David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Hedera Group AB (publ) (STO:HEGR) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Hedera Group

What Is Hedera Group's Debt?

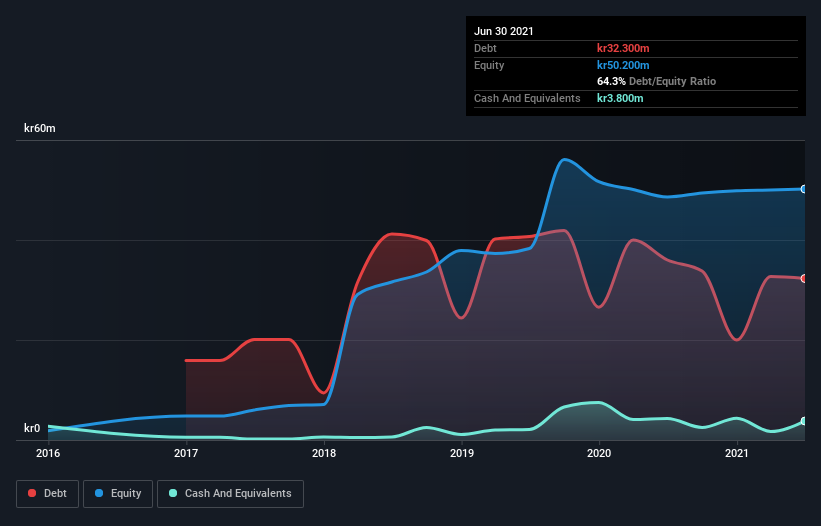

As you can see below, Hedera Group had kr32.3m of debt at June 2021, down from kr36.0m a year prior. However, it also had kr3.80m in cash, and so its net debt is kr28.5m.

How Strong Is Hedera Group's Balance Sheet?

According to the last reported balance sheet, Hedera Group had liabilities of kr43.5m due within 12 months, and liabilities of kr28.5m due beyond 12 months. Offsetting this, it had kr3.80m in cash and kr28.4m in receivables that were due within 12 months. So its liabilities total kr39.8m more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since Hedera Group has a market capitalization of kr69.2m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Hedera Group shareholders face the double whammy of a high net debt to EBITDA ratio (6.4), and fairly weak interest coverage, since EBIT is just 1.7 times the interest expense. The debt burden here is substantial. However, the silver lining was that Hedera Group achieved a positive EBIT of kr3.1m in the last twelve months, an improvement on the prior year's loss. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Hedera Group's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Happily for any shareholders, Hedera Group actually produced more free cash flow than EBIT over the last year. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

Hedera Group's net debt to EBITDA and interest cover definitely weigh on it, in our esteem. But the good news is it seems to be able to convert EBIT to free cash flow with ease. It's also worth noting that Hedera Group is in the Healthcare industry, which is often considered to be quite defensive. Looking at all the angles mentioned above, it does seem to us that Hedera Group is a somewhat risky investment as a result of its debt. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. We've identified 4 warning signs with Hedera Group (at least 3 which are concerning) , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Hedera Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:HEGR

Hedera Group

Provides personal assistance, staffing, and recruitment services for healthcare and social care sectors in Sweden.

Good value with adequate balance sheet.

Market Insights

Community Narratives