Premium Snacks Nordic AB (publ)'s (STO:SNX) Shares Leap 26% Yet They're Still Not Telling The Full Story

Despite an already strong run, Premium Snacks Nordic AB (publ) (STO:SNX) shares have been powering on, with a gain of 26% in the last thirty days. The annual gain comes to 296% following the latest surge, making investors sit up and take notice.

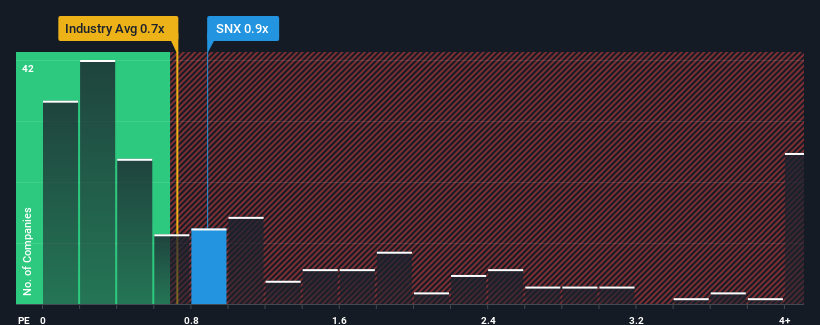

Although its price has surged higher, you could still be forgiven for feeling indifferent about Premium Snacks Nordic's P/S ratio of 0.9x, since the median price-to-sales (or "P/S") ratio for the Food industry in Sweden is about the same. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Our free stock report includes 3 warning signs investors should be aware of before investing in Premium Snacks Nordic. Read for free now.Check out our latest analysis for Premium Snacks Nordic

What Does Premium Snacks Nordic's P/S Mean For Shareholders?

The revenue growth achieved at Premium Snacks Nordic over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. Those who are bullish on Premium Snacks Nordic will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Premium Snacks Nordic will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Premium Snacks Nordic?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Premium Snacks Nordic's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. The latest three year period has also seen an excellent 43% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

In contrast to the company, the rest of the industry is expected to decline by 1.5% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

In light of this, it's peculiar that Premium Snacks Nordic's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What Does Premium Snacks Nordic's P/S Mean For Investors?

Its shares have lifted substantially and now Premium Snacks Nordic's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Premium Snacks Nordic revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. There could be some unobserved threats to revenue preventing the P/S ratio from outpacing the industry much like its revenue performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you settle on your opinion, we've discovered 3 warning signs for Premium Snacks Nordic that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SNX

Premium Snacks Nordic

Engages in the development, manufacture, sale, import, and export of snacks under the Exotic Snacks and Gårdschips brand names in Sweden and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives