- Sweden

- /

- Medical Equipment

- /

- NGM:BIOWKS

We Think Bio-Works Technologies (STO:BIOWKS) Can Easily Afford To Drive Business Growth

We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So should Bio-Works Technologies (STO:BIOWKS) shareholders be worried about its cash burn? In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

Check out our latest analysis for Bio-Works Technologies

When Might Bio-Works Technologies Run Out Of Money?

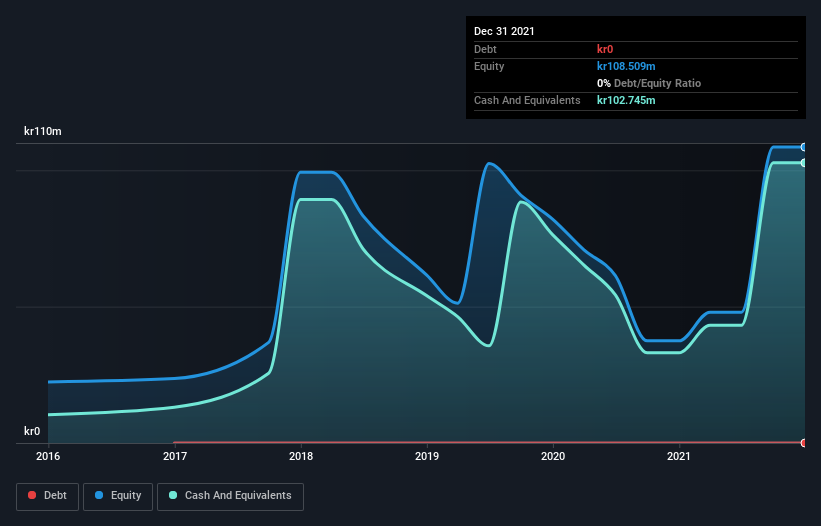

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In December 2021, Bio-Works Technologies had kr103m in cash, and was debt-free. Importantly, its cash burn was kr14m over the trailing twelve months. Therefore, from December 2021 it had 7.2 years of cash runway. While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about. Depicted below, you can see how its cash holdings have changed over time.

How Is Bio-Works Technologies' Cash Burn Changing Over Time?

In our view, Bio-Works Technologies doesn't yet produce significant amounts of operating revenue, since it reported just kr22m in the last twelve months. As a result, we think it's a bit early to focus on the revenue growth, so we'll limit ourselves to looking at how the cash burn is changing over time. Notably, its cash burn was actually down by 67% in the last year, which is a real positive in terms of resilience, but uninspiring when it comes to investment for growth. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Hard Would It Be For Bio-Works Technologies To Raise More Cash For Growth?

While we're comforted by the recent reduction evident from our analysis of Bio-Works Technologies' cash burn, it is still worth considering how easily the company could raise more funds, if it wanted to accelerate spending to drive growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash and drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Bio-Works Technologies has a market capitalisation of kr535m and burnt through kr14m last year, which is 2.7% of the company's market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

How Risky Is Bio-Works Technologies' Cash Burn Situation?

It may already be apparent to you that we're relatively comfortable with the way Bio-Works Technologies is burning through its cash. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. But it's fair to say that its cash burn reduction was also very reassuring. Taking all the factors in this report into account, we're not at all worried about its cash burn, as the business appears well capitalized to spend as needs be. On another note, we conducted an in-depth investigation of the company, and identified 5 warning signs for Bio-Works Technologies (1 is potentially serious!) that you should be aware of before investing here.

Of course Bio-Works Technologies may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Bio-Works Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:BIOWKS

Bio-Works Technologies

Engages in the manufactures and sale of chromatography resins for the purification of biopharmaceuticals in Sweden.

Medium-low risk with adequate balance sheet.

Market Insights

Community Narratives