- Sweden

- /

- Medical Equipment

- /

- OM:EKTA B

Why Investors Shouldn't Be Surprised By Elekta AB (publ)'s (STO:EKTA B) P/E

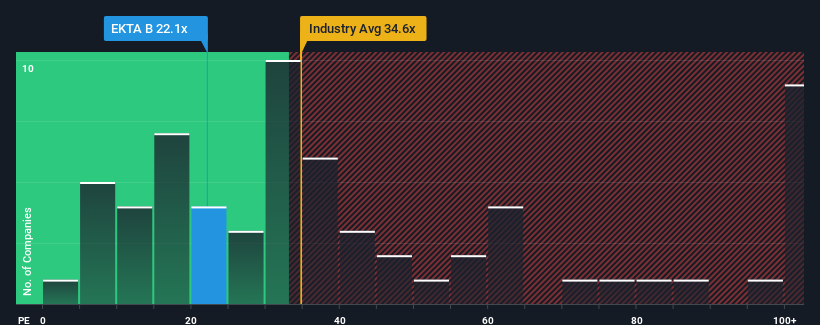

There wouldn't be many who think Elekta AB (publ)'s (STO:EKTA B) price-to-earnings (or "P/E") ratio of 22.1x is worth a mention when the median P/E in Sweden is similar at about 22x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been advantageous for Elekta as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Elekta

How Is Elekta's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Elekta's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 63% last year. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 20% per year as estimated by the twelve analysts watching the company. With the market predicted to deliver 19% growth per year, the company is positioned for a comparable earnings result.

With this information, we can see why Elekta is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Elekta's P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Elekta maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for Elekta you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Elekta might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:EKTA B

Elekta

A medical technology company, provides clinical solutions for treating cancer and brain disorders in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives