- Sweden

- /

- Healthcare Services

- /

- OM:HEGR

Benign Growth For Hedera Group AB (publ) (STO:HEGR) Underpins Stock's 26% Plummet

Hedera Group AB (publ) (STO:HEGR) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 32% share price drop.

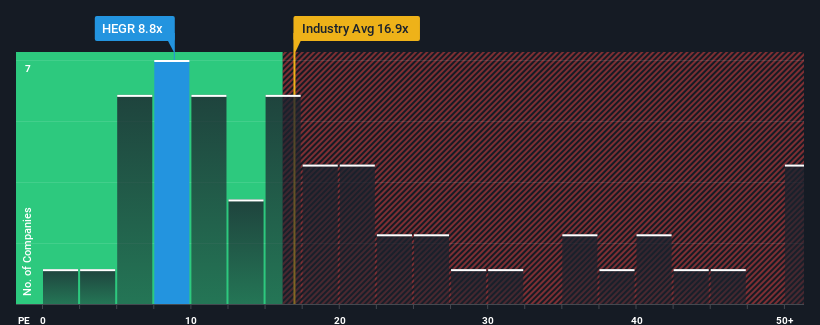

Even after such a large drop in price, Hedera Group may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 8.8x, since almost half of all companies in Sweden have P/E ratios greater than 22x and even P/E's higher than 40x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

For instance, Hedera Group's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for Hedera Group

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Hedera Group would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 38%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 25% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Hedera Group is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Hedera Group's P/E looks about as weak as its stock price lately. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Hedera Group revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - Hedera Group has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

You might be able to find a better investment than Hedera Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Hedera Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hedera Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:HEGR

Hedera Group

Provides personal assistance, staffing, and recruitment services for healthcare and social care sectors in Sweden.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives