Stock Analysis

Exploring Three Swedish Growth Companies With High Insider Ownership On The Stockholm Exchange

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets, the Swedish stock market continues to present intriguing opportunities for investors. As we explore three growth companies with high insider ownership listed on the Stockholm Exchange, understanding the significance of such ownership can provide valuable insights, especially in current market conditions where stability and informed leadership are key.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 21.6% |

| Spago Nanomedical (OM:SPAGO) | 16.1% | 52.1% |

| BioArctic (OM:BIOA B) | 35.1% | 63% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 49.4% |

| Sileon (OM:SILEON) | 33.3% | 109.3% |

| InCoax Networks (OM:INCOAX) | 18.9% | 104.9% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Egetis Therapeutics (OM:EGTX) | 17.6% | 98.2% |

| Yubico (OM:YUBICO) | 37.5% | 42.5% |

| SaveLend Group (OM:YIELD) | 24.9% | 106.8% |

Let's explore several standout options from the results in the screener.

Fortnox (OM:FNOX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fortnox AB (publ), operating in Sweden, offers a range of financial and administrative software solutions tailored for small and medium-sized businesses, accounting firms, and organizations, with a market capitalization of approximately SEK 41.81 billion.

Operations: The company's revenue is primarily derived from its core products (SEK 698 million), followed by entrepreneurship (SEK 356 million), the agency (SEK 327 million), and marketplaces (SEK 150 million).

Insider Ownership: 21%

Fortnox, a Swedish growth company with high insider ownership, reported a robust first quarter in 2024 with significant increases in sales and net income. Despite not having substantial insider buying recently, the company's earnings are expected to grow significantly over the next three years. Although revenue growth forecasts are slightly below 20%, they still outpace the broader Swedish market. The anticipated high Return on Equity (33.2%) underscores Fortnox's efficient use of shareholder funds.

- Delve into the full analysis future growth report here for a deeper understanding of Fortnox.

- According our valuation report, there's an indication that Fortnox's share price might be on the expensive side.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) operates in the medical IT and cybersecurity sectors across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market capitalization of SEK 46.63 billion.

Operations: The company's revenue is primarily generated from its Imaging IT Solutions segment at SEK 2.45 billion, followed by Secure Communications at SEK 301.16 million, and Business Innovation contributing SEK 86.71 million.

Insider Ownership: 30.3%

Sectra, a Swedish growth company with high insider ownership, recently enhanced its market position through strategic FDA approvals and significant contracts in Germany and Canada. These developments underscore Sectra's commitment to advancing digital pathology and radiology solutions globally. Although the company's revenue growth is forecasted at 13.9% per year, slightly below the high-growth benchmark of 20%, it still surpasses the average market growth in Sweden. Sectra's Return on Equity is expected to remain robust, reflecting efficient capital utilization.

- Click here to discover the nuances of Sectra with our detailed analytical future growth report.

- Our expertly prepared valuation report Sectra implies its share price may be too high.

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★★★

Overview: Yubico AB specializes in authentication solutions for computers, networks, and online services, with a market capitalization of SEK 19.55 billion.

Operations: The firm specializes in providing secure authentication solutions across various digital platforms.

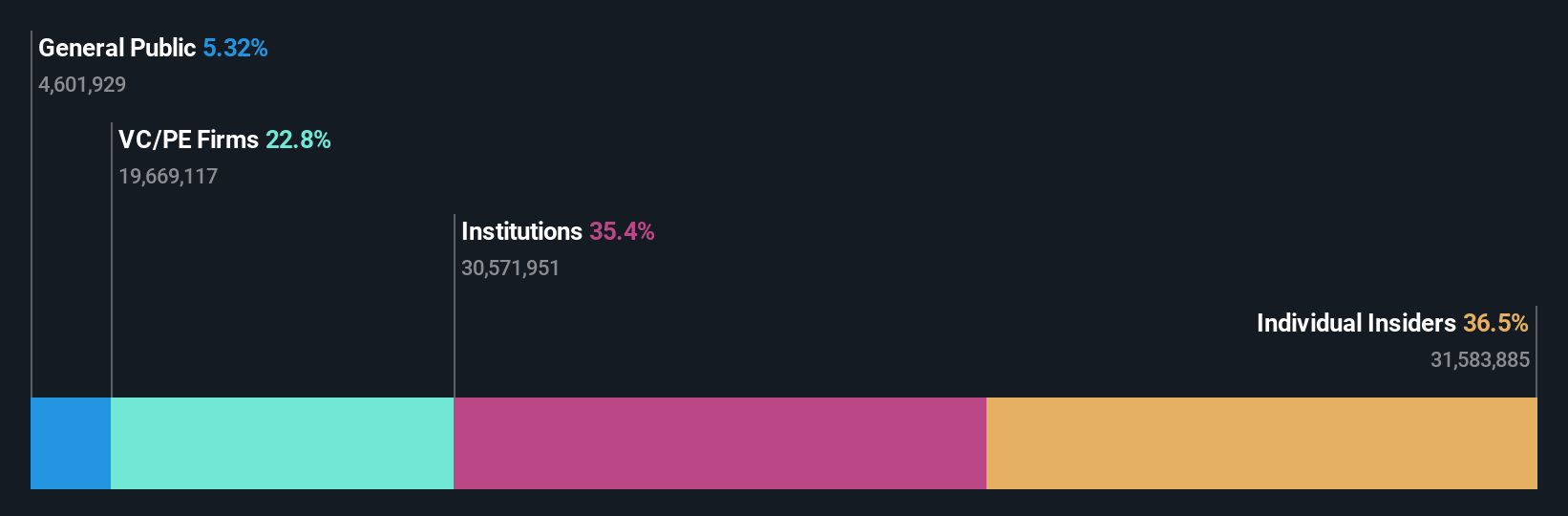

Insider Ownership: 37.5%

Yubico, a Swedish growth company with high insider ownership, recently reported a robust first quarter with sales increasing to SEK 504.4 million and net income rising to SEK 77.5 million. Despite this growth, the company experienced a slight decrease in earnings per share and faces challenges with lower profit margins compared to last year. Yubico is actively expanding its product line, as evidenced by the upcoming release of YubiKey 5.7 firmware, aimed at enhancing enterprise security solutions. This aligns with their significant expected annual profit growth which outpaces the broader Swedish market forecast.

- Click to explore a detailed breakdown of our findings in Yubico's earnings growth report.

- Our comprehensive valuation report raises the possibility that Yubico is priced higher than what may be justified by its financials.

Where To Now?

- Navigate through the entire inventory of 84 Fast Growing Swedish Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Yubico is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:YUBICO

Yubico

Provides authentication solutions for use in computers, networks, and online services.

Exceptional growth potential with adequate balance sheet.