Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Elos Medtech AB (publ) (STO:ELOS B) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Elos Medtech

What Is Elos Medtech's Net Debt?

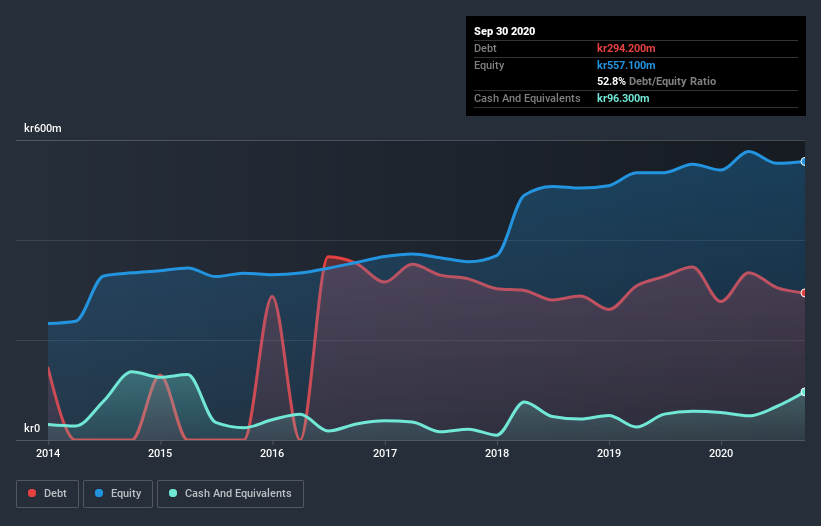

As you can see below, Elos Medtech had kr243.3m of debt at September 2020, down from kr346.0m a year prior. However, because it has a cash reserve of kr96.3m, its net debt is less, at about kr147.0m.

How Strong Is Elos Medtech's Balance Sheet?

We can see from the most recent balance sheet that Elos Medtech had liabilities of kr172.4m falling due within a year, and liabilities of kr314.7m due beyond that. On the other hand, it had cash of kr96.3m and kr70.3m worth of receivables due within a year. So its liabilities total kr320.5m more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since Elos Medtech has a market capitalization of kr835.0m, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Even though Elos Medtech's debt is only 2.3, its interest cover is really very low at 0.77. The main reason for this is that it has such high depreciation and amortisation. While companies often boast that these charges are non-cash, most such businesses will therefore require ongoing investment (that is not expensed.) In any case, it's safe to say the company has meaningful debt. Shareholders should be aware that Elos Medtech's EBIT was down 75% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Elos Medtech can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the most recent three years, Elos Medtech recorded free cash flow worth 51% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

To be frank both Elos Medtech's interest cover and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. But at least its conversion of EBIT to free cash flow is not so bad. It's also worth noting that Elos Medtech is in the Medical Equipment industry, which is often considered to be quite defensive. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Elos Medtech stock a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 3 warning signs for Elos Medtech (1 is potentially serious!) that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade Elos Medtech, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Elos Medtech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OM:ELOS B

Elos Medtech

Elos Medtech AB (publ) engages in the development and contract manufacturing of medical devices and components for dental, orthopedics, diagnostics, and hearing and other medical device markets.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives