- Netherlands

- /

- Entertainment

- /

- ENXTAM:BNJ

3 European Growth Companies With High Insider Ownership And Up To 28% Earnings Growth

Reviewed by Simply Wall St

As European markets face challenges from U.S. trade policy uncertainties and mixed economic signals, investors are keenly observing the region for resilient opportunities. In this environment, companies with strong insider ownership and robust earnings growth potential stand out as attractive prospects, offering a blend of confidence in management's commitment and promising financial performance.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Elicera Therapeutics (OM:ELIC) | 27.8% | 97.2% |

| Vow (OB:VOW) | 13.1% | 120.9% |

| Pharma Mar (BME:PHM) | 11.8% | 40.8% |

| CD Projekt (WSE:CDR) | 29.7% | 41.3% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Nordic Halibut (OB:NOHAL) | 29.8% | 56.3% |

| Ortoma (OM:ORT B) | 27.7% | 68.6% |

| MedinCell (ENXTPA:MEDCL) | 13.9% | 114.3% |

| Circus (XTRA:CA1) | 26% | 51.4% |

Here we highlight a subset of our preferred stocks from the screener.

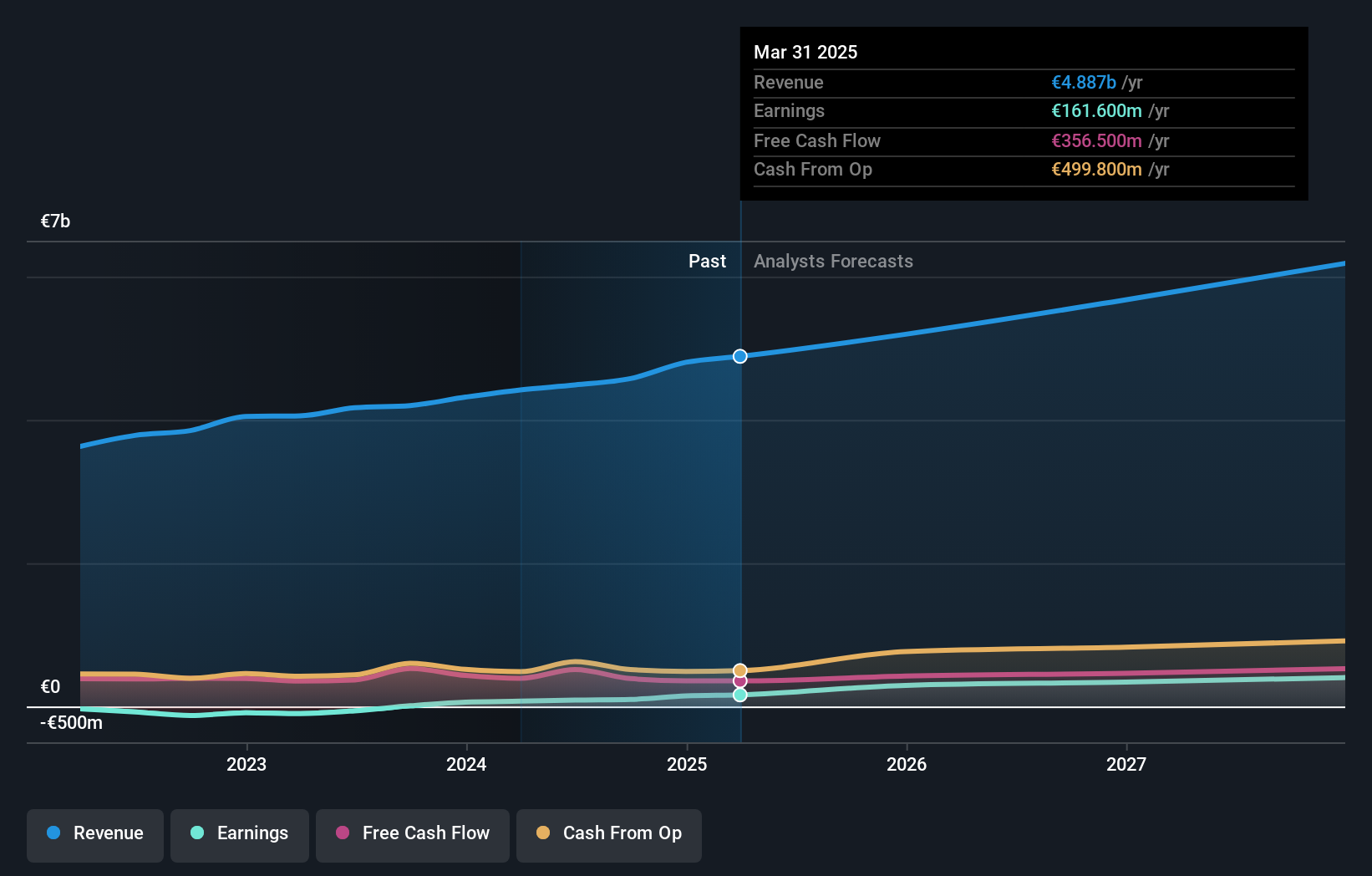

Banijay Group (ENXTAM:BNJ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Banijay Group N.V. operates in content production, distribution, online sports betting, and gaming across the USA, Europe, and internationally with a market cap of €3.64 billion.

Operations: The company's revenue segments include Banijay Gaming, generating €1.46 billion, and Banijay Entertainment & Banijay Live, contributing €3.35 billion.

Insider Ownership: 10%

Earnings Growth Forecast: 29.0% p.a.

Banijay Group displays strong growth potential with earnings forecast to grow significantly at 29% annually, outpacing the Dutch market. Insider confidence is evident as substantial shares have been bought recently. However, revenue growth at 7.4% lags behind the market's 8.1%. The proposed dividend of €0.35 per share reflects a sustainable payout ratio, yet interest coverage remains weak and earnings quality is impacted by large one-off items. The stock trades below estimated fair value with analysts anticipating a price rise of 27.5%.

- Get an in-depth perspective on Banijay Group's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Banijay Group implies its share price may be lower than expected.

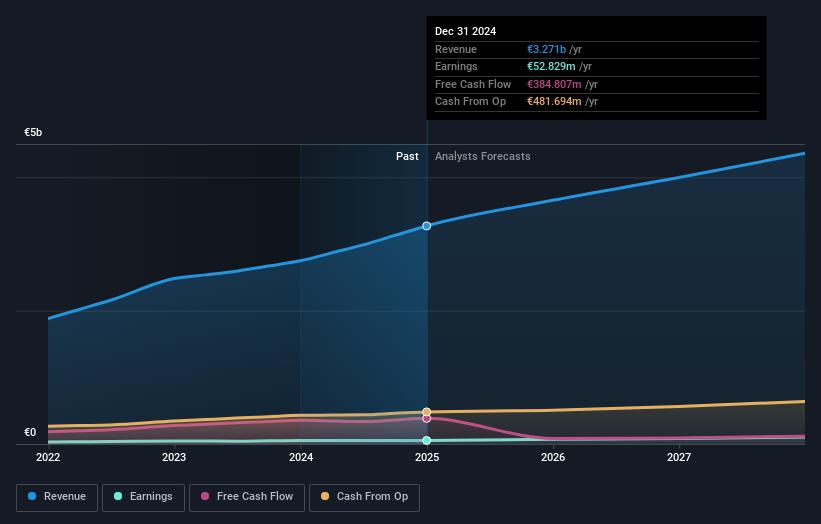

ID Logistics Group (ENXTPA:IDL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ID Logistics Group SA offers contract logistics services both in France and internationally, with a market cap of €2.36 billion.

Operations: The company's revenue is primarily generated from its Transportation - Trucking segment, amounting to €3.27 billion.

Insider Ownership: 21.2%

Earnings Growth Forecast: 20.9% p.a.

ID Logistics Group shows promising growth potential with earnings projected to rise 20.9% annually, surpassing the French market's growth rate. Despite revenue growth trailing at 8%, it still outpaces the market's 6%. Recent earnings reports indicate sales increased to €3.27 billion from €2.75 billion, while net income saw a marginal increase to €52.8 million. Trading significantly below fair value, analysts expect a stock price increase of 28.7%, though interest coverage remains weak and insider trading activity is minimal recently.

- Navigate through the intricacies of ID Logistics Group with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, ID Logistics Group's share price might be too pessimistic.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sectra AB (publ) operates in the medical IT and cybersecurity sectors across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market cap of approximately SEK42.63 billion.

Operations: The company generates revenue primarily from its Imaging IT Solutions segment, which accounts for SEK2.61 billion, and Secure Communications segment, contributing SEK425.85 million.

Insider Ownership: 16.3%

Earnings Growth Forecast: 25.3% p.a.

Sectra demonstrates robust growth potential, with earnings expected to grow significantly at 25.3% annually, outpacing the Swedish market's 9.4%. Revenue is forecast to increase by 16.2% per year, surpassing the market's modest growth of 0.9%. Recent contracts with Swedish authorities and healthcare providers highlight Sectra's strong position in secure communication and medical imaging solutions. Despite no substantial insider trading activity recently, high insider ownership aligns management interests with shareholders' long-term goals.

- Delve into the full analysis future growth report here for a deeper understanding of Sectra.

- According our valuation report, there's an indication that Sectra's share price might be on the expensive side.

Key Takeaways

- Unlock our comprehensive list of 226 Fast Growing European Companies With High Insider Ownership by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Banijay Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:BNJ

Banijay Group

Engages in the content production, distribution, online sports betting, and gaming businesses in the United States of America, Europe, and internationally.

Undervalued with high growth potential.

Market Insights

Community Narratives