- Sweden

- /

- Healthtech

- /

- OM:RAY B

European Growth Stocks With Strong Insider Backing

Reviewed by Simply Wall St

As European markets experience a pullback, with the pan-European STOXX Europe 600 Index ending 1.24% lower amid concerns about overvaluation in AI-related stocks, investors are increasingly focused on identifying robust growth opportunities backed by strong fundamentals. In such an environment, companies that exhibit high insider ownership often attract attention as they suggest confidence from those who know the business best and can offer potential resilience against broader market volatility.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 44.9% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 96.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| Egetis Therapeutics (OM:EGTX) | 10.3% | 86.1% |

| DNO (OB:DNO) | 13.5% | 102.1% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.5% |

| CD Projekt (WSE:CDR) | 29.7% | 51% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

Here's a peek at a few of the choices from the screener.

K-Fast Holding (OM:KFAST B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: K-Fast Holding AB (publ) operates in Sweden, focusing on property management and construction, with a market capitalization of approximately SEK3.22 billion.

Operations: The company's revenue segments include property management and construction activities in Sweden.

Insider Ownership: 31.7%

Return On Equity Forecast: N/A (2028 estimate)

K-Fast Holding AB has demonstrated significant growth potential, with earnings expected to increase by a substantial 77.8% annually over the next three years, outpacing the Swedish market's average growth. Recent acquisitions in Gothenburg aim to expand rental apartment offerings, potentially enhancing revenue streams. Despite becoming profitable this year and insiders showing confidence through net share purchases, financial challenges remain as interest payments are not well covered by earnings.

- Unlock comprehensive insights into our analysis of K-Fast Holding stock in this growth report.

- According our valuation report, there's an indication that K-Fast Holding's share price might be on the expensive side.

RaySearch Laboratories (OM:RAY B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: RaySearch Laboratories AB (publ) is a medical technology company that offers software solutions for cancer treatment globally, with a market cap of SEK7.66 billion.

Operations: RaySearch Laboratories generates revenue through its global provision of software solutions designed for cancer treatment.

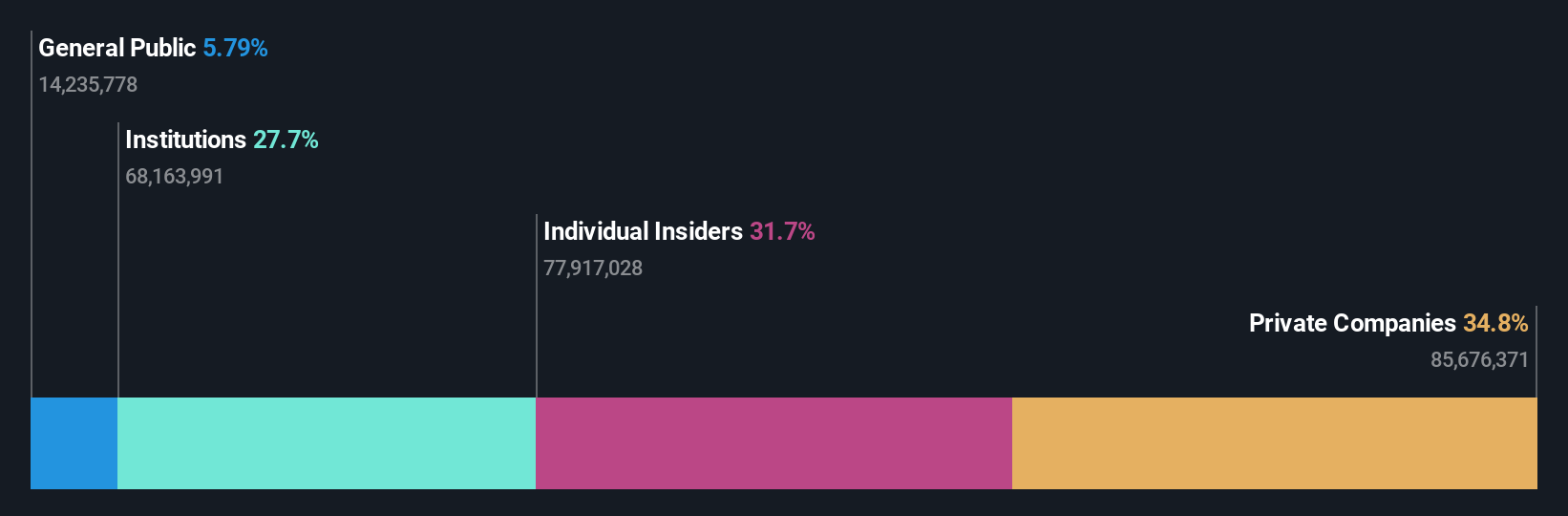

Insider Ownership: 17%

Return On Equity Forecast: 30% (2028 estimate)

RaySearch Laboratories demonstrates strong growth potential, with earnings forecasted to grow 24.31% annually, surpassing the Swedish market's average. Recent Q3 results show robust performance with sales reaching SEK 332.3 million and net income at SEK 71.6 million. The company's strategic collaborations for advanced proton therapy and innovations in oncology systems highlight its commitment to cutting-edge technology in cancer treatment, while insider ownership remains a key factor supporting long-term growth interests.

- Dive into the specifics of RaySearch Laboratories here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, RaySearch Laboratories' share price might be too optimistic.

VAT Group (SWX:VACN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: VAT Group AG, with a market cap of CHF10.20 billion, develops, manufactures, and sells vacuum and gas inlet valves, multi-valve modules, motion components, and edge-welded metal bellows through its subsidiaries.

Operations: The company's revenue segments consist of CHF946.68 million from Valves and CHF172.14 million from Global Service.

Insider Ownership: 10.2%

Return On Equity Forecast: 36% (2028 estimate)

VAT Group exhibits solid growth prospects, with earnings projected to grow 17.3% annually, outpacing the Swiss market. Revenue is expected to increase by 10.3% per year, faster than the market average. Despite recent volatility in share price and no significant insider trading activity noted over the past three months, VAT Group's high return on equity forecast of 35.9% underscores its robust financial health. Recent executive changes may impact strategic direction in semiconductor solutions.

- Click to explore a detailed breakdown of our findings in VAT Group's earnings growth report.

- Our valuation report here indicates VAT Group may be overvalued.

Summing It All Up

- Embark on your investment journey to our 187 Fast Growing European Companies With High Insider Ownership selection here.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:RAY B

RaySearch Laboratories

A medical technology company, provides software solutions for cancer treatment worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives