- Sweden

- /

- Medical Equipment

- /

- OM:CRAD B

Investors Continue Waiting On Sidelines For C-Rad AB (publ) (STO:CRAD B)

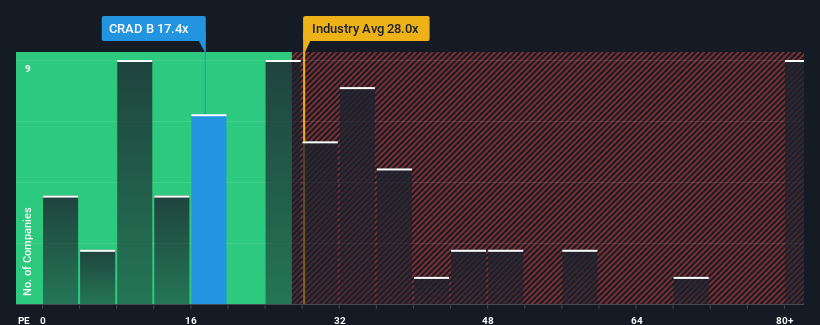

When close to half the companies in Sweden have price-to-earnings ratios (or "P/E's") above 21x, you may consider C-Rad AB (publ) (STO:CRAD B) as an attractive investment with its 17.4x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Our free stock report includes 1 warning sign investors should be aware of before investing in C-Rad. Read for free now.Recent times have been advantageous for C-Rad as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for C-Rad

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, C-Rad would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 59% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 126% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 25% per annum as estimated by the one analyst watching the company. That's shaping up to be materially higher than the 20% each year growth forecast for the broader market.

With this information, we find it odd that C-Rad is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From C-Rad's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of C-Rad's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for C-Rad that you should be aware of.

You might be able to find a better investment than C-Rad. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:CRAD B

C-Rad

Develops, manufactures, and sells products and systems with applications in radiotherapy for the treatment of cancer in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success