Stock Analysis

- Sweden

- /

- Specialty Stores

- /

- OM:BILI A

Swedish Exchange Highlights: Three Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

Amidst a backdrop of global economic fluctuations and mixed market signals, the Swedish stock exchange presents unique opportunities for investors interested in growth companies with significant insider ownership. Such stocks often indicate a strong alignment between company management and shareholder interests, which can be particularly appealing in uncertain times.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 21.6% |

| BioArctic (OM:BIOA B) | 35.1% | 50.9% |

| Sileon (OM:SILEON) | 33.3% | 109.3% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| InCoax Networks (OM:INCOAX) | 17.9% | 104.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

| Egetis Therapeutics (OM:EGTX) | 17.6% | 98.2% |

| Yubico (OM:YUBICO) | 37.5% | 43.4% |

| SaveLend Group (OM:YIELD) | 24.9% | 103.4% |

Here's a peek at a few of the choices from the screener.

Bilia (OM:BILI A)

Simply Wall St Growth Rating: ★★★★☆☆

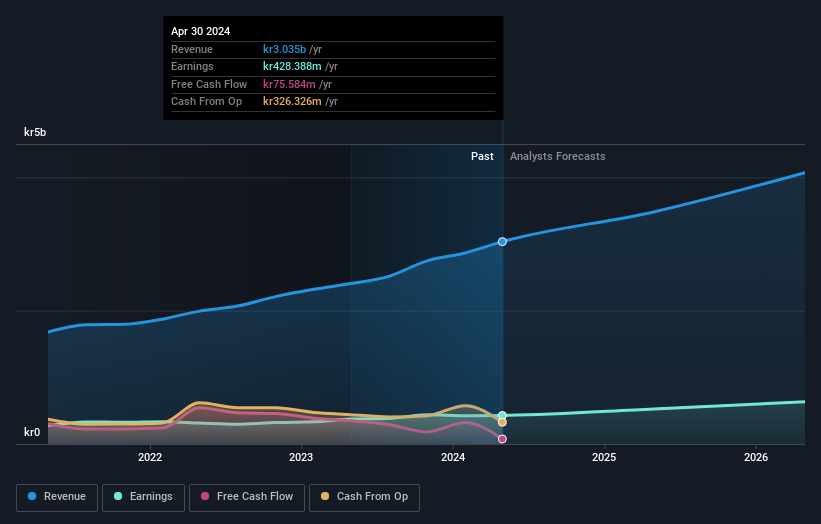

Overview: Bilia AB (publ) is a full-service supplier for car ownership, operating in Sweden, Norway, Luxembourg, and Belgium with a market capitalization of SEK 13.36 billion.

Operations: Bilia generates revenue through various segments, including car sales in Norway (SEK 7.16 billion), Sweden (SEK 19.28 billion), and Western Europe (SEK 3.61 billion), along with service revenues in Norway (SEK 2.16 billion), Sweden (SEK 6.16 billion), and Western Europe (SEK 0.65 billion).

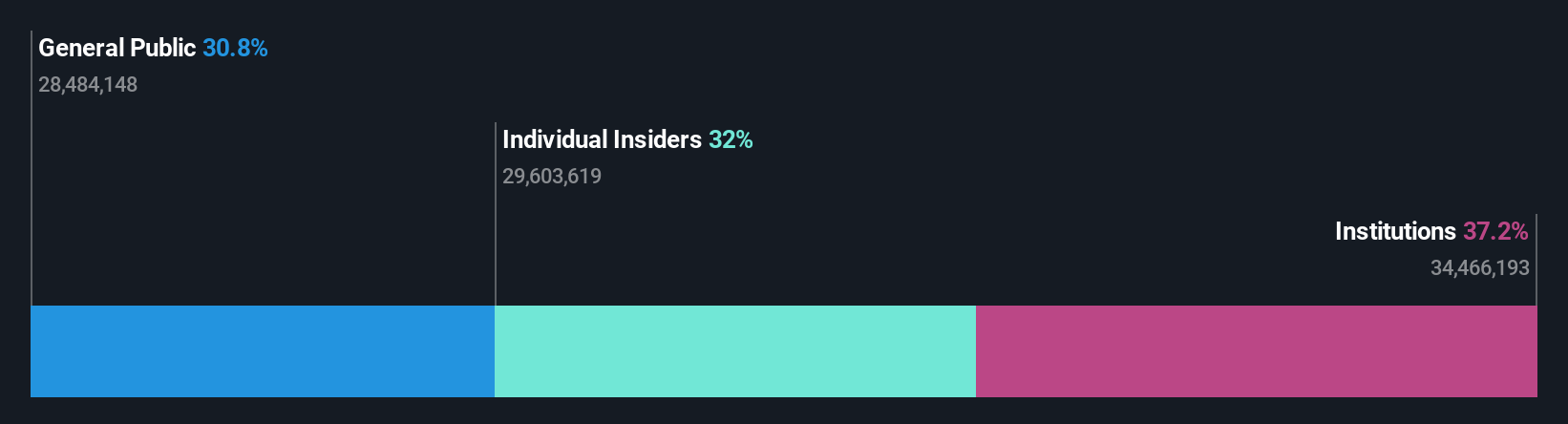

Insider Ownership: 31.6%

Earnings Growth Forecast: 15.2% p.a.

Bilia, a Swedish company with significant insider ownership, is trading at 59.2% below its estimated fair value, indicating potential undervaluation relative to peers. While its earnings are expected to grow by 15.2% annually, outpacing the Swedish market forecast of 14.2%, revenue growth projections remain modest at 3.9% per year. Recent strategic moves include a partnership with Volvo Car Sweden and expansion into electric vehicle sales through new facilities and taking over XPENG operations in Scandinavia, enhancing its market presence despite facing challenges like high debt levels and undercovered dividends.

- Navigate through the intricacies of Bilia with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Bilia is priced lower than what may be justified by its financials.

Lime Technologies (OM:LIME)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lime Technologies AB specializes in providing SaaS-based customer relationship management (CRM) solutions primarily in the Nordic region, with a market capitalization of approximately SEK 4.68 billion.

Operations: The company generates revenue primarily through the sale and implementation of CRM systems, totaling SEK 601.83 million.

Insider Ownership: 10.7%

Earnings Growth Forecast: 21.5% p.a.

Lime Technologies, a Swedish growth company with high insider ownership, reported a robust first quarter in 2024 with revenues and net income showing significant increases from the previous year. While Lime's revenue growth forecast of 14.7% per year is slightly below the high-growth threshold, its earnings are expected to surge at an impressive rate of 21.5% per year, outpacing the broader Swedish market's forecast. However, concerns about its high debt levels may temper optimism about its financial health and future performance.

- Click here and access our complete growth analysis report to understand the dynamics of Lime Technologies.

- Insights from our recent valuation report point to the potential overvaluation of Lime Technologies shares in the market.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) operates in the medical IT and cybersecurity sectors across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market capitalization of approximately SEK 48.24 billion.

Operations: The company generates revenue primarily through its Imaging IT Solutions segment, which brought in SEK 2.55 billion, followed by Secure Communications at SEK 367.40 million and Business Innovation contributing SEK 89.90 million.

Insider Ownership: 30.3%

Earnings Growth Forecast: 19.3% p.a.

Sectra, a Swedish company with substantial insider ownership, demonstrated solid financial performance in its recent earnings report. For Q4 FY2024, revenue increased to SEK 915.7 million from SEK 745.72 million year-over-year. Annual figures also showed growth with revenue reaching SEK 3.04 billion, up from SEK 2.41 billion the previous year. While Sectra's annual profit growth forecast of 19.3% is robust and above the market average, it does not reach the high-growth benchmark of over 20%. Additionally, Sectra is enhancing its product offerings in precision medicine and digital pathology—sectors poised for rapid expansion—further solidifying its competitive position within healthcare technology markets.

- Click here to discover the nuances of Sectra with our detailed analytical future growth report.

- According our valuation report, there's an indication that Sectra's share price might be on the expensive side.

Summing It All Up

- Unlock more gems! Our Fast Growing Swedish Companies With High Insider Ownership screener has unearthed 78 more companies for you to explore.Click here to unveil our expertly curated list of 81 Fast Growing Swedish Companies With High Insider Ownership.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Bilia is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BILI A

Bilia

Operates as a full-service supplier for car ownership in Sweden, Norway, Luxemburg, and Belgium.

Undervalued with excellent balance sheet and pays a dividend.