- Sweden

- /

- Medical Equipment

- /

- OM:NOSA

Nordic LEVEL Group AB (publ.) And 2 Other European Penny Stocks To Watch

Reviewed by Simply Wall St

The European market has recently shown resilience, with the STOXX Europe 600 Index rising by 3.44% as concerns over tariffs eased, and major indices in Germany, Italy, and France also seeing gains. Amidst this backdrop of economic growth acceleration in the eurozone, investors are increasingly exploring opportunities within smaller or newer companies. Penny stocks—despite their somewhat outdated moniker—continue to offer potential value for those looking to invest in firms with strong financial foundations. In this article, we explore three European penny stocks that stand out for their financial strength and potential for growth.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.24 | SEK2.14B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.78 | SEK272.36M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.70 | SEK277.44M | ✅ 3 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.34 | SEK203.2M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.63 | PLN123.04M | ✅ 4 ⚠️ 2 View Analysis > |

| AMSC (OB:AMSC) | NOK1.50 | NOK107.8M | ✅ 2 ⚠️ 5 View Analysis > |

| Cellularline (BIT:CELL) | €2.60 | €54.84M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.99 | €33.15M | ✅ 3 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.57 | €17.09M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.20 | €303.74M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 437 stocks from our European Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Nordic LEVEL Group AB (publ.) (OM:LEVEL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nordic LEVEL Group AB (publ.) offers safety and security solutions mainly in Sweden, with a market cap of SEK 126.07 million.

Operations: The company generates revenue through its segments, with SEK 355.06 million from Technology, SEK 19.28 million from Advisory, and SEK 13.22 million from Group-wide services.

Market Cap: SEK126.07M

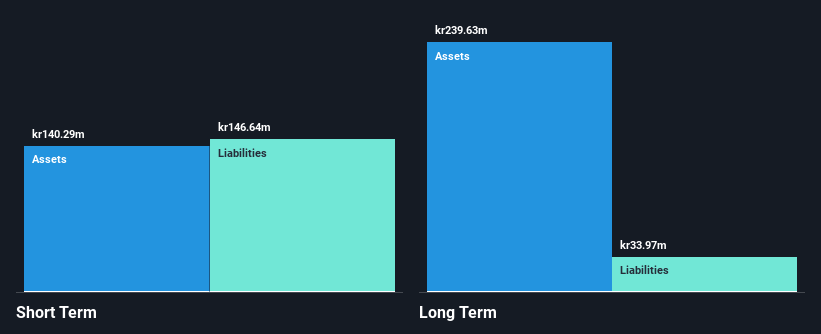

Nordic LEVEL Group AB (publ.) is trading at a significant discount to its estimated fair value and peers, making it an attractive option within the penny stock category. Despite being unprofitable, it has a solid cash runway exceeding three years and reduced its debt-to-equity ratio significantly over five years. The company reported SEK 375.76 million in revenue for 2024, with a net loss of SEK 6.03 million, indicating improved earnings stability compared to prior periods. However, short-term liabilities slightly exceed short-term assets, requiring careful monitoring by investors interested in this security solutions provider.

- Unlock comprehensive insights into our analysis of Nordic LEVEL Group AB (publ.) stock in this financial health report.

- Review our growth performance report to gain insights into Nordic LEVEL Group AB (publ.)'s future.

Nosa Plugs (OM:NOSA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nosa Plugs AB is a medical technology company that manufactures and sells intranasal breathing products primarily in Europe and North America, with a market cap of SEK168.78 million.

Operations: The company generates revenue from two main segments: B2B, contributing SEK12.72 million, and B2C, accounting for SEK3.38 million.

Market Cap: SEK168.78M

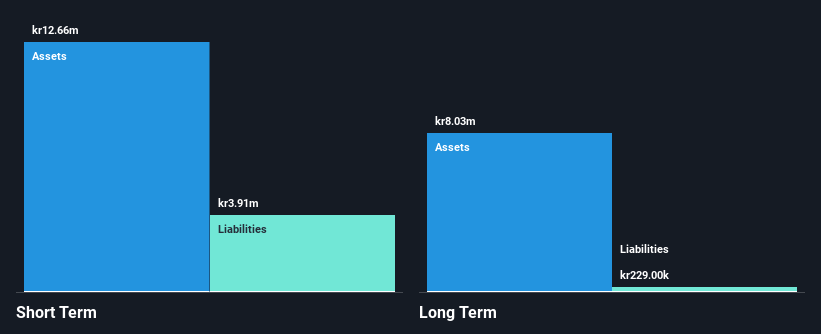

Nosa Plugs AB, with a market cap of SEK168.78 million, has shown promising revenue growth, increasing from SEK10.48 million to SEK16.13 million over the past year. Despite being unprofitable and having a negative return on equity of -61.36%, the company's short-term assets exceed both its short and long-term liabilities, suggesting financial stability in the near term. The stock's high volatility may concern some investors; however, it remains undiluted over the past year and is expected to see earnings grow significantly by 103% annually according to forecasts, offering potential upside for risk-tolerant investors interested in penny stocks.

- Navigate through the intricacies of Nosa Plugs with our comprehensive balance sheet health report here.

- Assess Nosa Plugs' future earnings estimates with our detailed growth reports.

PCC Exol (WSE:PCX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: PCC Exol S.A. is a company that manufactures and distributes surfactants both in Poland and internationally, with a market cap of PLN393.55 million.

Operations: The company's revenue from its Specialty Chemicals segment is PLN948.12 million.

Market Cap: PLN393.55M

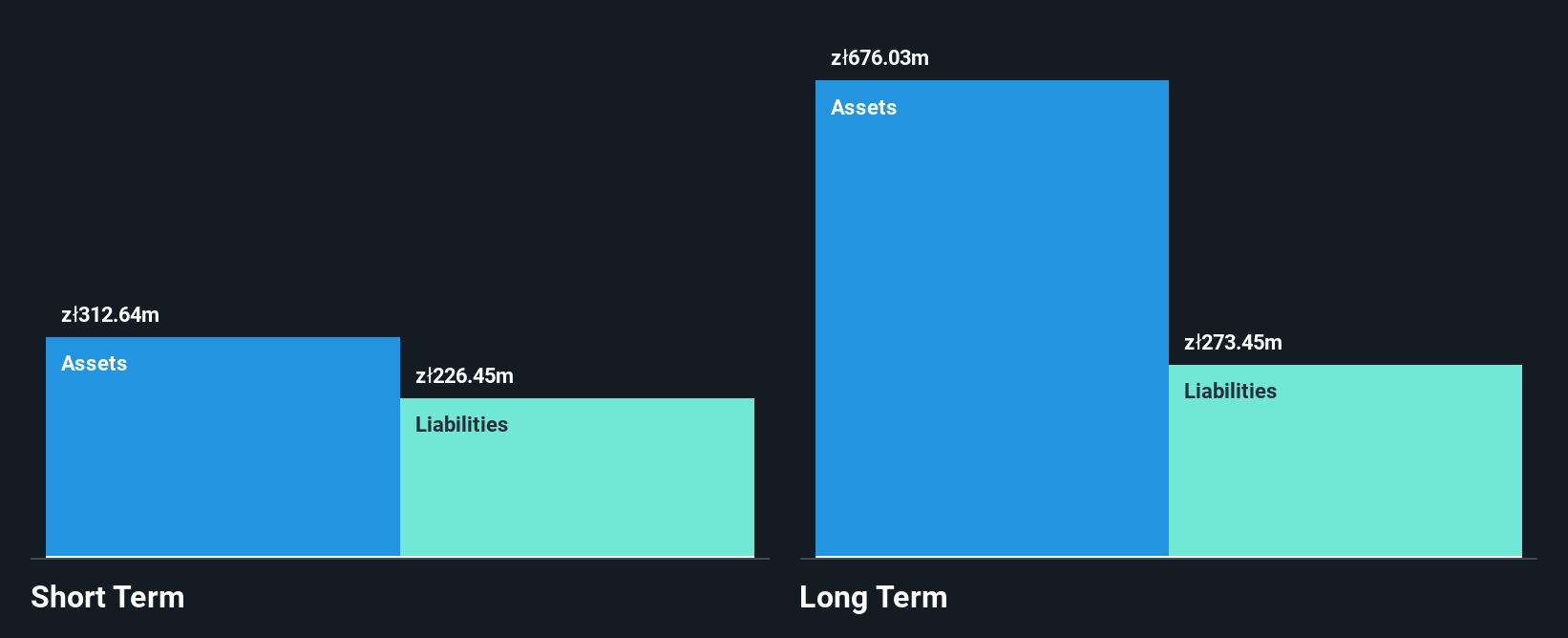

PCC Exol S.A., with a market cap of PLN393.55 million, presents an intriguing case within the penny stock landscape. The company reported stable annual sales of PLN948.12 million but experienced a decline in net income to PLN35.59 million from the previous year. While PCC Exol's earnings have grown modestly over five years, recent negative growth and lower profit margins may concern some investors. Despite high debt levels, its short-term assets cover both short- and long-term liabilities, indicating financial resilience. Additionally, its board is experienced, and interest payments are well covered by EBIT (4.1x), offering some stability amidst volatility in earnings growth.

- Get an in-depth perspective on PCC Exol's performance by reading our balance sheet health report here.

- Evaluate PCC Exol's historical performance by accessing our past performance report.

Next Steps

- Investigate our full lineup of 437 European Penny Stocks right here.

- Searching for a Fresh Perspective? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nosa Plugs might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NOSA

Nosa Plugs

A medical technology company, manufactures and sells intranasal breathing products primarily in Europe and North America.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives