- Sweden

- /

- Healthtech

- /

- OM:SECT B

Sectra (OM:SECT B) Declares SEK 2.10 Per Share Dividend at AGM Approval

Reviewed by Simply Wall St

Sectra (OM:SECT B) recently confirmed a total dividend of SEK 2.10 per share at its AGM. This announcement, reflective of the company’s stable financial health, harmonized with a positive quarterly earnings report. Sectra reported increased revenue and net income compared to the previous year, indicating solid growth. While the broader market advanced significantly, reaching new highs, Sectra's stock price saw a modest movement over the past week. The company's dividend announcement and strong earnings may have provided underlying support, aligning with the general upbeat sentiment, though the overall move was in line with market trends.

Buy, Hold or Sell Sectra? View our complete analysis and fair value estimate and you decide.

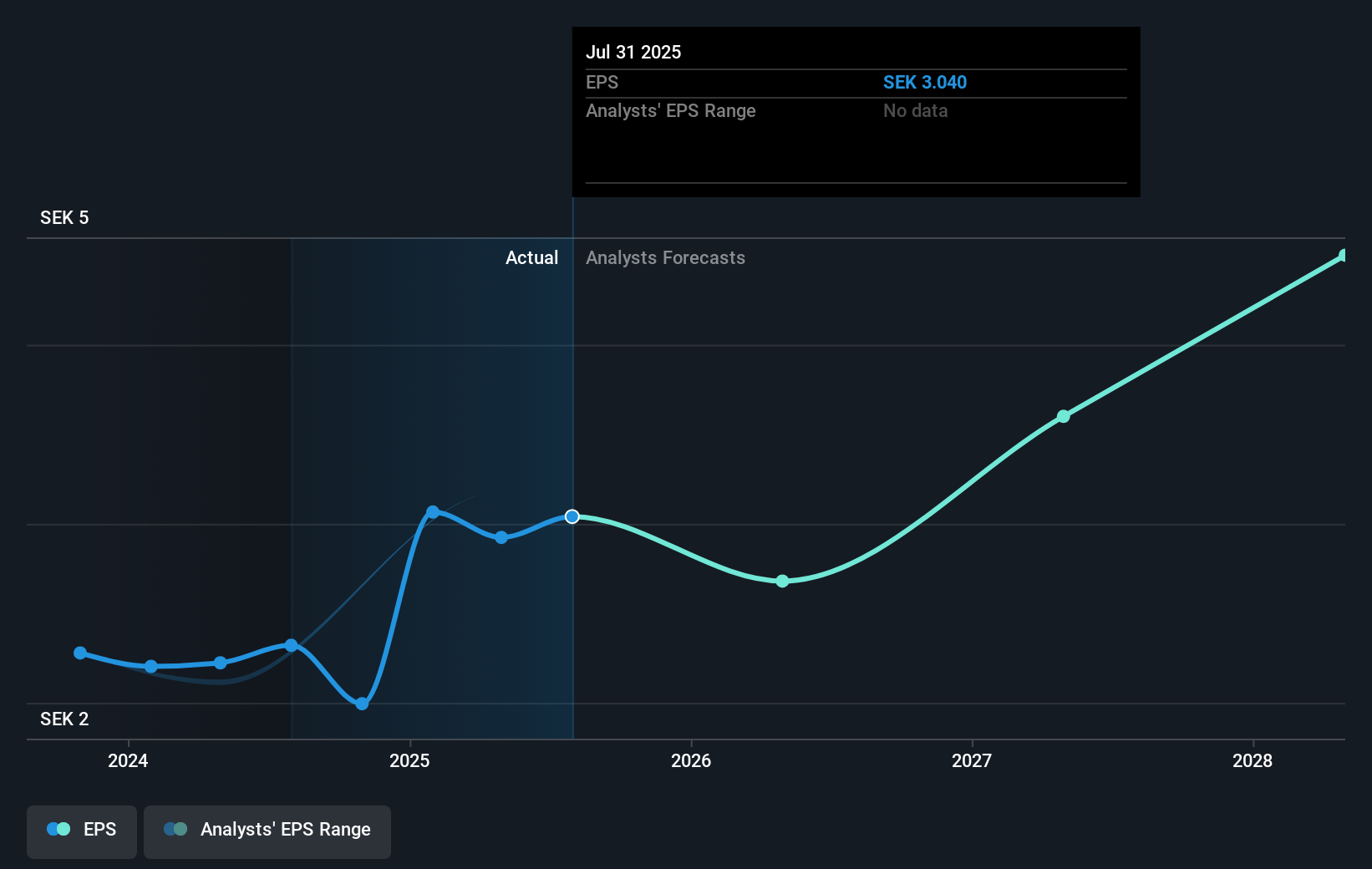

The recent announcement of Sectra's SEK 2.10 per share dividend at the AGM, alongside a positive earnings report, underscores the company's financial resilience, potentially boosting investor confidence. This announcement aligns with Sectra's strategic transition to a SaaS model, which promises long-term revenue stability and recurring income. However, the move could introduce short-term volatility as the shift from initial license sales to recurring revenue might temporarily strain profit margins. Despite Sectra's current share price of SEK327 trading above the SEK300 analyst price target, suggesting market expectations may be high, the foundation of robust earnings growth could support future valuation adjustments.

Over the past five years, Sectra's total shareholder return reached 192.13%, reflecting substantial appreciation. While this longer-term growth is impressive, it's essential to compare recent performance, where the stock outperformed the Swedish Market's one-year return of 0.5% but fell short of the Swedish Healthcare Services industry's 27.2% return. Such context highlights Sectra's capability to provide solid returns, although relative performance might fluctuate annually.

The dividend and earnings news could influence future revenue and earnings forecasts, showcasing Sectra's commitment to shareholder value during its business model transition. Analysts' expectations of an annual revenue growth of 16.3% over the next three years remain tied to successful SaaS model execution. As the company navigates potential risks like financial volatility and cybersecurity challenges, its established revenue streams and high customer satisfaction could offset near-term pressures and align with its growth trajectory.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SECT B

Sectra

Provides solutions for medical IT and cybersecurity sectors in Sweden, the United Kingdom, the Netherlands, and rest of Europe.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives