Stock Analysis

- Sweden

- /

- Medical Equipment

- /

- OM:BACTI B

Bactiguard Holding's (STO:BACTI B) growing losses don't faze investors as the stock pops 10% this past week

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. Buying under-rated businesses is one path to excess returns. To wit, the Bactiguard Holding share price has climbed 67% in five years, easily topping the market return of 47% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 18%.

The past week has proven to be lucrative for Bactiguard Holding investors, so let's see if fundamentals drove the company's five-year performance.

View our latest analysis for Bactiguard Holding

Bactiguard Holding wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

For the last half decade, Bactiguard Holding can boast revenue growth at a rate of 6.9% per year. That's a pretty good long term growth rate. Revenue has been growing at a reasonable clip, so it's debatable whether the share price growth of 11% full reflects the underlying business growth. If revenue growth can maintain for long enough, it's likely profits will flow. There's no doubt that it can be difficult to value pre-profit companies.

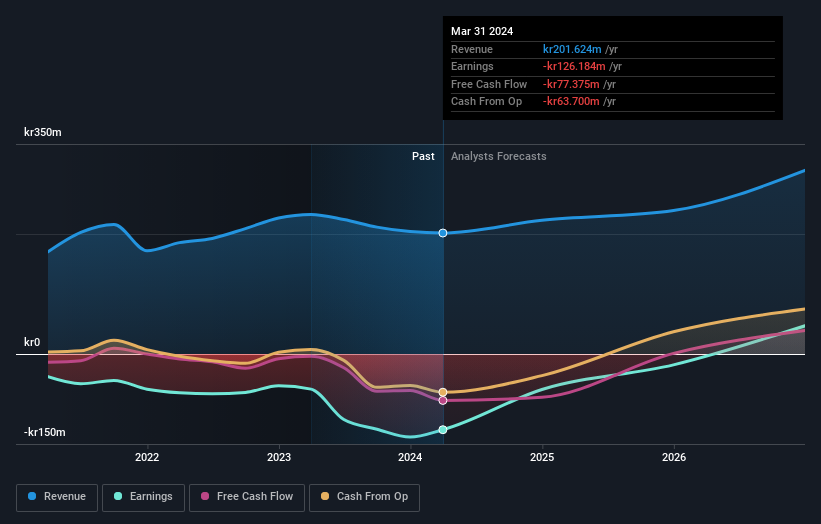

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. This free report showing analyst forecasts should help you form a view on Bactiguard Holding

A Different Perspective

Bactiguard Holding's TSR for the year was broadly in line with the market average, at 18%. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 11%. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. It's always interesting to track share price performance over the longer term. But to understand Bactiguard Holding better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Bactiguard Holding .

Bactiguard Holding is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Bactiguard Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Bactiguard Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BACTI B

Bactiguard Holding

A medical device company, provides infection prevention solutions in orthopedics, urology, intravascular/critical care, dental, and wound care therapeutic areas in the United States, Sweden, Malaysia, India, Bangladesh, Indonesia, the Kingdom of Saudi Arabia, and internationally.

Mediocre balance sheet and slightly overvalued.