As global markets rally on optimism around potential trade deals and AI-driven growth, major indices like the S&P 500 have reached record highs, showcasing a strong performance in growth stocks over value shares. In such an environment, companies with high insider ownership can be particularly appealing to investors, as they often indicate confidence from those closely involved with the business and may align well with current market enthusiasm for robust growth opportunities.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Waystream Holding (OM:WAYS) | 11.3% | 113.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Underneath we present a selection of stocks filtered out by our screen.

RaySearch Laboratories (OM:RAY B)

Simply Wall St Growth Rating: ★★★★★☆

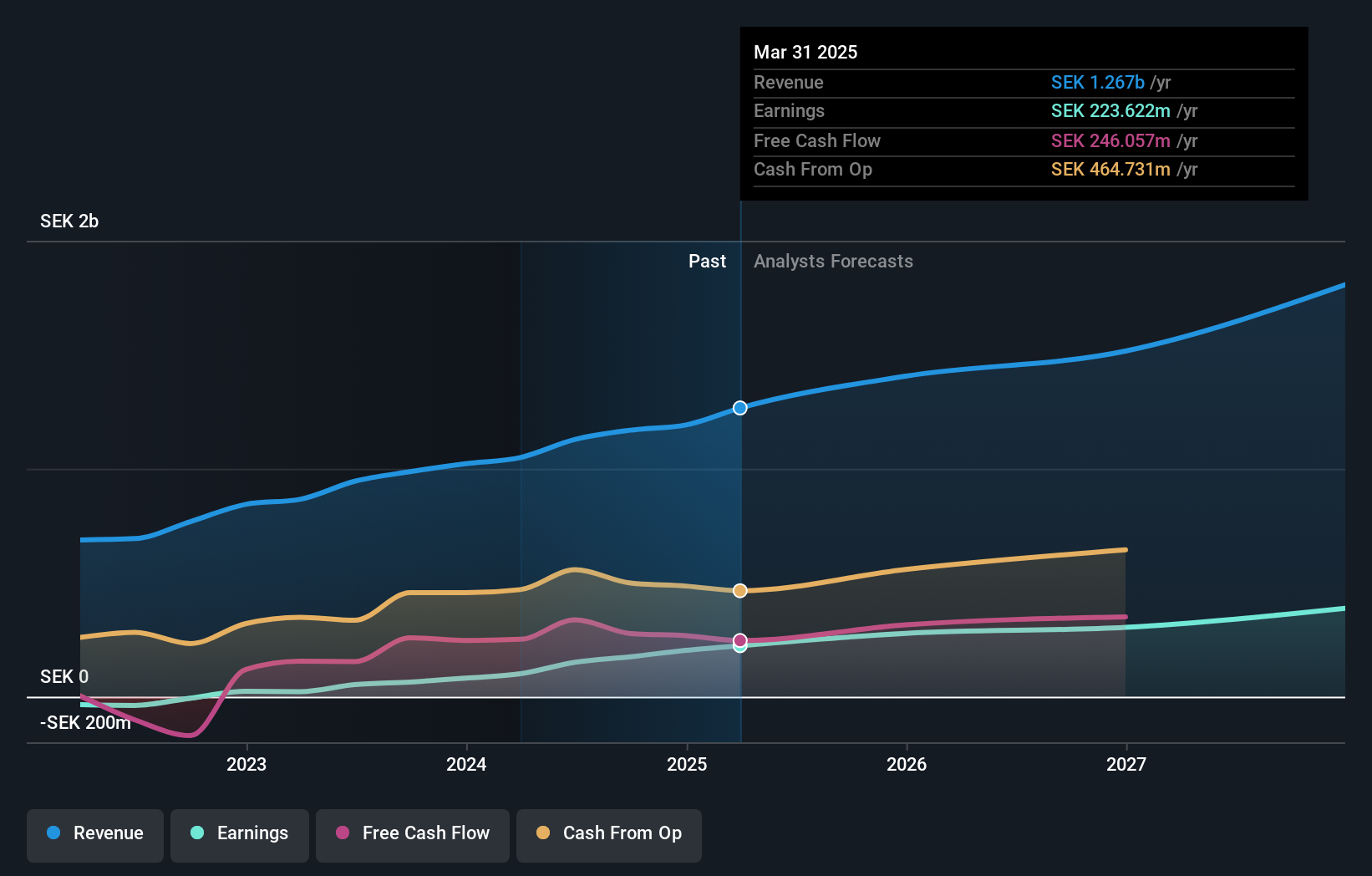

Overview: RaySearch Laboratories AB (publ) is a medical technology company that develops software solutions for cancer care across various regions, with a market cap of approximately SEK7.92 billion.

Operations: The company generates revenue of SEK1.17 billion from its healthcare software segment, focusing on cancer care solutions across multiple regions.

Insider Ownership: 23.6%

Earnings Growth Forecast: 24.1% p.a.

RaySearch Laboratories has demonstrated strong growth potential with its earnings increasing by 172.8% over the past year and a forecasted annual profit growth of 24.1%, surpassing the Swedish market average. Recent client acquisitions, such as Medim's order for DrugLog and Institut Curie's purchase of RayStation, bolster its revenue stream, which is projected to grow at 11.5% annually. Despite no significant insider trading activity recently, high insider ownership aligns interests with shareholders' long-term goals.

- Get an in-depth perspective on RaySearch Laboratories' performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that RaySearch Laboratories is priced higher than what may be justified by its financials.

Kunshan GuoLi Electronic Technology (SHSE:688103)

Simply Wall St Growth Rating: ★★★★★☆

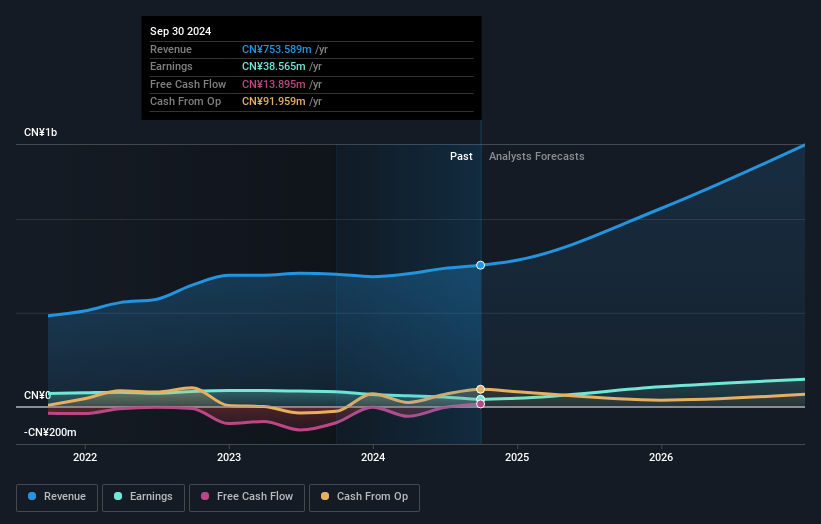

Overview: Kunshan GuoLi Electronic Technology Co., Ltd. operates in the electronics sector and has a market capitalization of CN¥3.52 billion.

Operations: The company generates revenue from its Research and Development, Production, and Sales of Vacuum Devices segment amounting to CN¥753.59 million.

Insider Ownership: 30.4%

Earnings Growth Forecast: 59.4% p.a.

Kunshan GuoLi Electronic Technology is poised for significant growth, with earnings expected to rise 59.4% annually, outpacing the Chinese market. Despite a dip in profit margins from 11.2% to 5.1%, revenue is forecasted to grow at 29.1% per year, driven by strategic moves like a technical collaboration in India for HVDC components manufacturing. Recent share buybacks totaling CNY 20.99 million reflect confidence but highlight challenges in sustaining dividends with current cash flows.

- Delve into the full analysis future growth report here for a deeper understanding of Kunshan GuoLi Electronic Technology.

- According our valuation report, there's an indication that Kunshan GuoLi Electronic Technology's share price might be on the expensive side.

SAKURA Internet (TSE:3778)

Simply Wall St Growth Rating: ★★★★★☆

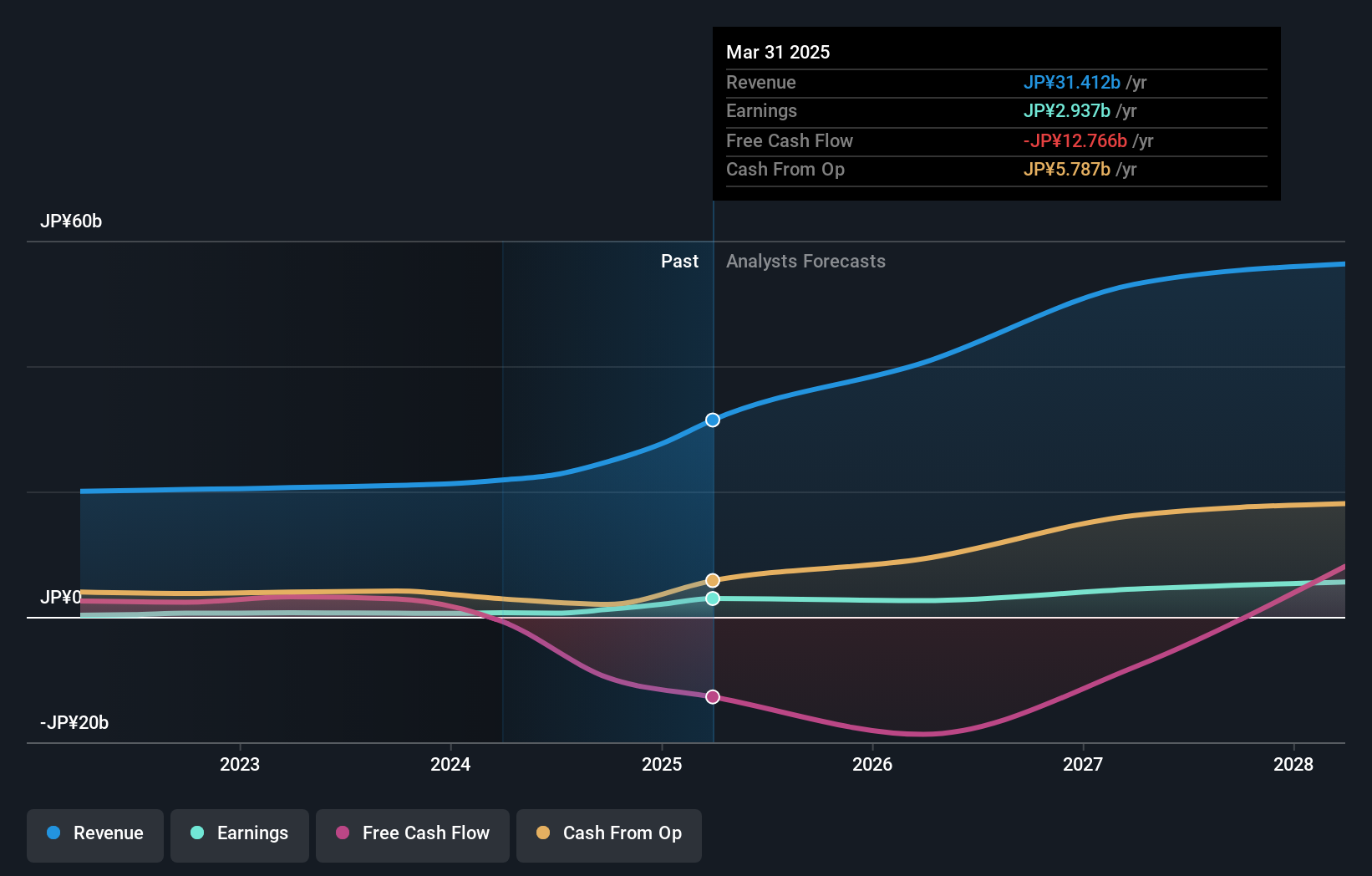

Overview: SAKURA Internet Inc. operates in Japan, providing cloud computing services, with a market cap of ¥179.99 billion.

Operations: The company's revenue primarily comes from its Internet Infrastructure Business, generating ¥24.75 billion.

Insider Ownership: 18.1%

Earnings Growth Forecast: 50.8% p.a.

SAKURA Internet is positioned for substantial growth, with earnings projected to increase by 50.83% annually, surpassing the Japanese market's growth rate. Revenue is forecasted to grow at 36.9% per year, significantly outpacing the market average of 4.3%. Despite high earnings growth expectations and a lack of insider trading activity over the past three months, its share price has been highly volatile recently. The company anticipates net sales of ¥29 billion and operating profit of ¥2.6 billion for FY2025.

- Dive into the specifics of SAKURA Internet here with our thorough growth forecast report.

- Our expertly prepared valuation report SAKURA Internet implies its share price may be too high.

Next Steps

- Discover the full array of 1469 Fast Growing Companies With High Insider Ownership right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3778

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives