Stock Analysis

As global markets show signs of cautious optimism, with indices like the STOXX Europe 600 and Germany's DAX posting gains amid easing monetary policies, Sweden's market landscape offers a unique opportunity for investors interested in growth companies. High insider ownership in Swedish firms often signals strong confidence from those who know the company best, aligning well with current market conditions that favor informed investment decisions.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 21.6% |

| BioArctic (OM:BIOA B) | 35.1% | 50.9% |

| Sileon (OM:SILEON) | 33.3% | 109.3% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

| Biovica International (OM:BIOVIC B) | 12.7% | 73.8% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| Egetis Therapeutics (OM:EGTX) | 17.6% | 98.2% |

| Yubico (OM:YUBICO) | 37.5% | 43.4% |

| SaveLend Group (OM:YIELD) | 24.9% | 103.4% |

We'll examine a selection from our screener results.

NIBE Industrier (OM:NIBE B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NIBE Industrier AB, a Swedish company, specializes in developing, manufacturing, and marketing energy-efficient solutions for indoor climate comfort and intelligent heating and control systems across the Nordic countries, Europe, North America, and globally. The company has a market capitalization of approximately SEK 98.26 billion.

Operations: NIBE Industrier's revenue is generated from three main segments: Stoves (SEK 5.62 billion), Element (SEK 13.62 billion), and Climate Solutions (SEK 36.83 billion).

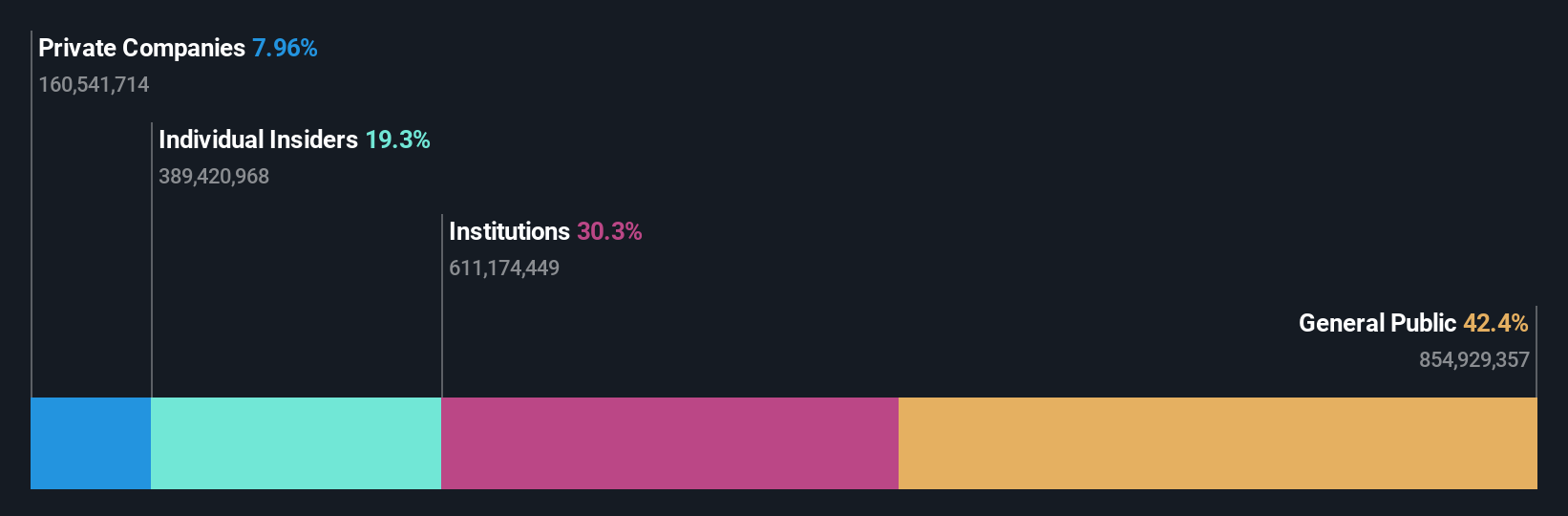

Insider Ownership: 20.2%

Earnings Growth Forecast: 27.6% p.a.

NIBE Industrier, a Swedish company, exhibits strong growth potential with its earnings expected to increase significantly over the next three years. Recently, insiders Sofia Schörling Högberg and Märta Schörling Andreen acquired a minority stake, signaling confidence in the company's trajectory. However, NIBE faces challenges as its debt is poorly covered by operating cash flow and profit margins have declined from 11.5% to 6%. Despite these concerns, the company trades at 23.2% below estimated fair value and revenue growth projections outpace the Swedish market.

- Click here and access our complete growth analysis report to understand the dynamics of NIBE Industrier.

- Our comprehensive valuation report raises the possibility that NIBE Industrier is priced lower than what may be justified by its financials.

Pandox (OM:PNDX B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pandox AB is a global hotel property company that owns, develops, and leases hotel properties, with a market capitalization of approximately SEK 34.78 billion.

Operations: The company generates revenue primarily through two segments: own operation (SEK 3.24 billion) and rental agreements (SEK 3.76 billion).

Insider Ownership: 12.3%

Earnings Growth Forecast: 41.6% p.a.

Pandox, a Swedish hotel operator, showed robust recovery with Q1 2024 sales reaching SEK 812 million and net income swinging to SEK 447 million from a loss last year. Despite this, the company's dividend sustainability is questioned as it's poorly covered by earnings. While insider trading data over the past three months isn't available, Pandox forecasts significant earnings growth at 41.6% annually over the next three years, outpacing its market. However, its revenue growth projections are modest at 2.2% annually but still above the Swedish market average.

- Click here to discover the nuances of Pandox with our detailed analytical future growth report.

- Our expertly prepared valuation report Pandox implies its share price may be lower than expected.

Vimian Group (OM:VIMIAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vimian Group AB operates globally in the animal health sector and has a market capitalization of approximately SEK 18.15 billion.

Operations: The company's revenue is divided into several key segments: Medtech (€109.03 million), Diagnostics (€21.14 million), Specialty Pharma (€153.26 million), and Veterinary Services (€51.63 million).

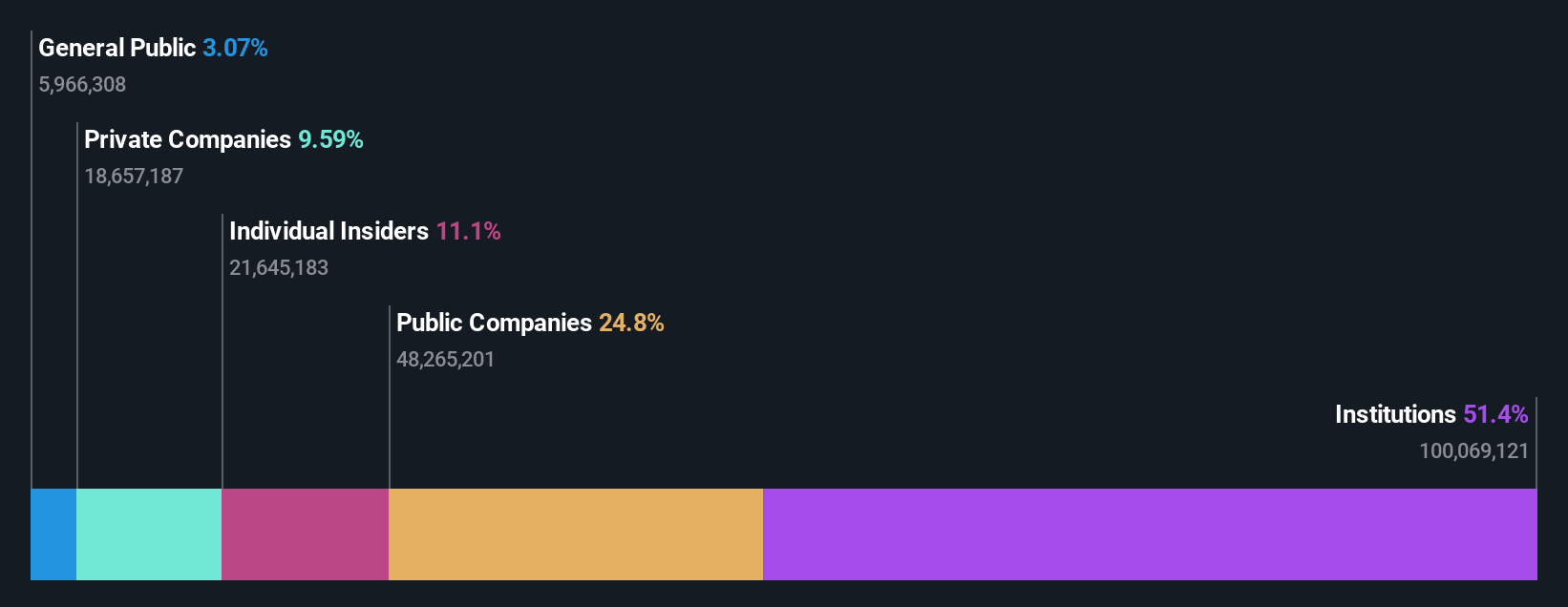

Insider Ownership: 11%

Earnings Growth Forecast: 58.6% p.a.

Vimian Group, recently profitable, is experiencing rapid earnings growth, forecasted at 58.6% annually over the next three years. Despite this, its revenue growth at 12.2% per year is below the high-growth threshold but still outpaces the Swedish market's 1.8%. Insider activity shows more buying than selling, though not in large volumes. Challenges include significant one-off items affecting results and shareholder dilution within the last year. Recent leadership changes introduced Magnus Welander as chairman during their AGM on May 22, 2024.

- Click to explore a detailed breakdown of our findings in Vimian Group's earnings growth report.

- Upon reviewing our latest valuation report, Vimian Group's share price might be too pessimistic.

Taking Advantage

- Get an in-depth perspective on all 84 Fast Growing Swedish Companies With High Insider Ownership by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether NIBE Industrier is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NIBE B

NIBE Industrier

Develops, manufactures, markets, and sells various energy-efficient solutions for indoor climate comfort, and components and solutions for intelligent heating and control in Nordic countries, rest of Europe, North America, and internationally.

Reasonable growth potential and fair value.