- Sweden

- /

- Medical Equipment

- /

- OM:GETI B

Why Getinge (OM:GETI B) Is Up 8.1% After Reaffirming Guidance and Resuming Cardiosave Deliveries

Reviewed by Sasha Jovanovic

- Getinge reaffirmed its 2025 earnings guidance and long-term financial targets, highlighting robust Q3 results with organic growth, improved profitability, and record-setting sales in several segments, while confirming the resumption of Cardiosave device deliveries after regaining CE Mark.

- This update underscores Getinge’s resilience, as the company maintains growth momentum and earnings expectations despite ongoing challenges from tariffs and currency fluctuations.

- We’ll explore how Getinge’s reaffirmed outlook, despite tariff and currency headwinds, may influence the company’s investment narrative going forward.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Getinge Investment Narrative Recap

For anyone considering Getinge stock, the long-term case rests on the company’s ability to deliver steady organic growth, margin resilience despite tariff and currency pressures, and to capitalize on hospital digitalization and demographic trends. The reaffirmed 2025 guidance, announced alongside robust Q3 results and the resumption of Cardiosave device deliveries, represents a continuation rather than a meaningful change to the primary short-term catalyst, consistent profitable expansion across key medical segments, while the main risk, prolonged tariff and FX cost headwinds, remains firmly in place.

Most relevant to this update is the imminent return of Cardiosave shipments after regaining the CE Mark, as regulatory obstacles have posed significant risks for product availability and market share in acute care. This announcement intersects directly with Getinge’s key growth catalyst: sustaining high demand and reliability in advanced care therapies, which drives both recurring revenues and reinforces customer trust.

In contrast, investors should be mindful that while product approvals have progressed as hoped, the persistent inability to pass rising tariff and FX costs onto customers continues to...

Read the full narrative on Getinge (it's free!)

Getinge's narrative projects SEK 40.9 billion revenue and SEK 4.0 billion earnings by 2028. This requires 4.8% yearly revenue growth and a SEK 2.5 billion increase in earnings from the current SEK 1.5 billion.

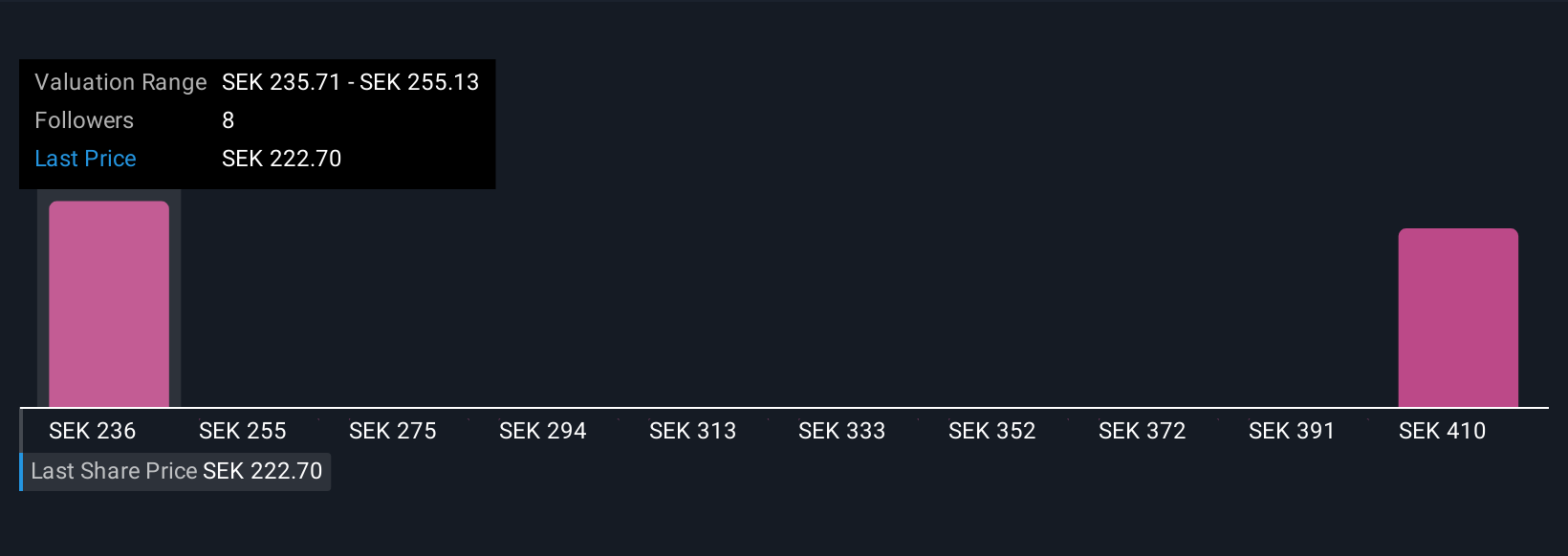

Uncover how Getinge's forecasts yield a SEK235.71 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Getinge range from SEK235.71 to SEK443.22 across three opinions, illustrating significant differences in outlook. Despite a positive sales and earnings outlook, ongoing tariff and currency headwinds raise real questions about future margin stability, take the time to review the full spectrum of views before making any judgment.

Explore 3 other fair value estimates on Getinge - why the stock might be worth just SEK235.71!

Build Your Own Getinge Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Getinge research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Getinge research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Getinge's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:GETI B

Getinge

Provides products and solutions for operating rooms, intensive-care units, and sterilization departments in Sweden and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives