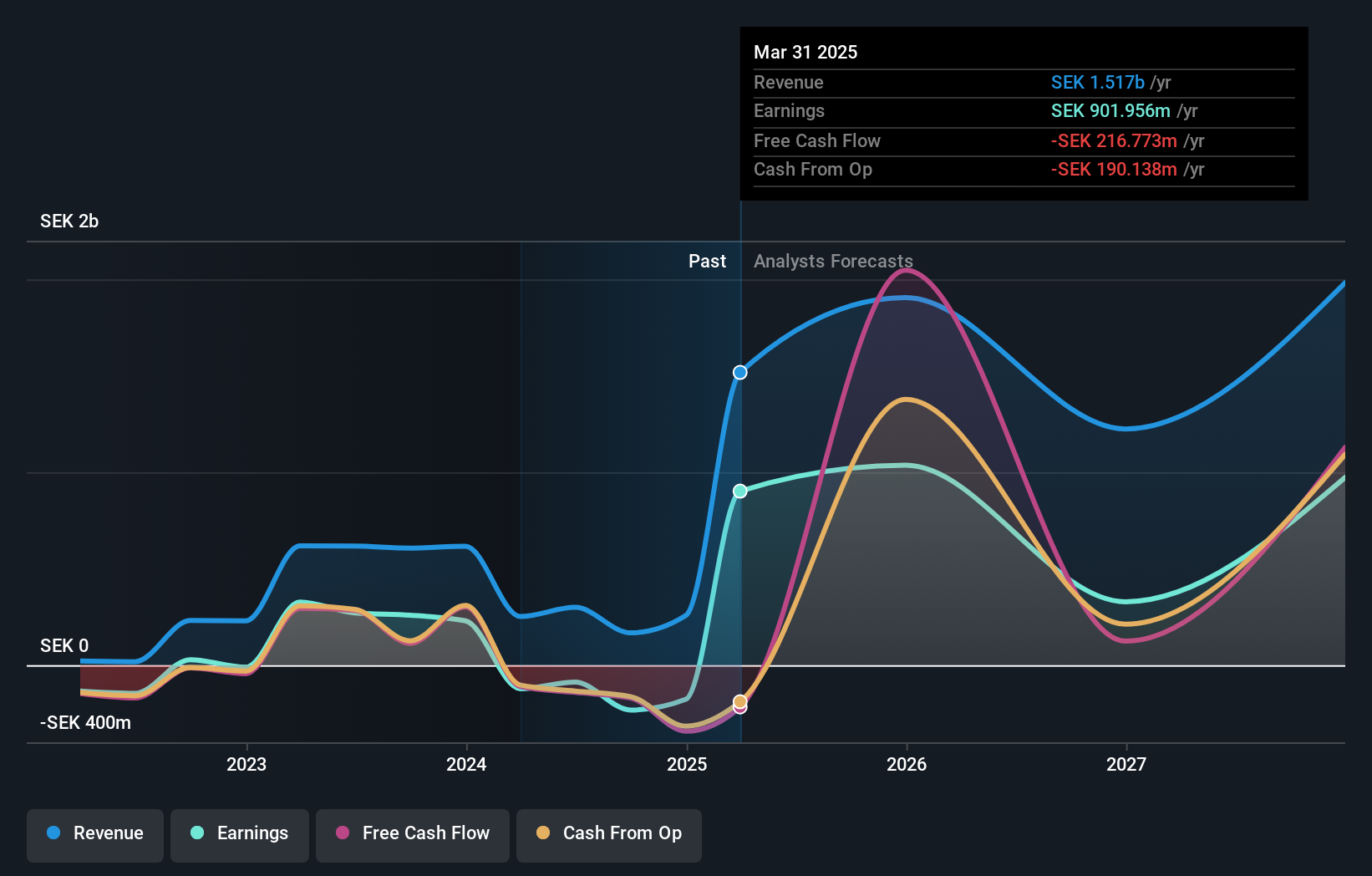

Nolato (OM:NOLA B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nolato AB specializes in developing, manufacturing, and selling plastic, silicone, and thermoplastic elastomer products across various sectors including medical technology, pharmaceuticals, and consumer electronics globally; it has a market capitalization of approximately SEK 16.71 billion.

Operations: The company generates SEK 5.34 billion from its Medical Solutions segment.

Insider Ownership: 28.9%

Nolato, a Swedish company with high insider ownership, recently reported a slight dip in quarterly sales but an increase in net income, indicating resilient profitability. The firm is investing SEK 600 million to expand its manufacturing capabilities for medical devices, signaling growth potential and commitment to long-term customer agreements. Despite trading below fair value and facing challenges in covering dividends with cash flow, Nolato shows promising earnings growth forecasted at 22.7% annually over the next three years.

- Unlock comprehensive insights into our analysis of Nolato stock in this growth report.

- Our expertly prepared valuation report Nolato implies its share price may be lower than expected.

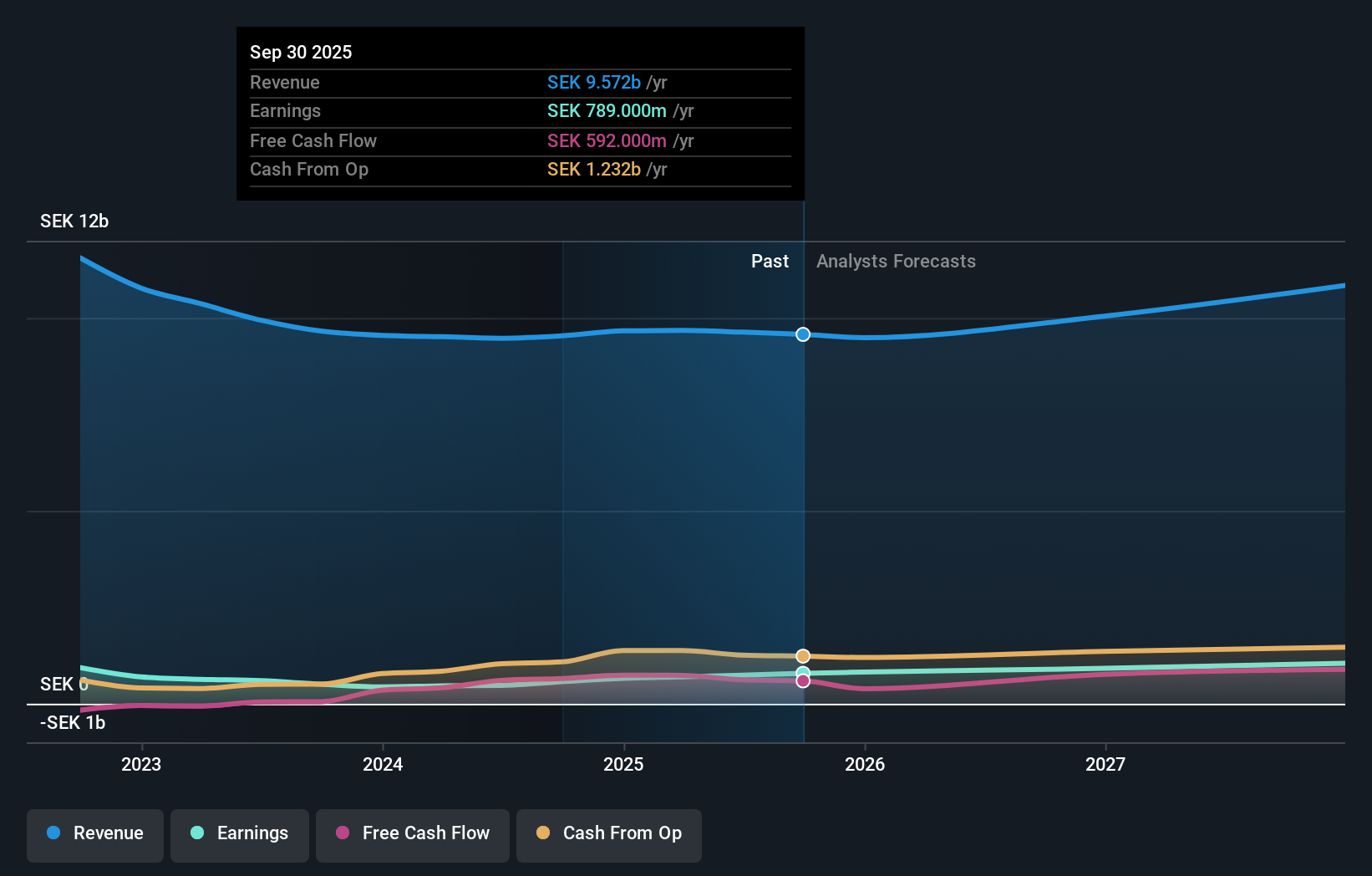

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) specializes in medical IT and cybersecurity solutions across Sweden, the UK, the Netherlands, and other European countries, with a market capitalization of SEK 46.63 billion.

Operations: Sectra's revenue is primarily generated from its Imaging IT Solutions and Secure Communications segments, which contributed SEK 2.45 billion and SEK 301.16 million respectively, along with a smaller contribution of SEK 86.71 million from Business Innovation.

Insider Ownership: 30.3%

Sectra, a Swedish company with significant insider ownership, demonstrates robust growth with earnings and revenue forecasted to outpace the Swedish market. Recent contracts for its medical and security technology solutions, including a notable extension with NATO's NCI Agency and multiple healthcare imaging solutions across Europe and North America, underscore its expanding influence in digital pathology and secure communications. Despite not reaching high growth thresholds, Sectra's strategic advancements suggest solid potential in specialized markets.

- Dive into the specifics of Sectra here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Sectra's share price might be too optimistic.

Make It Happen

- Take a closer look at our Fast Growing Swedish Companies With High Insider Ownership list of 84 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Nolato might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NOLA B

Nolato

Develops, manufactures, and sells plastic, silicone, and thermoplastic elastomer products for medical technology, pharmaceutical, consumer electronics, telecom, automotive, hygiene, and other industrial sectors in Sweden, Other Nordic countries, Asia, Rest of Europe, and North America, and internationally.

Excellent balance sheet with reasonable growth potential and pays a dividend.