- Sweden

- /

- Medical Equipment

- /

- OM:SCIB

Is SciBase Holding (STO:SCIB) In A Good Position To Deliver On Growth Plans?

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, SciBase Holding (STO:SCIB) shareholders have done very well over the last year, with the share price soaring by 141%. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

In light of its strong share price run, we think now is a good time to investigate how risky SciBase Holding's cash burn is. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

See our latest analysis for SciBase Holding

Does SciBase Holding Have A Long Cash Runway?

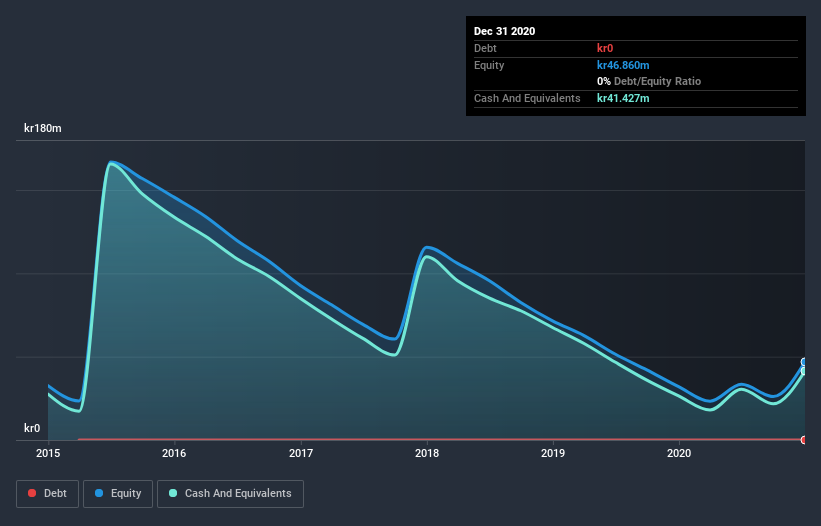

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. SciBase Holding has such a small amount of debt that we'll set it aside, and focus on the kr41m in cash it held at December 2020. Looking at the last year, the company burnt through kr34m. That means it had a cash runway of around 15 months as of December 2020. Notably, one analyst forecasts that SciBase Holding will break even (at a free cash flow level) in about 4 years. Essentially, that means the company will either reduce its cash burn, or else require more cash. Depicted below, you can see how its cash holdings have changed over time.

How Well Is SciBase Holding Growing?

On balance, we think it's mildly positive that SciBase Holding trimmed its cash burn by 13% over the last twelve months. And operating revenue was up by 2.6% too. On balance, we'd say the company is improving over time. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Easily Can SciBase Holding Raise Cash?

Even though it seems like SciBase Holding is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of kr262m, SciBase Holding's kr34m in cash burn equates to about 13% of its market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

Is SciBase Holding's Cash Burn A Worry?

SciBase Holding appears to be in pretty good health when it comes to its cash burn situation. One the one hand we have its solid cash burn reduction, while on the other it can also boast very strong cash burn relative to its market cap. Shareholders can take heart from the fact that at least one analyst is forecasting it will reach breakeven. We don't think its cash burn is particularly problematic, but after considering the range of factors in this article, we do think shareholders should be monitoring how it changes over time. Taking a deeper dive, we've spotted 5 warning signs for SciBase Holding you should be aware of, and 2 of them make us uncomfortable.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

When trading SciBase Holding or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:SCIB

SciBase Holding

A medical technology company, develops and commercializes point-of-care platforms for skin health management in Europe, the United States, North America, Asia, Oceania, and internationally.

Flawless balance sheet with moderate risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026