Midsona (OM:MSON B) Profit Margin Jumps—Testing Doubts on Turnaround Sustainability

Reviewed by Simply Wall St

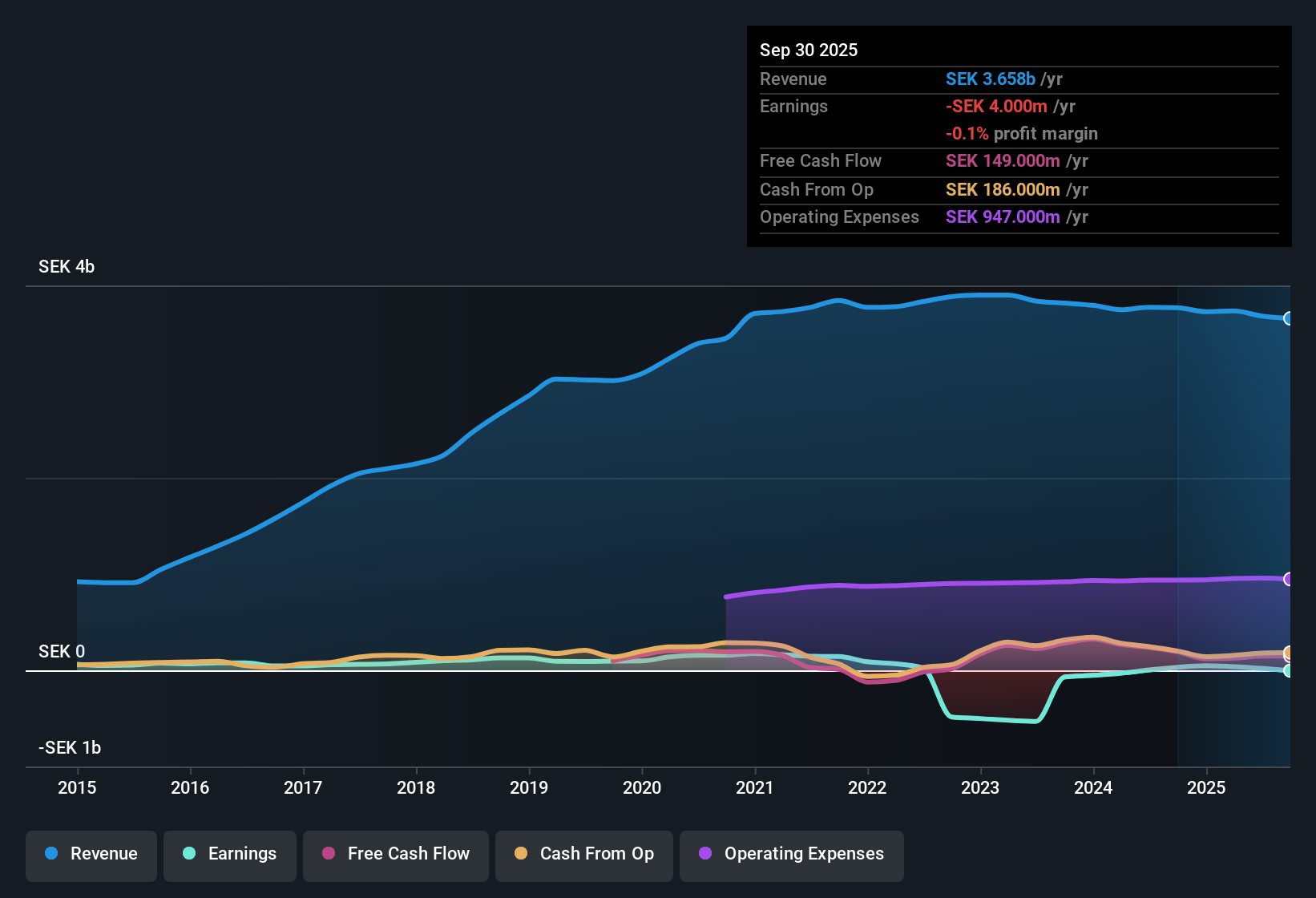

Midsona (OM:MSON B) posted a sharp turnaround in profitability, with net profit margin climbing to 0.5% from last year’s 0.1% and earnings growing 400% year over year, reversing a multi-year earnings decline that averaged a 22.3% annual drop. While revenue is expected to grow at 2.3% per year, lagging the Swedish market’s 3.3%, the real story for investors is the projected 85.1% annual earnings growth, which outpaces both the broader Swedish market and benchmarks what is considered robust profit expansion.

See our full analysis for Midsona.Next up, we’ll see how the numbers measure up to the most-watched narratives. Some expectations may be confirmed, while others get put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Premium Price Tag Despite Market Discount

- Midsona trades at a hefty Price-To-Earnings ratio of 61.4x, which is far higher than the European food industry average (15.7x) and its closest peer group (29.2x). However, the stock currently sits at SEK8.44, well below its DCF fair value of SEK25.35.

- What is surprising, given the premium multiple, is that the company’s share price significantly trails its estimated DCF fair value. This raises questions about whether the market is pricing in persistent risks or doubts regarding future earnings durability.

- This tension between a premium valuation and a discounted market price indicates that investors are likely waiting for sustained profit momentum or clearer signals that recent earnings growth will be maintained.

- Margin recovery and the sharp reversal from multi-year earnings decline may encourage “value” investors. Yet, the valuation multiple suggests skepticism remains around the upside potential relative to peers.

Dividend Sustainability in Doubt

- The EDGAR summary flags dividend sustainability as a key risk, noting that the recent improvement in net profit margins to 0.5% may not be enough to guarantee stable or growing shareholder payouts.

- Critics highlight that, while operating momentum has returned after years of declining earnings, cash flow strength and payout confidence remain weak spots for income-focused investors.

- With revenue growth forecasted at only 2.3% per year, below the Swedish market average, any dividends may be more vulnerable if margin gains do not hold up.

- Dividend caution is likely a drag on investor sentiment, making it harder for the stock to attract buyers seeking both growth and income stability.

Runaway Earnings Growth Forecasts

- While revenue expectations remain modest, with a forecasted growth of 2.3% per year, Midsona’s annual earnings are projected to rise by an impressive 85.1%, far outpacing the Swedish market’s 12.5% average outlook.

- What stands out is that, despite recent operational headwinds flagged by news coverage and cautious market sentiment, the company’s forward profit guidance positions it as a turnaround story in an otherwise competitive sector.

- This outsized earnings recovery, if achieved, could shift sentiment and justify higher valuation multiples if management can sustain cost control and meet ambitious targets.

- Current figures suggest the company is at an inflection point, with growth prospects strong enough to challenge persistent skepticism about long-term improvement.

See our latest analysis for Midsona.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Midsona's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Midsona’s weak cash flow, uncertain dividend prospects, and sluggish revenue growth raise concerns about both payout stability and long-term resilience.

If uninterrupted income and financial reliability are your priorities, check out these 1991 dividend stocks with yields > 3% to find companies delivering stronger yields backed by sustainable earnings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MSON B

Midsona

A consumer goods company, provides organic and consumer health products, and health food products in Sweden, Denmark, Finland, Norway, France, Spain, Germany, Rest of Europe, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives