- Sweden

- /

- Healthcare Services

- /

- OM:ATT

Attendo (OM:ATT) Net Margin Rises to 2.9%, Challenging Financial Stability Concerns

Reviewed by Simply Wall St

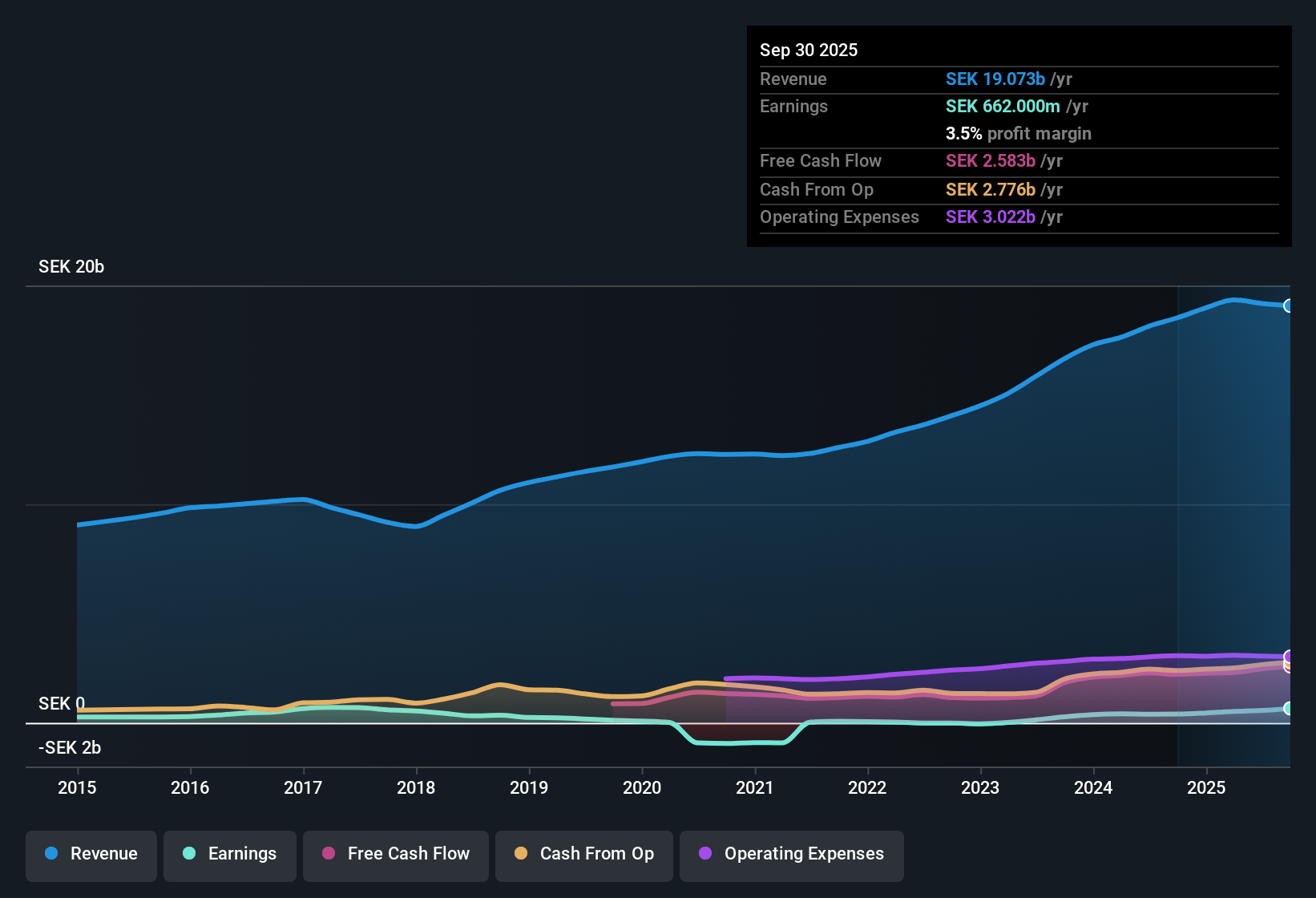

Attendo (OM:ATT) reported a net profit margin of 2.9%, a step up from last year’s 2.2%. Earnings grew by 42.8% over the past year, which is below its five-year average annual growth rate of 81.7%. Over the last five years, the company has averaged 81.7% annual earnings growth as it moved into profitability. Looking ahead, annual earnings are forecast to rise 13.05%, which is slightly faster than the Swedish market at 12.6%. While profit and revenue are both expected to continue rising, future growth rates are now more modest compared with Attendo’s rapid improvements in recent years.

See our full analysis for Attendo.Up next, we’ll see how the latest results stack up against the widely held narratives for Attendo. This will highlight where the data supports or challenges what investors expect.

See what the community is saying about Attendo

Margin Expansion and Efficiency Drive Under Scrutiny

- Profit margins have expanded from 2.2% to 2.9%, and analysts expect further improvement to 4.4% over three years, supported by efficiency projects, better staffing systems, and digitalization initiatives.

- Consensus narrative credits these margin gains to operational restructuring and digital upgrades,

- with emphasis on how efficiency programs and regulatory tailwinds help sustain profitability even as revenue growth slows below the Swedish market average of 3.9%.

- However, persistent contract exits and near-term cost pressures, such as ramp-down inefficiencies and labor challenges, have contributed to volatile margins. This underlines that success depends on keeping efficiency gains ahead of rising costs.

Valuation Sits Between Peers and Industry

- Attendo’s Price-to-Earnings ratio of 20.4x is lower than the peer average (21.9x) but remains above the broader European Healthcare industry average of 18.9x. The current share price (SEK77.7) trades at a deep discount relative to the DCF fair value of SEK310.99 and is 15.3% below the consensus analyst price target (SEK75.00).

- According to the consensus narrative, valuation appears supported by a profitable track record and healthy growth,

- but the implied discount to DCF fair value signals that investors are concerned about sustainability, particularly as analyst forecasts reflect only modest profit and revenue growth for coming years.

- Significant upside exists if Attendo closes its gap to DCF fair value. However, this depends on meeting efficiency targets and maintaining more consistent margins amidst industry headwinds.

Analysts note that Attendo’s margin improvements and valuation discounts are shaping divergent views on its upside and risks. Read the full consensus narrative for a balanced perspective on whether the momentum can continue. 📊 Read the full Attendo Consensus Narrative.

Financial Stability Remains a Watchpoint

- A major risk flagged is the company’s financial position, with its ability to comfortably service debt and reinvest in growth coming under closer scrutiny, even as stable free cash flow and expanded credit lines provide some buffer.

- Consensus narrative describes how increased financial flexibility, backed by strong free cash flow, share buybacks, and an expanded revolving credit facility, enables ongoing strategic investments,

- but caution remains as future gains depend on successfully navigating challenges in home care contract terms and potential regulatory shifts that could reverse recent margin gains.

- If labor shortages or higher wage demands occur, they could quickly erode improved margins. This underscores why management’s focus on efficiency and capital allocation is so crucial this year.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Attendo on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the figures from a different angle? Share your viewpoint and shape the story in just a few minutes by clicking here: Do it your way

A great starting point for your Attendo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite Attendo’s improving profitability, doubts remain over its financial stability as margin gains could be quickly reversed by debt risks or shifting industry costs.

If you’re seeking companies with stronger balance sheets built to weather uncertainty, consider our selection of solid balance sheet and fundamentals stocks screener (1977 results) that prioritize financial health and long-term security.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ATT

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives