High Growth Swedish Stocks With Strong Insider Ownership For October 2024

Reviewed by Simply Wall St

As global markets react to China's robust stimulus measures and mixed economic signals from the U.S. and Europe, Sweden's stock market has shown resilience with notable interest rate cuts by the Riksbank. In this environment, high-growth companies with strong insider ownership can offer a compelling investment narrative, as these factors often indicate confidence in the company's future prospects and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Truecaller (OM:TRUE B) | 29.6% | 21.6% |

| Fortnox (OM:FNOX) | 21.1% | 22.2% |

| Biovica International (OM:BIOVIC B) | 17.6% | 78.5% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| BioArctic (OM:BIOA B) | 34% | 98.4% |

| Yubico (OM:YUBICO) | 37.5% | 42.3% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| InCoax Networks (OM:INCOAX) | 19.5% | 115.5% |

| OrganoClick (OM:ORGC) | 23.1% | 109.0% |

We'll examine a selection from our screener results.

NIBE Industrier (OM:NIBE B)

Simply Wall St Growth Rating: ★★★★☆☆

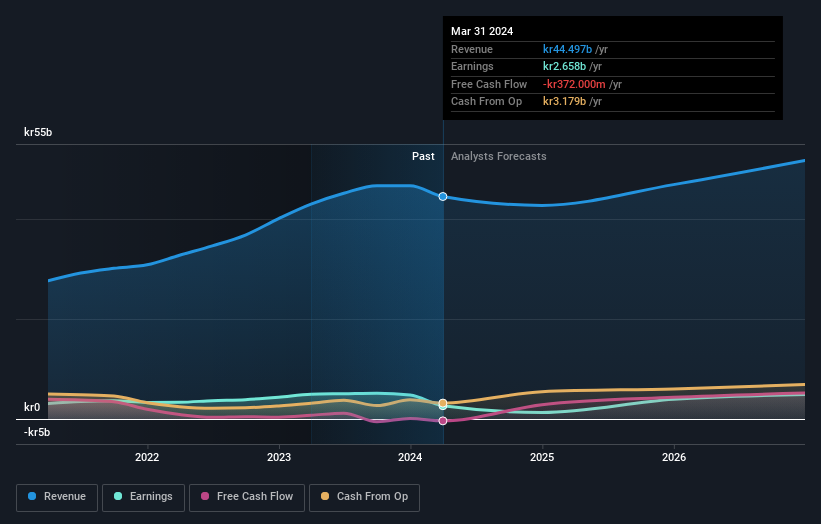

Overview: NIBE Industrier AB (publ) develops, manufactures, markets, and sells energy-efficient solutions for indoor climate comfort and intelligent heating and control across the Nordic countries, Europe, North America, and internationally; it has a market cap of SEK 109.15 billion.

Operations: Revenue segments for NIBE Industrier AB (publ) include Stoves at SEK 5.33 billion, Element at SEK 13.48 billion, and Climate Solutions at SEK 35.22 billion.

Insider Ownership: 20.2%

NIBE Industrier, a growth company with high insider ownership in Sweden, has faced recent financial challenges. For the second quarter of 2024, sales dropped to SEK 10.04 billion from SEK 11.83 billion a year ago, and net income fell sharply to SEK 219 million from SEK 1.32 billion. Despite this, NIBE's earnings are forecast to grow significantly at an annual rate of 42.55%, outpacing the Swedish market's expected growth of 15.1%.

- Unlock comprehensive insights into our analysis of NIBE Industrier stock in this growth report.

- Upon reviewing our latest valuation report, NIBE Industrier's share price might be too optimistic.

AB Sagax (OM:SAGA A)

Simply Wall St Growth Rating: ★★★★☆☆

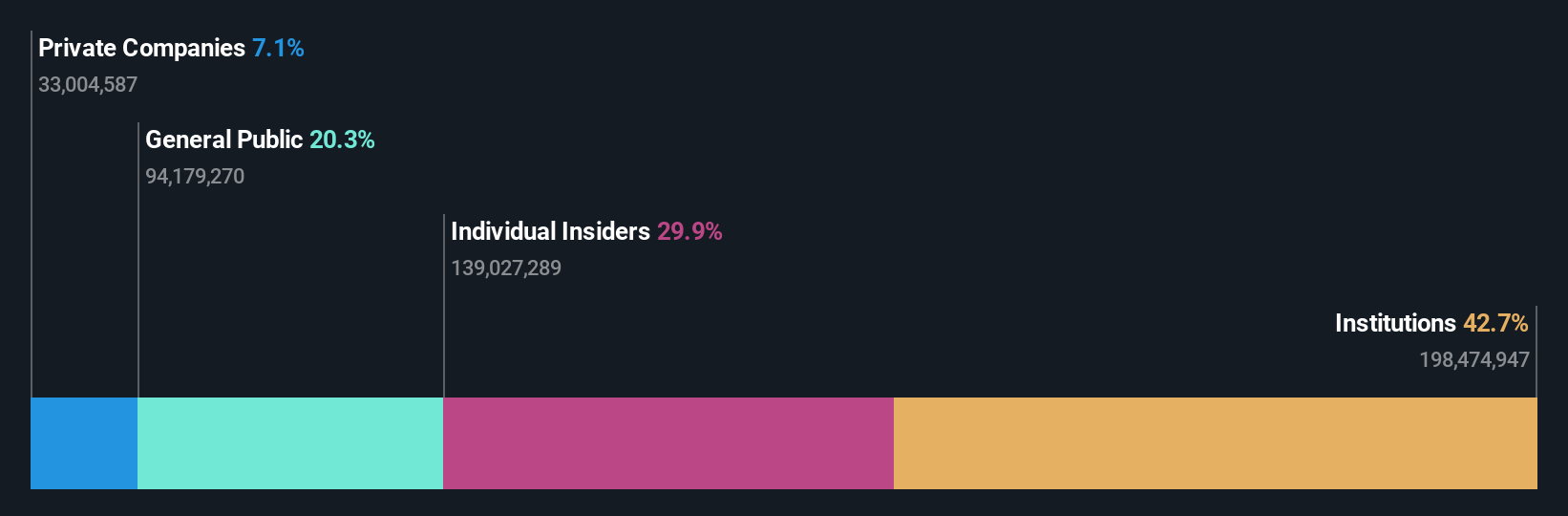

Overview: AB Sagax (publ) is a property company operating in Sweden, Finland, France, Benelux, Spain, Germany and other European countries with a market cap of SEK103.73 billion.

Operations: Revenue from rental real estate amounts to SEK4.63 billion.

Insider Ownership: 28.6%

AB Sagax, with high insider ownership, has shown robust financial performance. For the second quarter of 2024, sales increased to SEK 1.20 billion from SEK 1.04 billion a year ago, and net income surged to SEK 978 million from SEK 53 million. The company expects its profit from property management for the full year to reach SEK 4.30 billion. Despite past shareholder dilution and debt concerns, earnings are forecast to grow significantly at an annual rate of 29.07%, outpacing the Swedish market's expected growth of 15.1%.

- Click to explore a detailed breakdown of our findings in AB Sagax's earnings growth report.

- Our comprehensive valuation report raises the possibility that AB Sagax is priced higher than what may be justified by its financials.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

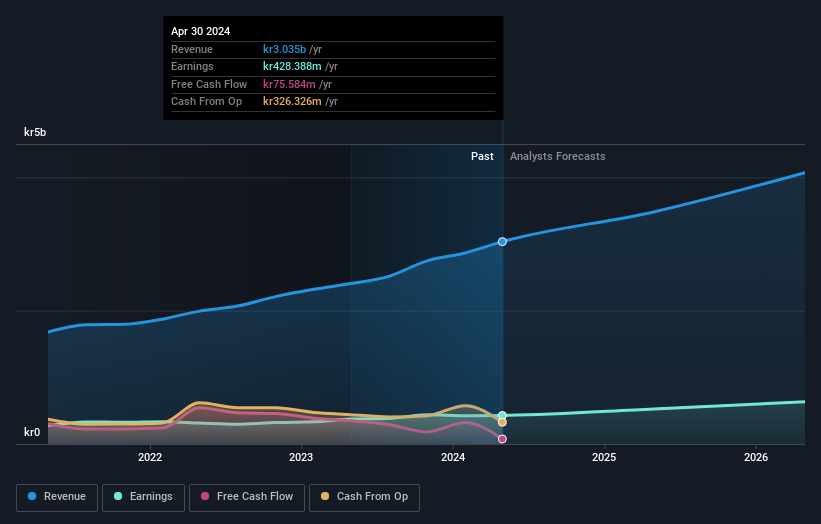

Overview: Sectra AB (publ) offers medical IT and cybersecurity solutions across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market cap of SEK54.10 billion.

Operations: Sectra's revenue segments include Imaging IT Solutions at SEK2.67 billion, Secure Communications at SEK388.55 million, and Business Innovation at SEK90.77 million.

Insider Ownership: 30.3%

Sectra, with high insider ownership, continues to demonstrate growth potential. For Q1 2024, Sectra reported sales of SEK 736.75 million and net income of SEK 80.4 million, showing year-over-year increases from SEK 601.71 million and SEK 61.56 million respectively. Revenue is forecast to grow at 14.2% annually, outpacing the Swedish market's 0.9%. Earnings are expected to grow significantly at an annual rate of 21.2%, also exceeding market expectations of 15.1%.

- Get an in-depth perspective on Sectra's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Sectra implies its share price may be too high.

Summing It All Up

- Discover the full array of 91 Fast Growing Swedish Companies With High Insider Ownership right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if NIBE Industrier might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NIBE B

NIBE Industrier

Develops, manufactures, markets, and sells various energy-efficient solutions for indoor climate comfort, and components and solutions for intelligent heating and control in Nordic countries, rest of Europe, North America, and internationally.

Reasonable growth potential with questionable track record.