- Israel

- /

- Electronic Equipment and Components

- /

- TASE:NYAX

High Growth Tech Stocks To Watch In September 2025

Reviewed by Simply Wall St

In the wake of recent economic data signaling a weakening U.S. labor market, global markets have experienced mixed reactions, with smaller-cap stocks showing resilience amid hopes for potential Federal Reserve rate cuts. As investors navigate these turbulent times, identifying high-growth tech stocks becomes crucial, as they often exhibit strong potential in dynamic market conditions and can capitalize on technological advancements and shifts in consumer behavior.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 31.53% | 46.86% | ★★★★★★ |

| Giant Network Group | 31.77% | 35.00% | ★★★★★★ |

| Fositek | 33.62% | 43.81% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| KebNi | 21.99% | 63.71% | ★★★★★★ |

| Hacksaw | 26.01% | 37.60% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CD Projekt | 35.15% | 43.54% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

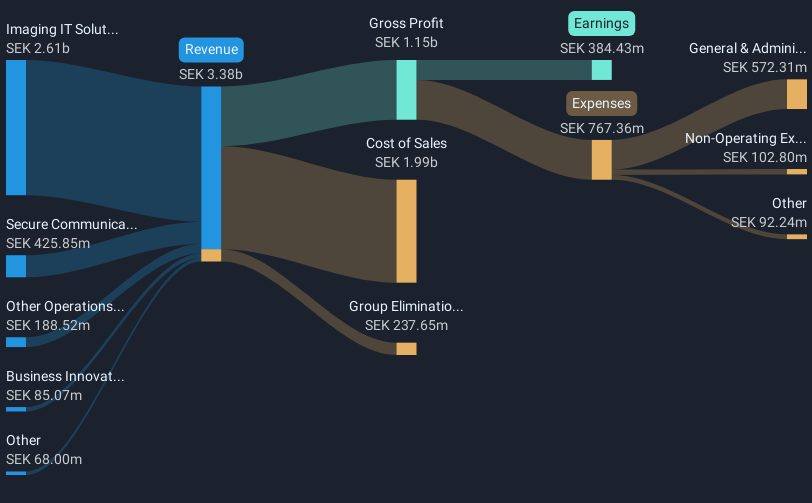

Overview: Sectra AB (publ) is a company that offers solutions in the medical IT and cybersecurity sectors across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market capitalization of approximately SEK 63 billion.

Operations: Sectra generates revenue primarily from its Imaging IT Solutions segment, which contributes SEK 2.82 billion, and Secure Communications, which adds SEK 422.26 million. The company's business operations focus on providing advanced solutions in medical IT and cybersecurity across key European markets.

Sectra, a Swedish tech firm, is outpacing its domestic market with a robust 14.5% annual revenue growth and an impressive 17.2% rise in earnings per year. The company's strategic focus on R&D has significantly contributed to these figures, ensuring continuous innovation and adaptation in a competitive landscape. Recently, Sectra expanded its enterprise imaging solution with the Sectra Amplifier Service at Universitatsmedizin Gottingen, enhancing workflow efficiency through AI integration within Microsoft Azure's cloud environment. This move not only underscores Sectra's commitment to advancing healthcare technology but also positions it favorably for future growth as it continues to integrate cutting-edge technologies into its offerings.

- Dive into the specifics of Sectra here with our thorough health report.

Examine Sectra's past performance report to understand how it has performed in the past.

Beijing Vastdata Technology (SHSE:603138)

Simply Wall St Growth Rating: ★★★★★☆

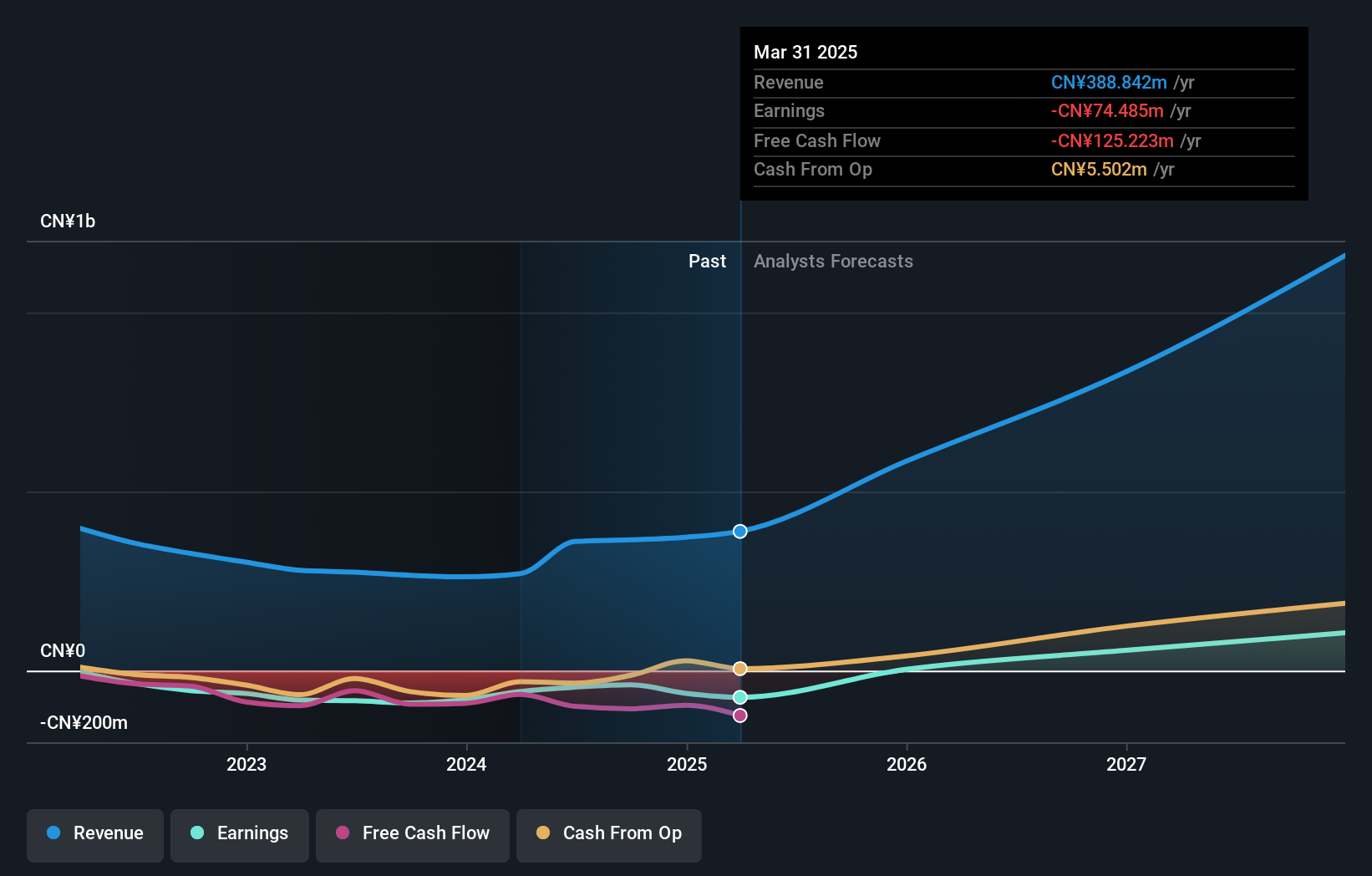

Overview: Beijing Vastdata Technology Co., Ltd. offers database services in China and has a market capitalization of CN¥4.54 billion.

Operations: Vastdata Technology generates revenue primarily from its Software and Information Technology Services segment, amounting to CN¥400.98 million.

Despite currently being unprofitable, Beijing Vastdata Technology has demonstrated a remarkable revenue growth rate of 39.7% per year, significantly outpacing the Chinese market average of 13.7%. This growth trajectory is supported by an aggressive focus on R&D, with recent reports showing substantial investment in this area to fuel future innovations. The company's latest earnings report indicates a challenging phase with increased losses; however, projections suggest a shift towards profitability within three years, driven by an expected annual profit surge of 112.4%. This potential turnaround is pivotal as the company continues to enhance its technological offerings in a competitive landscape.

- Navigate through the intricacies of Beijing Vastdata Technology with our comprehensive health report here.

Learn about Beijing Vastdata Technology's historical performance.

Nayax (TASE:NYAX)

Simply Wall St Growth Rating: ★★★★★☆

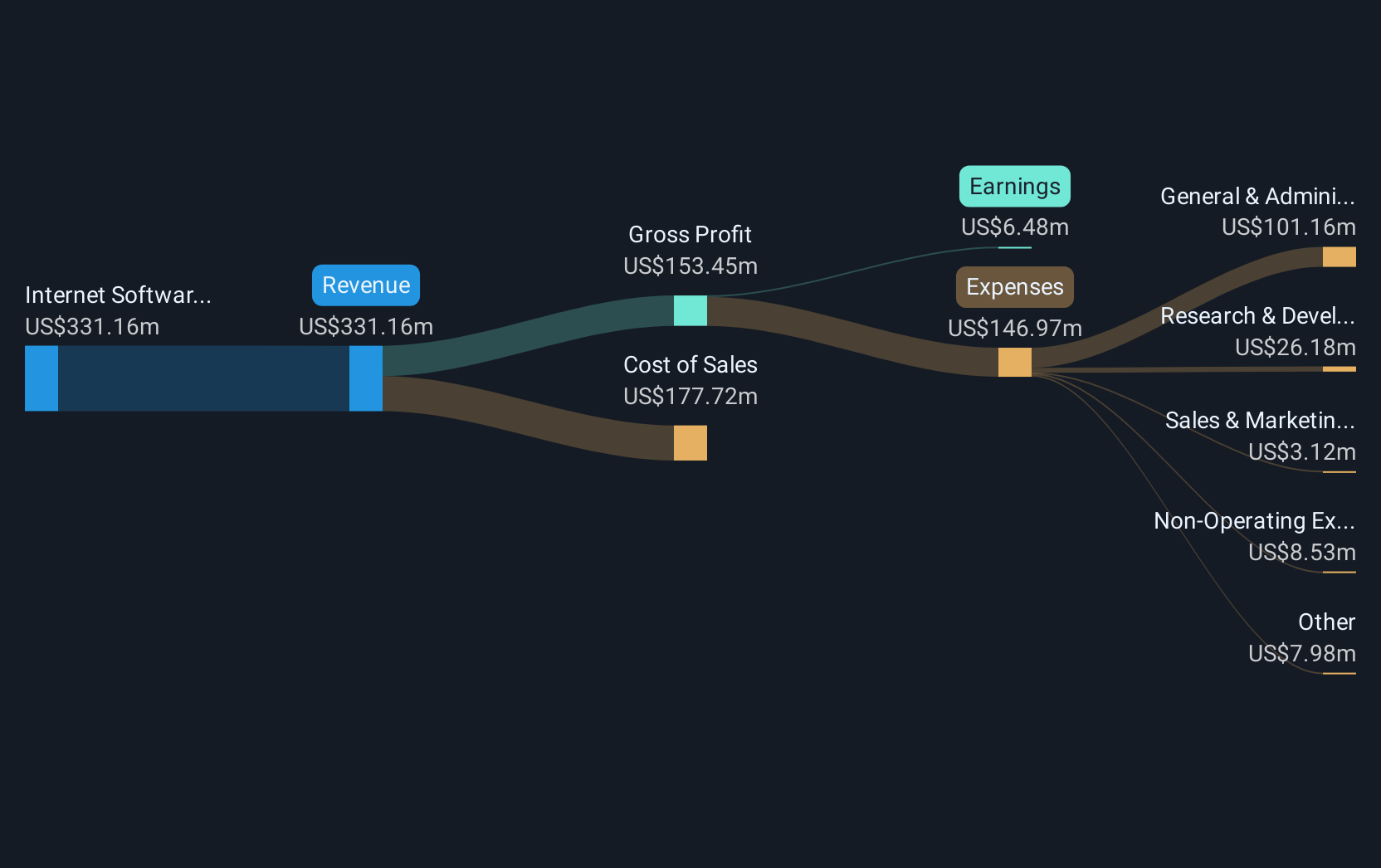

Overview: Nayax Ltd. is a fintech company that provides comprehensive solutions for automated self-service retailers and merchants globally, with a market cap of ₪6.23 billion.

Operations: The company generates revenue primarily from its Internet Software and Services segment, which amounted to $348.66 million.

Nayax has recently pivoted from a net loss to a profitable stance, with its second quarter showing net income of $11.65 million, up from a previous loss, supported by sales growth to $95.59 million from $78.09 million year-over-year. This turnaround is underscored by an aggressive revenue forecast aiming for 30% to 35% growth in 2025, reflecting confidence in sustained performance enhancements and strategic expansions like the partnership with Autel Energy for embedded payment solutions in EV chargers—a sector experiencing rapid demand increase. This collaboration not only broadens Nayax's market reach but also integrates its payment technologies into essential infrastructure for the burgeoning electric vehicle market, promising significant future revenue streams as global EV adoption accelerates.

- Click here and access our complete health analysis report to understand the dynamics of Nayax.

Explore historical data to track Nayax's performance over time in our Past section.

Where To Now?

- Delve into our full catalog of 246 Global High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nayax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:NYAX

Nayax

A fintech company, develops a complete solution for automated self-service retailers, commerce, and other merchants in the United States, Europe, the United Kingdom, Australia, Israel, and rest of the world.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives