- Germany

- /

- Aerospace & Defense

- /

- XTRA:RHM

3 European Stocks Estimated To Be Trading At Discounts Up To 49.9%

Reviewed by Simply Wall St

As the European markets experience a boost, with the pan-European STOXX Europe 600 Index rising by 3.44% and major stock indexes showing gains, investors are increasingly looking for opportunities that may be trading below their intrinsic value. In this favorable economic climate, identifying undervalued stocks can be key to capitalizing on potential market inefficiencies and securing promising investment prospects.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SNGN Romgaz (BVB:SNG) | RON5.77 | RON11.22 | 48.6% |

| Sword Group (ENXTPA:SWP) | €32.10 | €62.30 | 48.5% |

| Rheinmetall (XTRA:RHM) | €1645.00 | €3281.01 | 49.9% |

| Truecaller (OM:TRUE B) | SEK74.95 | SEK149.31 | 49.8% |

| BAWAG Group (WBAG:BG) | €97.00 | €190.65 | 49.1% |

| Net Insight (OM:NETI B) | SEK2.855 | SEK5.56 | 48.6% |

| Stille (OM:STIL) | SEK188.00 | SEK367.62 | 48.9% |

| Integrated System Credit Consulting Fintech (BIT:ISC) | €1.56 | €3.10 | 49.6% |

| dormakaba Holding (SWX:DOKA) | CHF704.00 | CHF1396.69 | 49.6% |

| Expert.ai (BIT:EXAI) | €1.32 | €2.60 | 49.3% |

Let's uncover some gems from our specialized screener.

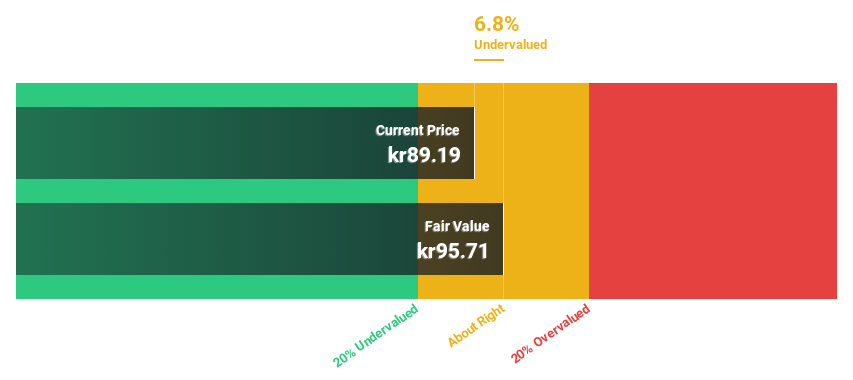

Asker Healthcare Group (OM:ASKER)

Overview: Asker Healthcare Group AB is a company that supplies medical products and solutions to support patient care, with a market cap of SEK33.32 billion.

Operations: The company's revenue segments are comprised of West at SEK7.22 billion, Central at SEK2.49 billion, and North (including East) at SEK5.49 billion.

Estimated Discount To Fair Value: 16.3%

Asker Healthcare Group, recently added to the OMX Nordic All-Share Index, completed an IPO raising SEK 8.89 billion. The stock trades at SEK 87, below its estimated fair value of SEK 104. Despite a high debt level and illiquid shares, earnings are forecast to grow significantly at 22.8% annually over the next three years, outpacing Swedish market expectations. Revenue growth is also expected to be higher than the market average but remains moderate overall.

- Upon reviewing our latest growth report, Asker Healthcare Group's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Asker Healthcare Group with our comprehensive financial health report here.

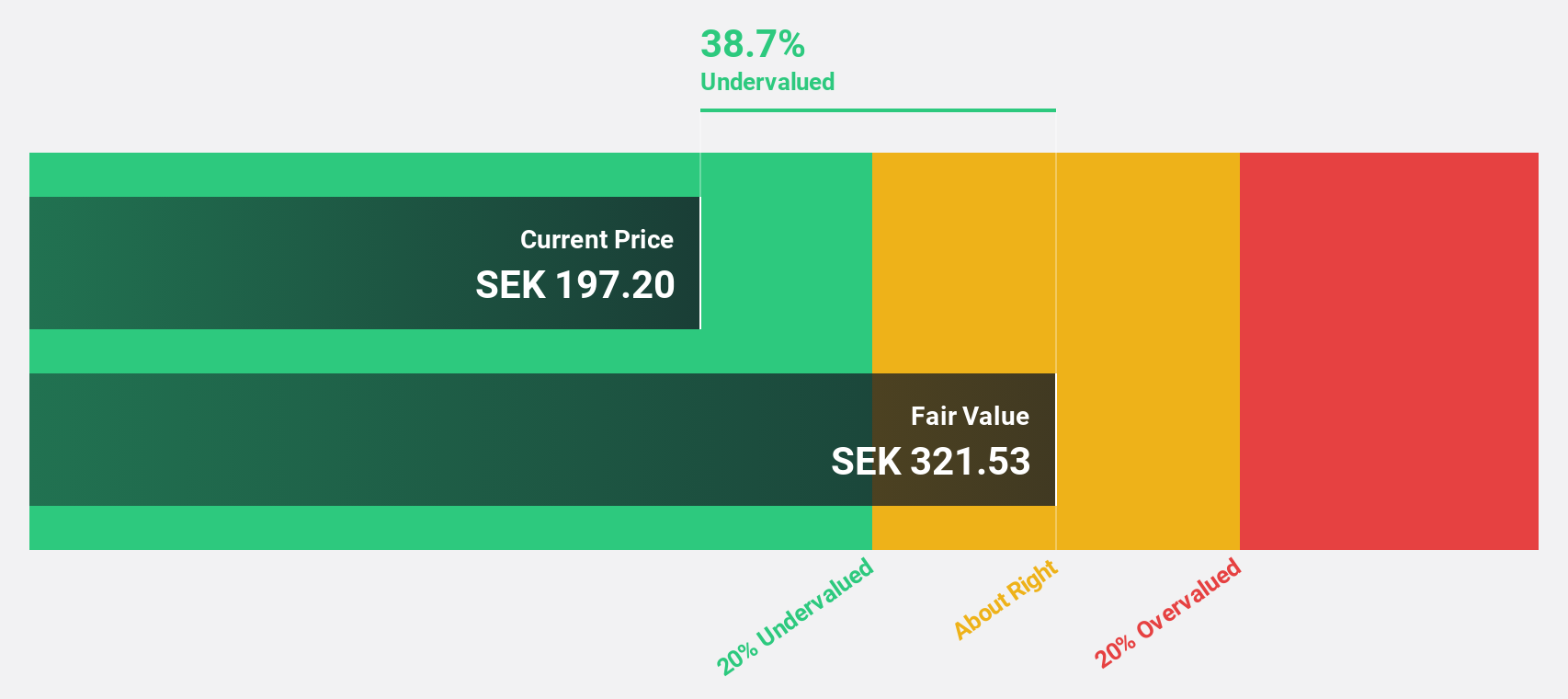

MilDef Group (OM:MILDEF)

Overview: MilDef Group AB (publ) develops, manufactures, and sells rugged IT solutions across several countries including Sweden, Norway, and the United States, with a market cap of SEK12.31 billion.

Operations: MilDef Group AB generates revenue from its Computer Hardware segment, amounting to SEK1.20 billion.

Estimated Discount To Fair Value: 31.5%

MilDef Group, trading at SEK 261.6, is significantly undervalued with an estimated fair value of SEK 381.87. Despite recent shareholder dilution and insider selling, the company benefits from robust revenue growth forecasts of 31.3% annually, outpacing the Swedish market's average. Recent contracts with the Swedish Defence Materiel Administration and Clavister enhance its position in defense technology and cybersecurity markets. Profitability is anticipated within three years, suggesting strong future potential despite current volatility.

- Our growth report here indicates MilDef Group may be poised for an improving outlook.

- Dive into the specifics of MilDef Group here with our thorough financial health report.

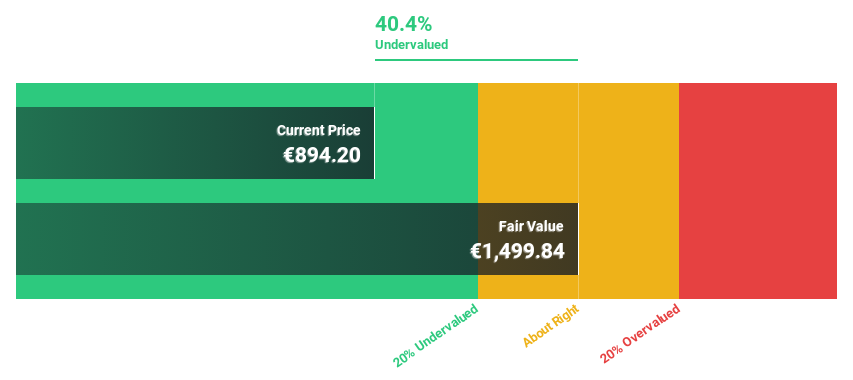

Rheinmetall (XTRA:RHM)

Overview: Rheinmetall AG is a global provider of mobility and security technologies, with a market cap of €71.45 billion.

Operations: The company's revenue is derived from Power Systems (€2.04 billion), Vehicle Systems (€3.79 billion), Electronic Solutions (€1.73 billion), and Weapon and Ammunition (€2.78 billion).

Estimated Discount To Fair Value: 49.9%

Rheinmetall is significantly undervalued, trading at €1,645 against an estimated fair value of €3,281.01. The company forecasts earnings growth of 32.2% annually and revenue growth of 21.4%, both surpassing the German market averages. Recent strong performance in its defense segment led to a substantial increase in sales and operating profit, exceeding expectations with a first-quarter revenue of €2.31 billion and operating profit of €199 million, highlighting robust cash flow potential amidst geopolitical demand increases.

- Insights from our recent growth report point to a promising forecast for Rheinmetall's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Rheinmetall.

Taking Advantage

- Dive into all 168 of the Undervalued European Stocks Based On Cash Flows we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:RHM

Rheinmetall

Provides mobility and security technologies in Germany, Rest of Europe, North, Middle, and South America, Asia and the Near East, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives