- Sweden

- /

- Healthcare Services

- /

- OM:MCOV B

European Growth Companies With High Insider Ownership In November 2025

Reviewed by Simply Wall St

As the European markets face mixed performances with major stock indexes showing varied results, the pan-European STOXX Europe 600 Index recently dipped slightly after reaching a new high. In this fluctuating environment, growth companies with high insider ownership can offer a unique perspective on potential resilience and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 58.2% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 95.9% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 69.2% |

| Egetis Therapeutics (OM:EGTX) | 10.3% | 81.8% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.5% |

| CD Projekt (WSE:CDR) | 29.7% | 49.6% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 51.4% |

Let's take a closer look at a couple of our picks from the screened companies.

TomTom (ENXTAM:TOM2)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TomTom N.V. develops and sells navigation and location-based products and services across Europe, the Americas, and internationally, with a market cap of €643.32 million.

Operations: TomTom's revenue is primarily derived from its Location Technology segment, which generated €503.92 million, and its Consumer segment, which contributed €77.52 million.

Insider Ownership: 13.4%

Earnings Growth Forecast: 108.6% p.a.

TomTom has demonstrated significant insider ownership, aligning management interests with shareholders. The company recently raised its full-year revenue guidance and reported a turnaround in Q3 net income to €9.1 million from a loss last year, despite slightly lower sales of €136.88 million. TomTom's innovative product launches and expanded partnerships, such as with Hyundai AutoEver, bolster its growth prospects. Although revenue growth is modest at 2.3% annually, profitability is expected within three years, outperforming market averages.

- Click here to discover the nuances of TomTom with our detailed analytical future growth report.

- According our valuation report, there's an indication that TomTom's share price might be on the cheaper side.

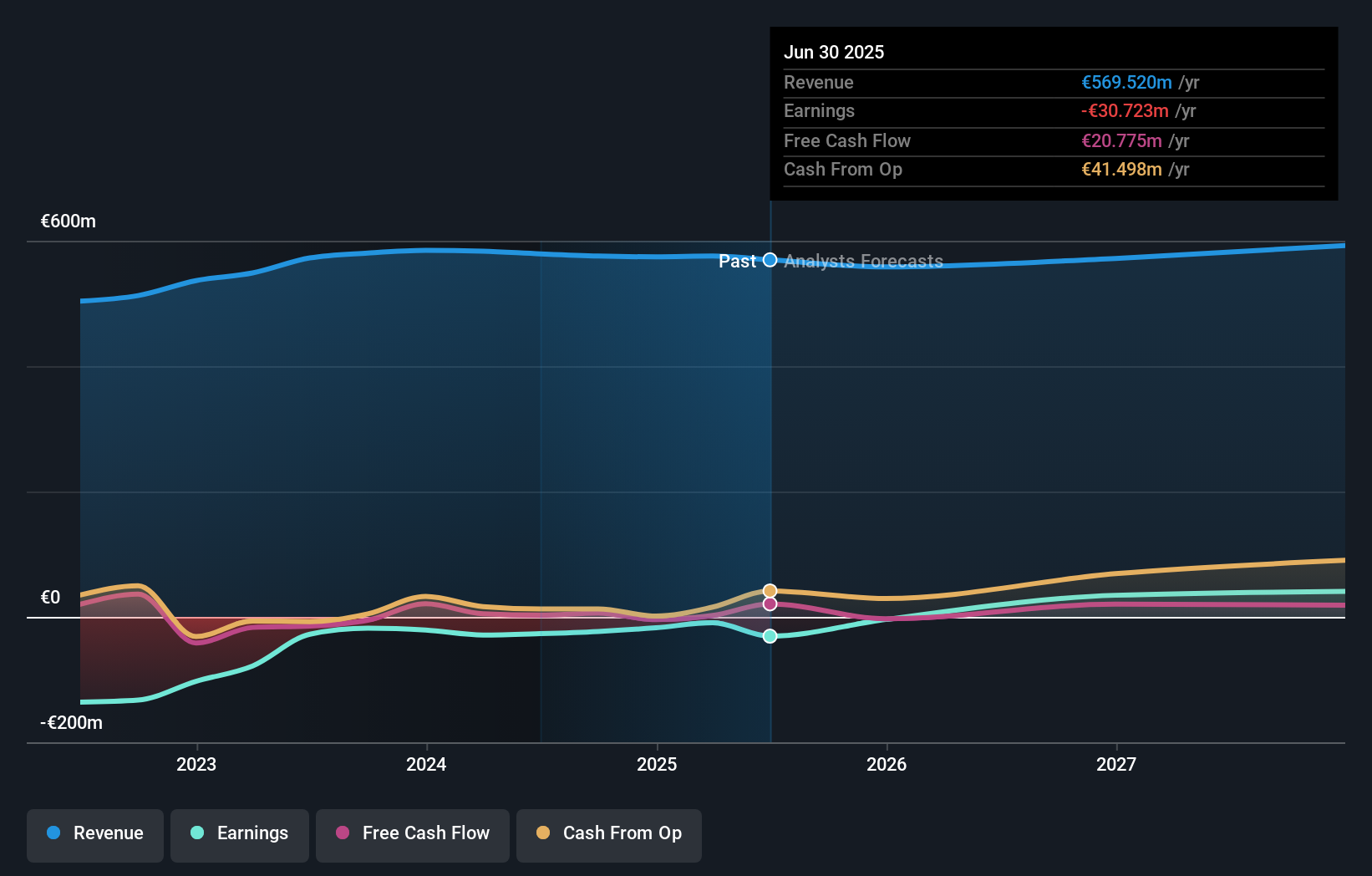

Medicover (OM:MCOV B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Medicover AB (publ) operates healthcare and diagnostic services in Poland, Sweden, and internationally, with a market cap of SEK38.27 billion.

Operations: The company's revenue is derived from Diagnostic Services, contributing €703.20 million, and Healthcare Services, accounting for €1.58 billion.

Insider Ownership: 11.2%

Earnings Growth Forecast: 29.9% p.a.

Medicover exhibits substantial insider ownership, aligning management interests with shareholders. The company is trading significantly below its estimated fair value, presenting potential upside. Earnings grew 87.9% last year and are forecast to grow at 29.94% annually, outpacing the Swedish market's growth rate. Recent results from the DART study highlight Medicover Genetics' innovative MRD assay's potential in predicting disease progression in NSCLC patients, enhancing its commercial prospects despite interest payments not being well-covered by earnings.

- Get an in-depth perspective on Medicover's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Medicover shares in the market.

Verve Group (XTRA:M8G)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Verve Group SE is a digital media company that provides ad-software solutions in North America and Europe, with a market cap of €400.02 million.

Operations: The company's revenue is primarily derived from its Supply Side Platforms (SSP) at €399.07 million and Demand Side Platforms (DSP) at €130.94 million.

Insider Ownership: 24.5%

Earnings Growth Forecast: 49.9% p.a.

Verve Group shows significant insider ownership, aligning management with shareholder interests. Despite a volatile share price and lowered revenue guidance due to technical issues and FX impacts, the company is trading well below its estimated fair value. Earnings are forecast to grow significantly at 49.9% annually, outpacing the German market's growth rate. Recent acquisition discussions for Acardo Group AG may influence future operational strategies, though interest coverage remains a concern.

- Take a closer look at Verve Group's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Verve Group shares in the market.

Seize The Opportunity

- Get an in-depth perspective on all 191 Fast Growing European Companies With High Insider Ownership by using our screener here.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MCOV B

Medicover

Provides healthcare and diagnostic services in Poland, Sweden, and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives