- Sweden

- /

- Medical Equipment

- /

- OM:BACTI B

Bactiguard Holding AB (publ) (STO:BACTI B) Shares May Have Slumped 28% But Getting In Cheap Is Still Unlikely

Bactiguard Holding AB (publ) (STO:BACTI B) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 62% loss during that time.

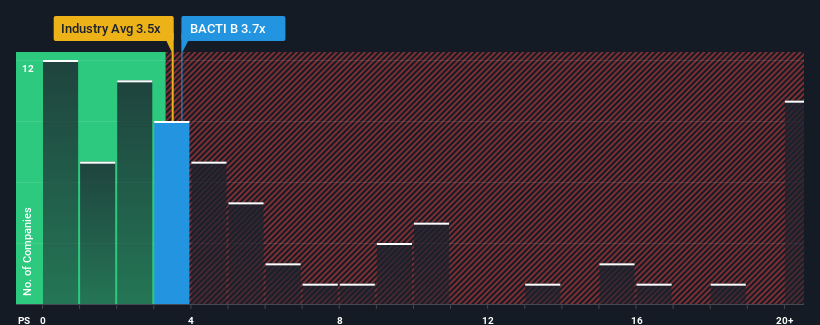

Although its price has dipped substantially, it's still not a stretch to say that Bactiguard Holding's price-to-sales (or "P/S") ratio of 3.7x right now seems quite "middle-of-the-road" compared to the Medical Equipment industry in Sweden, where the median P/S ratio is around 3.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Bactiguard Holding

What Does Bactiguard Holding's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Bactiguard Holding has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bactiguard Holding .Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Bactiguard Holding's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 23%. The strong recent performance means it was also able to grow revenue by 46% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 9.9% each year over the next three years. That's shaping up to be materially lower than the 50% each year growth forecast for the broader industry.

In light of this, it's curious that Bactiguard Holding's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Bottom Line On Bactiguard Holding's P/S

With its share price dropping off a cliff, the P/S for Bactiguard Holding looks to be in line with the rest of the Medical Equipment industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

When you consider that Bactiguard Holding's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Bactiguard Holding , and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Bactiguard Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BACTI B

Bactiguard Holding

A medTech company, provides infection prevention technology and solutions in orthopedics, cardiology, neurology, urology, and vascular access areas in the United States, Sweden, Malaysia, India, Bangladesh, Indonesia, the Kingdom of Saudi Arabia, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives