- Sweden

- /

- Medical Equipment

- /

- OM:CMOTEC B

Renovalo Leads The Charge Among 3 European Penny Stocks

Reviewed by Simply Wall St

As European markets show mixed results, with the pan-European STOXX Europe 600 Index edging higher on hopes of interest rate cuts, investors are keenly observing opportunities in various market segments. Penny stocks, often associated with smaller or newer companies, continue to present intriguing possibilities for growth due to their affordability and potential for significant returns. Despite being considered a term from past trading days, penny stocks remain relevant as they offer investors a chance to uncover hidden value when backed by robust financials and solid fundamentals.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Orthex Oyj (HLSE:ORTHEX) | €4.66 | €82.76M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €0.985 | €14.63M | ✅ 4 ⚠️ 5 View Analysis > |

| DigiTouch (BIT:DGT) | €1.98 | €27.36M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €227.95M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.08 | €65.33M | ✅ 3 ⚠️ 3 View Analysis > |

| Hultstrom Group (OM:HULT B) | SEK3.14 | SEK191.03M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.345 | €384.03M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.235 | €308.92M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.84 | €28.13M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 278 stocks from our European Penny Stocks screener.

Let's explore several standout options from the results in the screener.

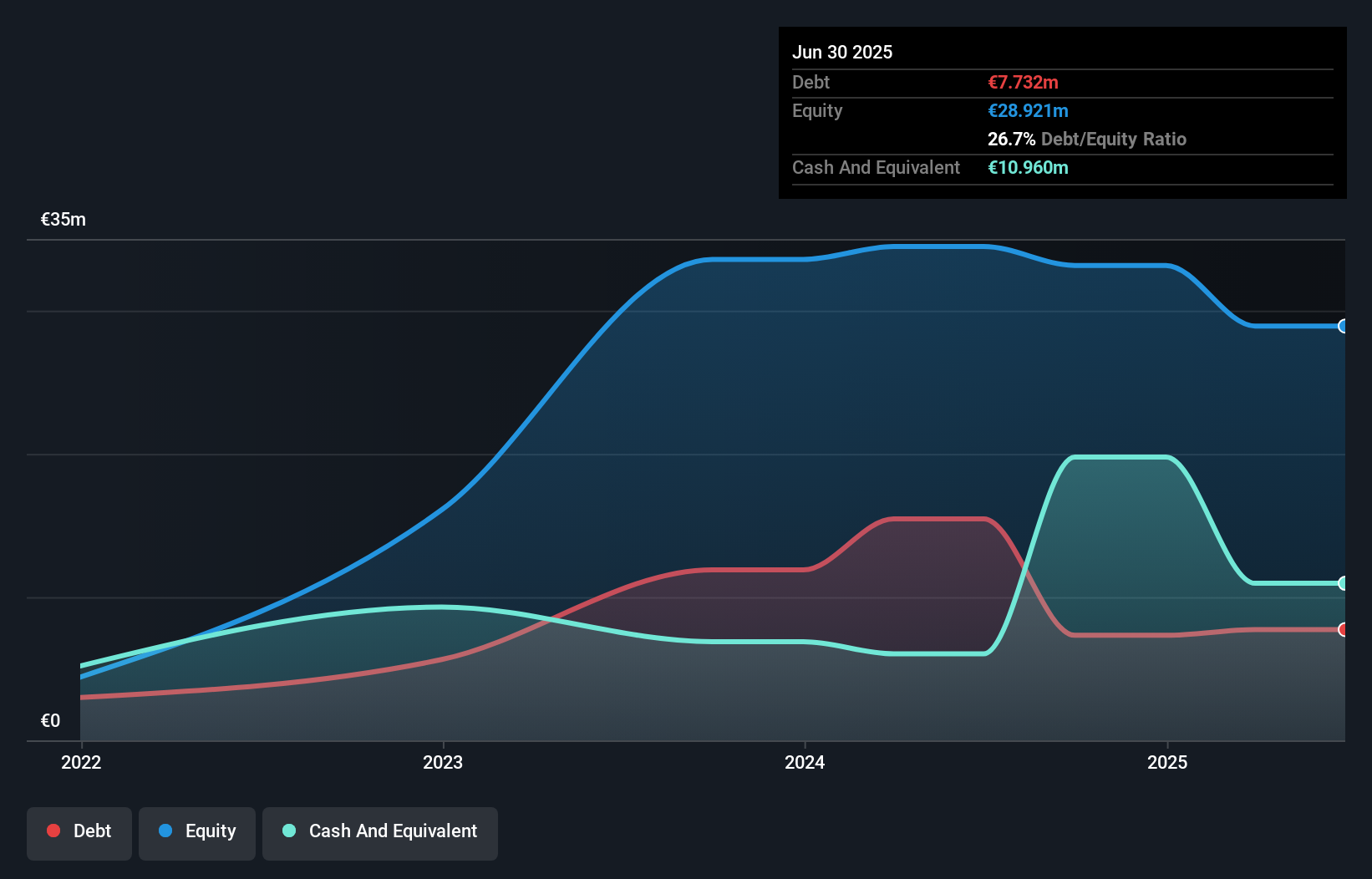

Renovalo (BIT:RNV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Renovalo S.p.A. operates in the construction industry in Italy and has a market cap of €13.94 million.

Operations: The company generates revenue of €32.81 million from its General Contractors segment.

Market Cap: €13.94M

Renovalo S.p.A. has shown revenue growth, with half-year sales rising to €12.93 million from €7.28 million year-on-year, yet it remains unprofitable with a net loss of €4.33 million compared to prior net income. Despite this, the company maintains a strong financial position; its short-term assets significantly exceed liabilities, and it holds more cash than debt. However, Renovalo's share price is highly volatile and its return on equity is negative due to ongoing losses. While trading slightly below estimated fair value and forecasted revenue growth of 8.49% annually offers potential upside, profitability challenges persist amidst an unstable dividend history.

- Dive into the specifics of Renovalo here with our thorough balance sheet health report.

- Assess Renovalo's future earnings estimates with our detailed growth reports.

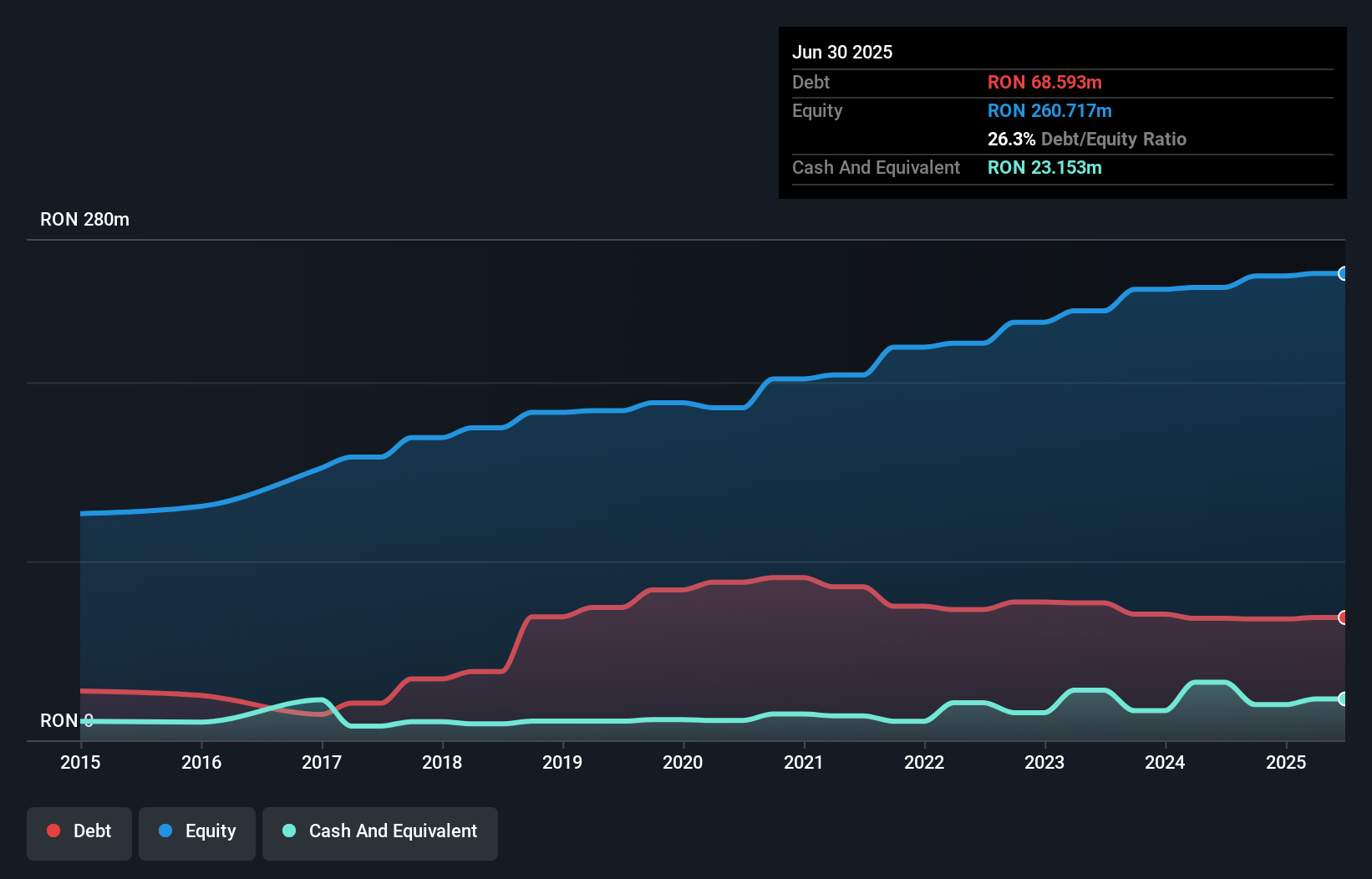

S.C. Ropharma (BVB:RPH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: S.C. Ropharma S.A. operates a chain of pharmacies in Romania and has a market cap of RON84.87 million.

Operations: Currently, there are no specific revenue segments reported for this Romanian pharmacy chain.

Market Cap: RON84.87M

S.C. Ropharma S.A. has demonstrated resilience in the penny stock segment with a market cap of RON84.87 million, despite earnings declining by 27.1% annually over five years. The company's debt management is commendable, with its debt to equity ratio reduced from 47.5% to 26.3%, and interest payments well covered by EBIT at 4.6x coverage, indicating financial stability in servicing obligations. With short-term assets (RON623.4M) exceeding both short and long-term liabilities, liquidity remains robust; however, the low return on equity (3%) and reliance on one-off gains suggest challenges in generating sustainable profits without these extraordinary items impacting results significantly.

- Jump into the full analysis health report here for a deeper understanding of S.C. Ropharma.

- Review our historical performance report to gain insights into S.C. Ropharma's track record.

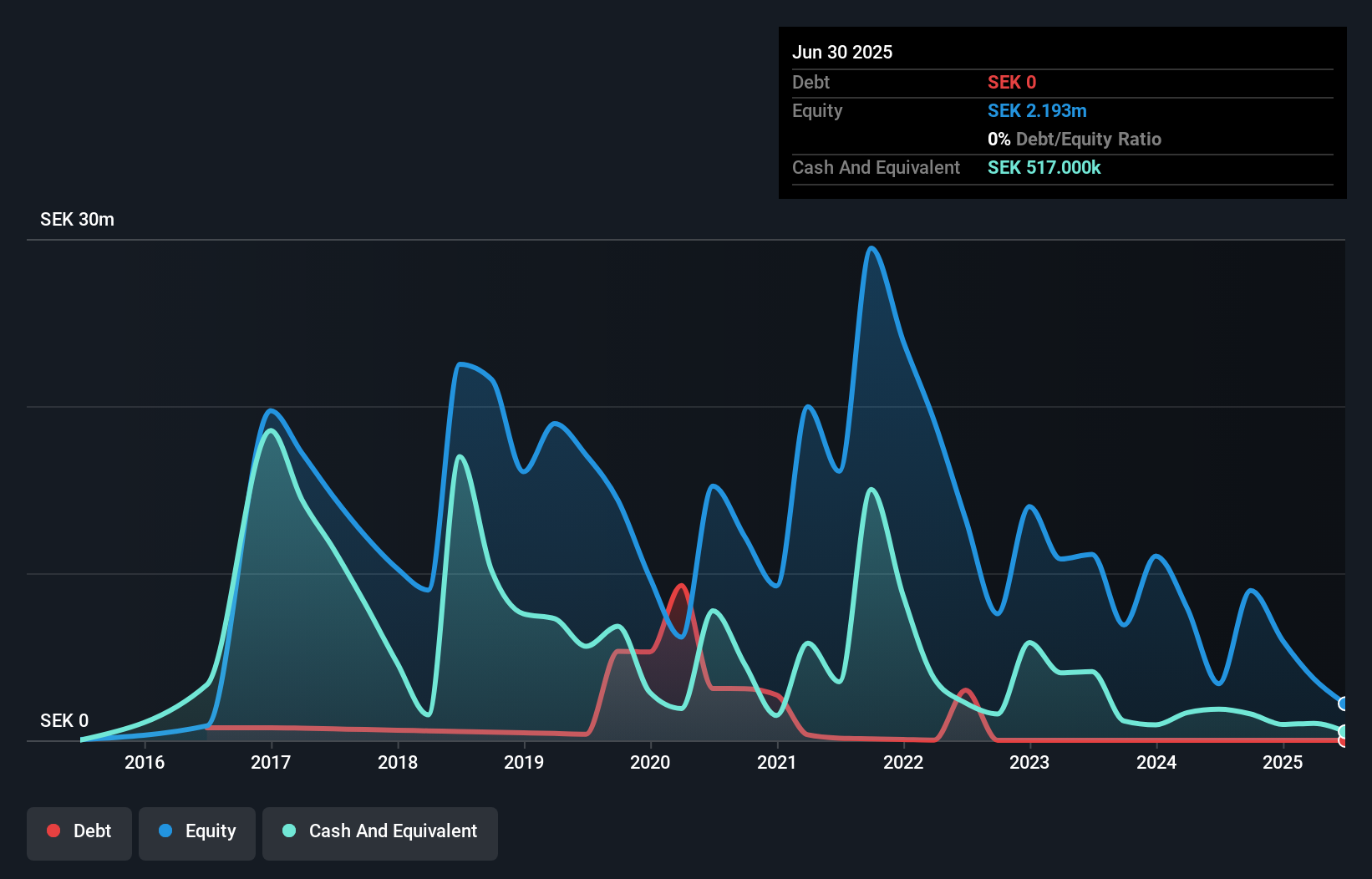

Scandinavian ChemoTech (OM:CMOTEC B)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Scandinavian ChemoTech AB (publ) provides cancer care and pain management solutions in Sweden and Florida, with a market cap of SEK89.17 million.

Operations: The company generates its revenue from the Medical Products segment, amounting to SEK11.68 million.

Market Cap: SEK89.17M

Scandinavian ChemoTech AB, with a market cap of SEK89.17 million, is navigating the penny stock landscape by leveraging its innovative Tumor-Specific Electroporation (TSE) technology in both human and veterinary oncology markets. Despite being pre-revenue with sales of SEK11.68 million from its Medical Products segment, recent strategic partnerships and client announcements highlight promising avenues for growth. The company has no debt and reduced losses over five years, yet remains unprofitable with less than a year of cash runway based on current free cash flow trends. Its share price volatility underscores the inherent risk associated with investing in such stocks.

- Navigate through the intricacies of Scandinavian ChemoTech with our comprehensive balance sheet health report here.

- Understand Scandinavian ChemoTech's earnings outlook by examining our growth report.

Taking Advantage

- Discover the full array of 278 European Penny Stocks right here.

- Curious About Other Options? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CMOTEC B

Scandinavian ChemoTech

Offers cancer care and pain management solutions in Sweden and Florida.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026