- Sweden

- /

- Medical Equipment

- /

- OM:OSSD

OssDsign AB (publ)'s (STO:OSSD) 25% Price Boost Is Out Of Tune With Revenues

OssDsign AB (publ) (STO:OSSD) shares have continued their recent momentum with a 25% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 47%.

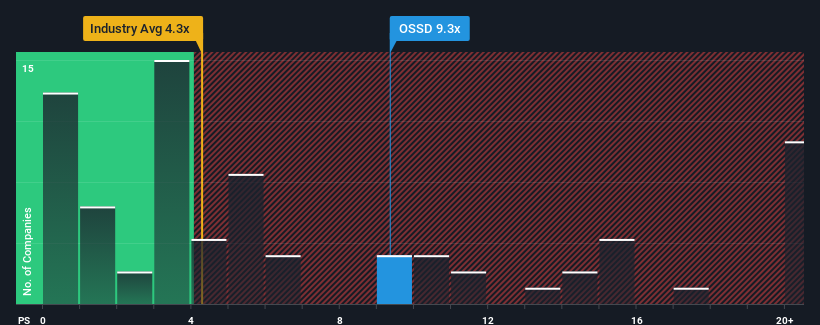

Following the firm bounce in price, you could be forgiven for thinking OssDsign is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 9.3x, considering almost half the companies in Sweden's Medical Equipment industry have P/S ratios below 4.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for OssDsign

What Does OssDsign's Recent Performance Look Like?

Recent times have been advantageous for OssDsign as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on OssDsign.Do Revenue Forecasts Match The High P/S Ratio?

OssDsign's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 19%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 29% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 59% each year, which is noticeably more attractive.

In light of this, it's alarming that OssDsign's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On OssDsign's P/S

The strong share price surge has lead to OssDsign's P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for OssDsign, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for OssDsign with six simple checks will allow you to discover any risks that could be an issue.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:OSSD

OssDsign

Designs, manufactures, and sells implants and material technology for bone regeneration in Sweden, Germany, the United States, the United Kingdom, rest of Europe, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives