Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Bactiguard Holding AB (publ) (STO:BACTI B) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Bactiguard Holding

What Is Bactiguard Holding's Net Debt?

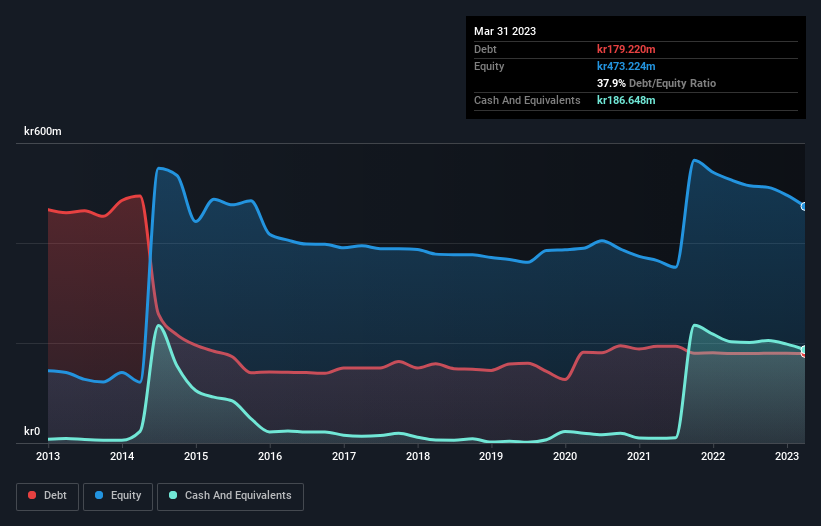

As you can see below, Bactiguard Holding had kr179.2m of debt, at March 2023, which is about the same as the year before. You can click the chart for greater detail. However, it does have kr186.6m in cash offsetting this, leading to net cash of kr7.43m.

How Strong Is Bactiguard Holding's Balance Sheet?

According to the last reported balance sheet, Bactiguard Holding had liabilities of kr82.4m due within 12 months, and liabilities of kr229.8m due beyond 12 months. Offsetting this, it had kr186.6m in cash and kr48.4m in receivables that were due within 12 months. So its liabilities total kr77.2m more than the combination of its cash and short-term receivables.

Of course, Bactiguard Holding has a market capitalization of kr2.50b, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. While it does have liabilities worth noting, Bactiguard Holding also has more cash than debt, so we're pretty confident it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Bactiguard Holding will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Bactiguard Holding wasn't profitable at an EBIT level, but managed to grow its revenue by 25%, to kr233m. With any luck the company will be able to grow its way to profitability.

So How Risky Is Bactiguard Holding?

Statistically speaking companies that lose money are riskier than those that make money. And we do note that Bactiguard Holding had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through kr3.8m of cash and made a loss of kr58m. Given it only has net cash of kr7.43m, the company may need to raise more capital if it doesn't reach break-even soon. Bactiguard Holding's revenue growth shone bright over the last year, so it may well be in a position to turn a profit in due course. By investing before those profits, shareholders take on more risk in the hope of bigger rewards. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 1 warning sign for Bactiguard Holding you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Bactiguard Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BACTI B

Bactiguard Holding

A medTech company, provides infection prevention technology and solutions in orthopedics, cardiology, neurology, urology, and vascular access areas in the United States, Sweden, Malaysia, India, Bangladesh, Indonesia, the Kingdom of Saudi Arabia, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives