- Italy

- /

- Food and Staples Retail

- /

- BIT:ORS

Exploring September 2025's Undiscovered Gems in Europe

Reviewed by Simply Wall St

As the European market experiences a modest uptick, with the STOXX Europe 600 Index rising by 1.03% amid expectations of U.S. rate cuts, investors are keenly observing how these macroeconomic shifts might influence small-cap stocks across the continent. In this dynamic environment, identifying promising stocks often involves looking for companies that demonstrate resilience and adaptability to changing economic conditions while maintaining robust growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Flügger group | 30.11% | 1.55% | -30.01% | ★★★★★☆ |

| Sparta | NA | -9.54% | -15.40% | ★★★★★☆ |

| Freetrailer Group | 0.01% | 22.96% | 31.56% | ★★★★★☆ |

| Dekpol | 63.20% | 11.99% | 14.08% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Orsero (BIT:ORS)

Simply Wall St Value Rating: ★★★★★★

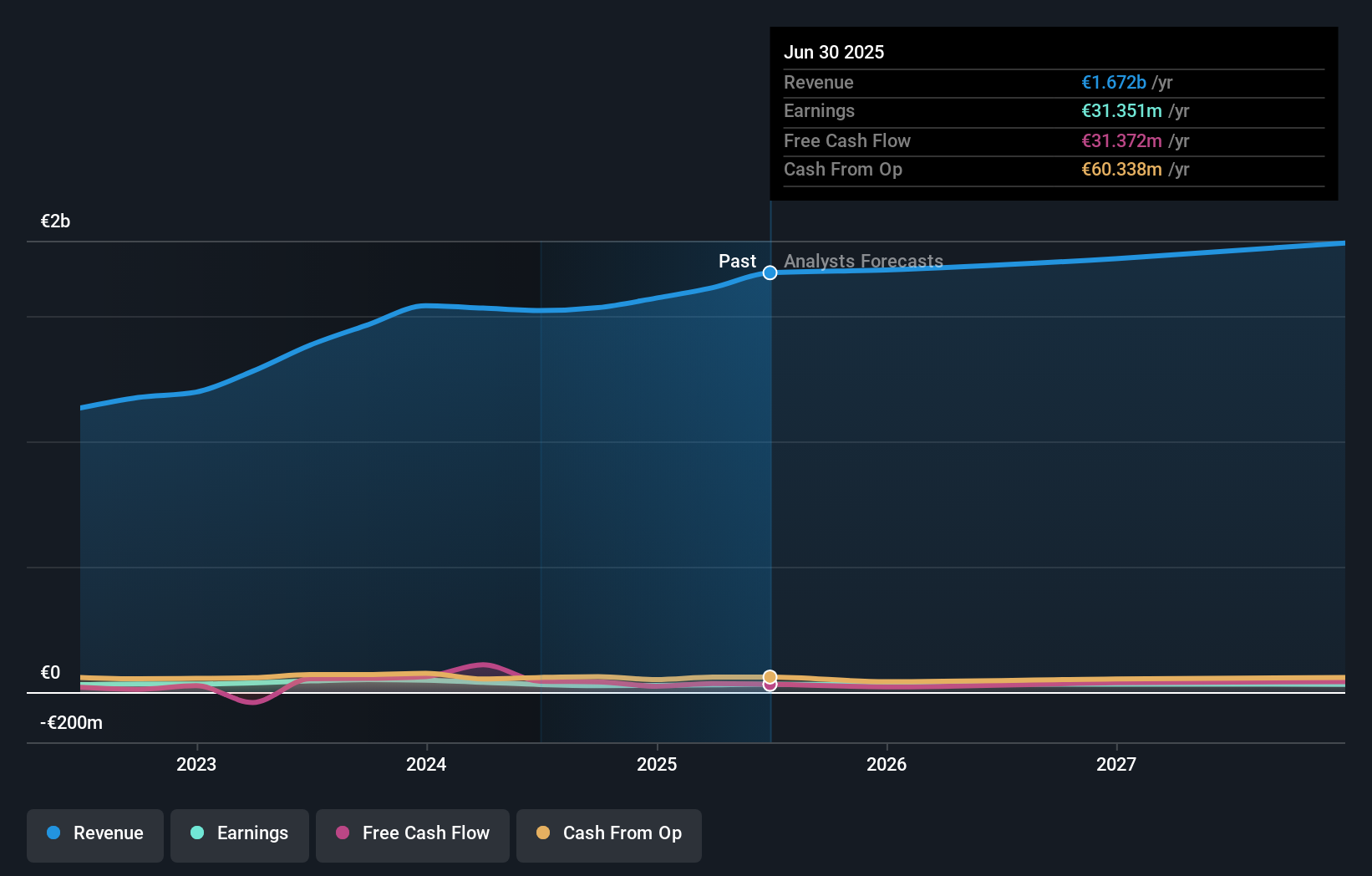

Overview: Orsero S.p.A. operates as an importer and distributor of fruits and vegetables across Europe, Latin America, and Central America, with a market capitalization of €304.62 million.

Operations: Orsero generates revenue primarily from importing and distributing fruits and vegetables across multiple regions. The company's financial performance is highlighted by a market capitalization of €304.62 million.

Orsero, a notable player in the fruit and vegetable sector, has demonstrated solid financial health with earnings rising 4.3% over the past year, outpacing the industry average of 0.7%. The company trades at 40.1% below its estimated fair value and maintains a satisfactory net debt to equity ratio of 22.6%. Recent half-year results showed sales climbing to €845 million from €744 million last year, while net income increased to €19.16 million from €14.62 million. Orsero's strategic focus on high-margin exotic fruits and efficient warehouse operations aims to bolster revenue despite forecasted profit margin declines over the next three years.

VIEL & Cie société anonyme (ENXTPA:VIL)

Simply Wall St Value Rating: ★★★★★☆

Overview: VIEL & Cie, société anonyme is an investment company offering interdealer broking, online trading, and private banking services across Europe, the Middle East, Africa, the Americas, and the Asia-Pacific region with a market cap of €1.01 billion.

Operations: VIEL & Cie generates revenue primarily through its interdealer broking, online trading, and private banking services across multiple regions. The company's financial performance is reflected in its market capitalization of €1.01 billion.

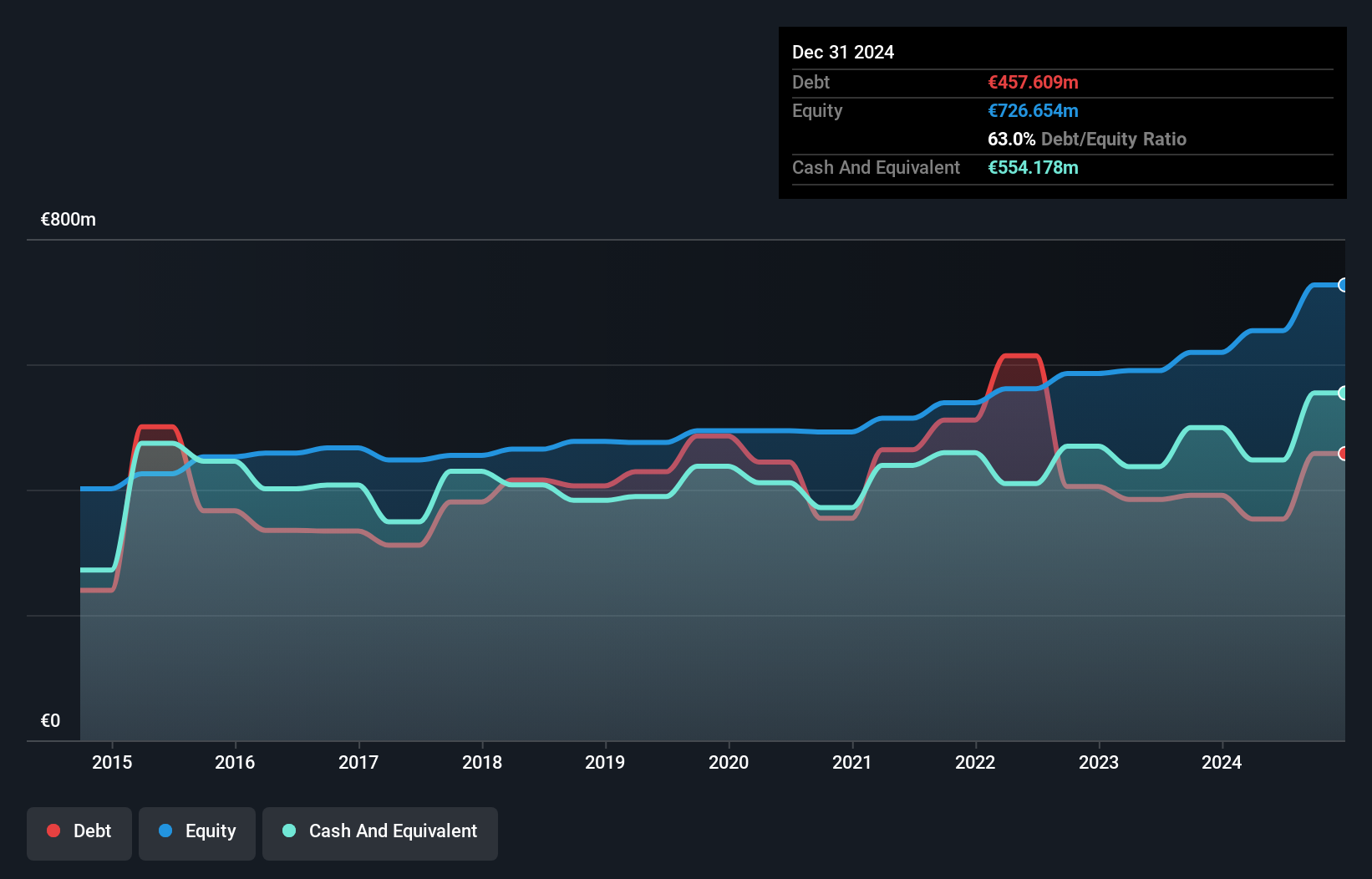

VIEL & Cie, a niche player in the European market, has shown robust financial health with earnings growing at an annual rate of 22.9% over five years. The company's debt to equity ratio improved from 89.9% to 69.9%, indicating prudent financial management. Recent half-year results revealed revenue of €655.2 million and net income of €69.2 million, both up from last year’s figures, suggesting steady growth momentum. Trading at 23.6% below its estimated fair value, VIEL appears undervalued with high-quality earnings and positive free cash flow, although interest coverage data remains insufficient for comprehensive analysis.

RaySearch Laboratories (OM:RAY B)

Simply Wall St Value Rating: ★★★★★★

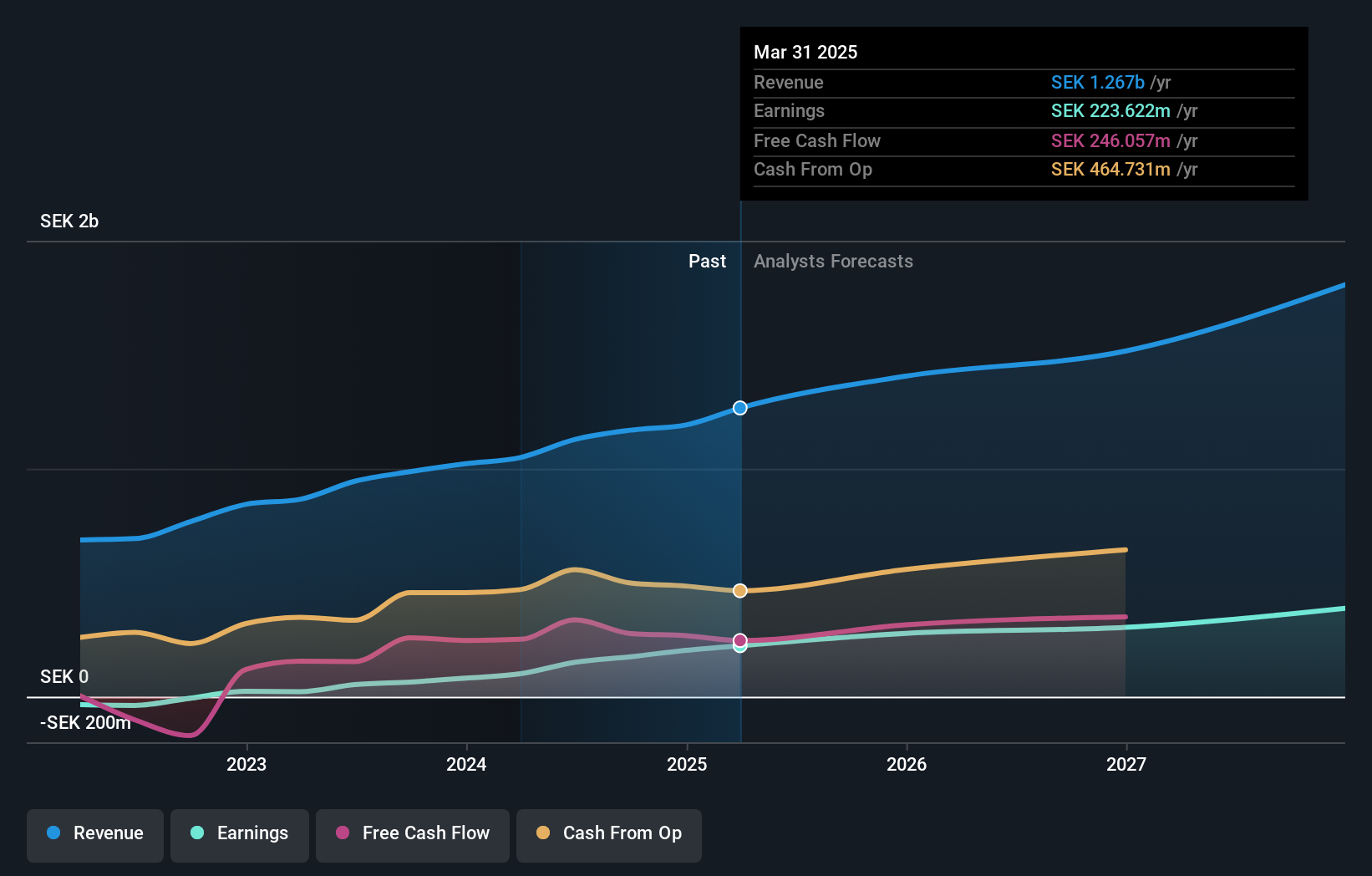

Overview: RaySearch Laboratories AB (publ) is a medical technology company that offers software solutions for cancer treatment on a global scale, with a market cap of approximately SEK8.54 billion.

Operations: RaySearch Laboratories generates revenue primarily from its healthcare software segment, which reported SEK1.25 billion.

RaySearch Laboratories, a nimble player in the oncology software space, has shown robust growth with earnings climbing by 27.6% over the past year, outpacing the Healthcare Services industry average of 14.4%. The company is debt-free, enhancing its financial stability compared to five years ago when it had a debt-to-equity ratio of 23.6%. Recent product innovations like RayIntelligence v2025 are designed to transform clinical data into actionable insights, potentially boosting market visibility and recurring revenues. With free cash flow at SEK 167.28 million as of June 2025 and strategic partnerships expanding its reach, RaySearch appears well-positioned for continued growth amidst rising global cancer treatment demand.

Make It Happen

- Unlock more gems! Our European Undiscovered Gems With Strong Fundamentals screener has unearthed 331 more companies for you to explore.Click here to unveil our expertly curated list of 334 European Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ORS

Orsero

Imports and distributes fruits and vegetables in Europe, Latin America, and Central America.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives