- Sweden

- /

- Medical Equipment

- /

- OM:EKTA B

Why It Might Not Make Sense To Buy Elekta AB (publ) (STO:EKTA B) For Its Upcoming Dividend

It looks like Elekta AB (publ) (STO:EKTA B) is about to go ex-dividend in the next 4 days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade takes at least two business day to settle. Accordingly, Elekta investors that purchase the stock on or after the 25th of August will not receive the dividend, which will be paid on the 31st of August.

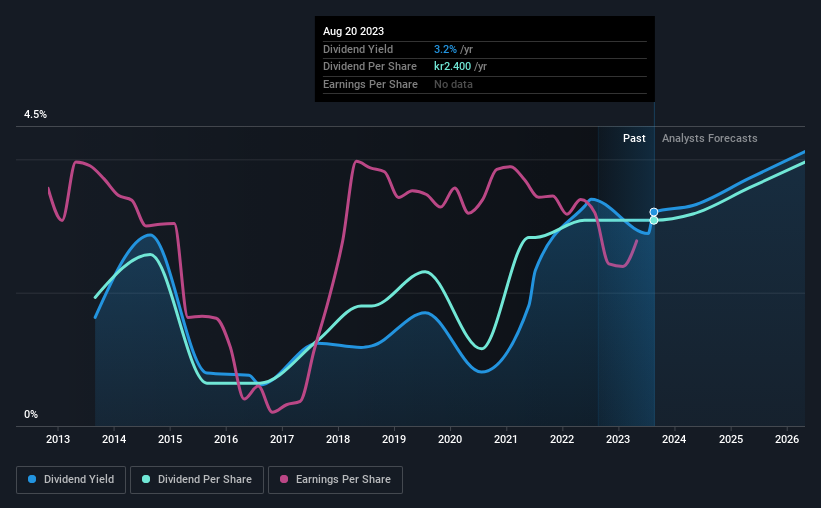

The company's next dividend payment will be kr1.20 per share. Last year, in total, the company distributed kr2.40 to shareholders. Based on the last year's worth of payments, Elekta has a trailing yield of 3.2% on the current stock price of SEK74.78. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to investigate whether Elekta can afford its dividend, and if the dividend could grow.

See our latest analysis for Elekta

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Last year, Elekta paid out 97% of its income as dividends, which is above a level that we're comfortable with, especially if the company needs to reinvest in its business. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Over the last year, it paid out dividends equivalent to 229% of what it generated in free cash flow, a disturbingly high percentage. Our definition of free cash flow excludes cash generated from asset sales, so since Elekta is paying out such a high percentage of its cash flow, it might be worth seeing if it sold assets or had similar events that might have led to such a high dividend payment.

Cash is slightly more important than profit from a dividend perspective, but given Elekta's payouts were not well covered by either earnings or cash flow, we would be concerned about the sustainability of this dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. With that in mind, we're discomforted by Elekta's 6.9% per annum decline in earnings in the past five years. When earnings per share fall, the maximum amount of dividends that can be paid also falls.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Elekta has delivered 4.8% dividend growth per year on average over the past 10 years. That's intriguing, but the combination of growing dividends despite declining earnings can typically only be achieved by paying out a larger percentage of profits. Elekta is already paying out 97% of its profits, and with shrinking earnings we think it's unlikely that this dividend will grow quickly in the future.

To Sum It Up

Is Elekta an attractive dividend stock, or better left on the shelf? Not only are earnings per share declining, but Elekta is paying out an uncomfortably high percentage of both its earnings and cashflow to shareholders as dividends. This is a clearly suboptimal combination that usually suggests the dividend is at risk of being cut. If not now, then perhaps in the future. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

So if you're still interested in Elekta despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. Every company has risks, and we've spotted 1 warning sign for Elekta you should know about.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Elekta might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:EKTA B

Elekta

A medical technology company, provides clinical solutions for treating cancer and brain disorders in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives