- Sweden

- /

- Medical Equipment

- /

- OM:IMP A SDB

Implantica (OM:IMP A SDB) Is Up 6.0% After Surgeons Endorse RefluxStop at Key Medical Meeting—Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Implantica AG recently announced third quarter 2025 earnings, reporting sales of €365,000 and a net loss of €4.34 million, alongside continued rollout of its RefluxStop® device across Europe.

- Recognition of RefluxStop®’s real-world success by leading acid reflux surgeons at the 2025 European Foregut Society Annual Meeting demonstrates growing clinical confidence in the device’s impact on GERD treatment.

- We'll explore how strong clinical adoption at a major European conference shapes Implantica's investment narrative and future growth prospects.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Implantica's Investment Narrative?

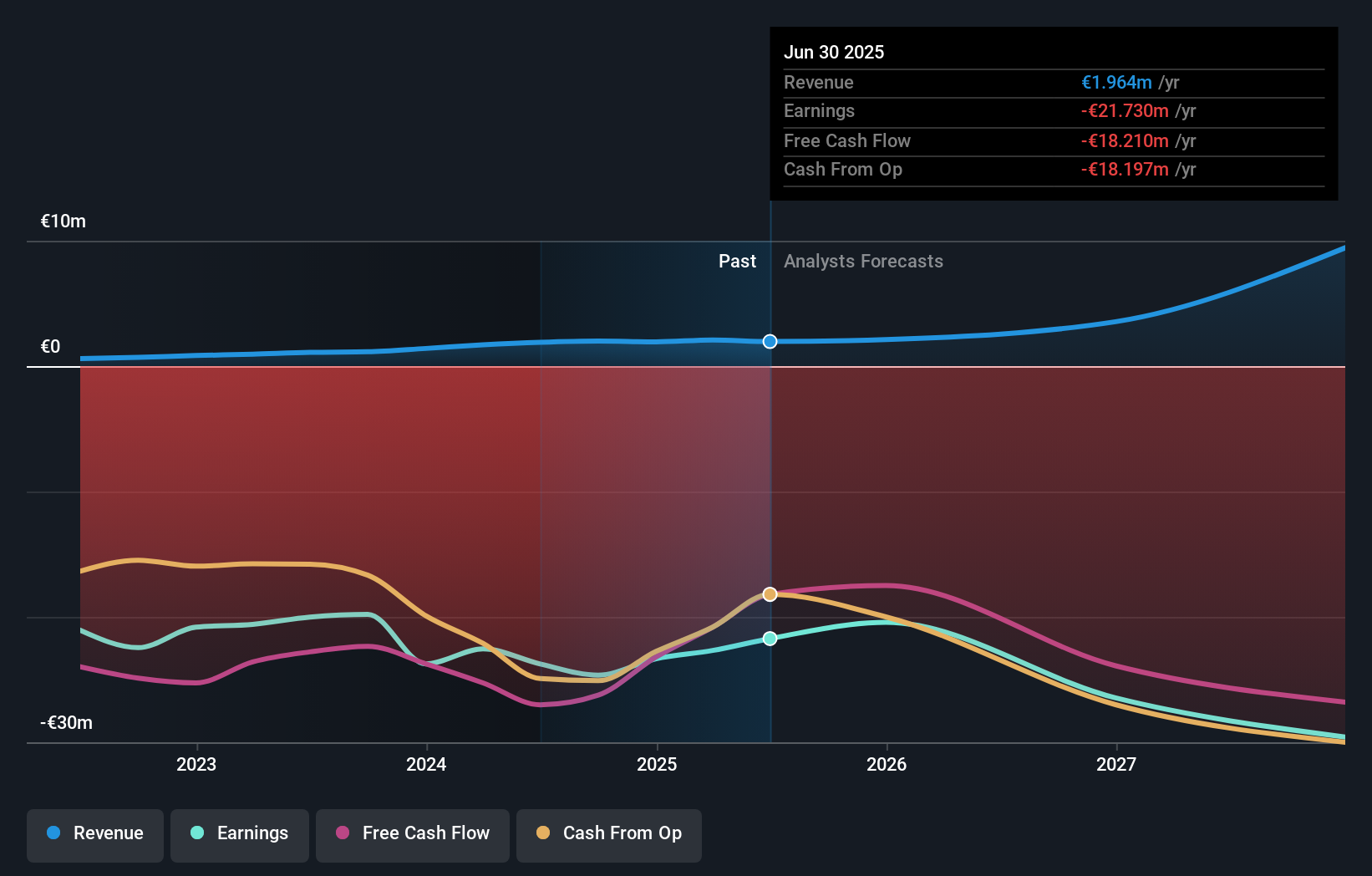

For someone considering Implantica as an investment, the primary story rests on whether RefluxStop® can achieve widespread adoption and commercial success, especially after this quarter’s headlines. The recognition from Europe’s leading foregut surgeons offers a clear boost to the clinical credibility that could accelerate uptake in new centers, potentially serving as a short-term catalyst if sales momentum builds. However, growth in revenue this quarter was modest, and the company remains meaningfully unprofitable, with net losses continuing, even as these are narrowing. The recent news does shift the risk profile a bit; while positive clinical momentum lowers commercial execution risk in Europe, Implantica’s future still hinges on successful FDA approval and the ability to scale sales meaningfully. Investors will likely keep an eye on cash burn and whether real-world enthusiasm translates to sustainable sales growth.

But even with strong clinical feedback, the path to profitability remains a critical risk for investors. In light of our recent valuation report, it seems possible that Implantica is trading beyond its estimated value.Exploring Other Perspectives

Explore another fair value estimate on Implantica - why the stock might be worth as much as 25% more than the current price!

Build Your Own Implantica Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Implantica research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Implantica research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Implantica's overall financial health at a glance.

No Opportunity In Implantica?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:IMP A SDB

Implantica

Engages in the research and distribution of medical implants in Switzerland.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives