Lohilo Foods AB (publ)'s (STO:LOHILO) Stock Retreats 32% But Revenues Haven't Escaped The Attention Of Investors

Lohilo Foods AB (publ) (STO:LOHILO) shareholders that were waiting for something to happen have been dealt a blow with a 32% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 55% loss during that time.

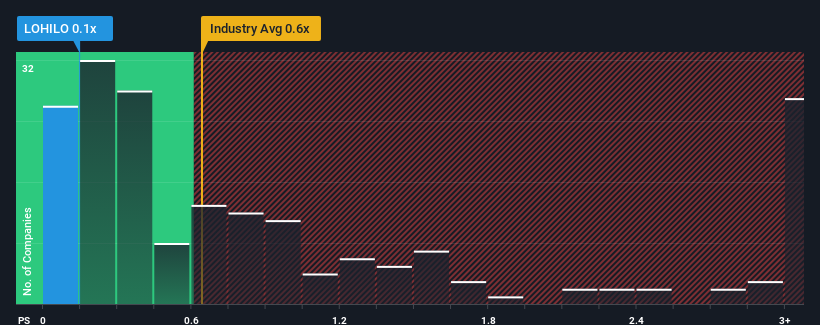

Although its price has dipped substantially, there still wouldn't be many who think Lohilo Foods' price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S in Sweden's Food industry is similar at about 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Lohilo Foods

How Lohilo Foods Has Been Performing

For instance, Lohilo Foods' receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Lohilo Foods' earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Lohilo Foods?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Lohilo Foods' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. As a result, revenue from three years ago have also fallen 7.3% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

It turns out the industry is also predicted to shrink 4.2% in the next 12 months, mirroring the company's downward momentum based on recent medium-term annualised revenue results.

With this in mind, it's no surprise that Lohilo Foods' P/S is similar to its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S long-term, which could set up shareholders for future disappointment regardless. There is potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

What Does Lohilo Foods' P/S Mean For Investors?

Following Lohilo Foods' share price tumble, its P/S is just clinging on to the industry median P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Lohilo Foods' P/S is justifiably on par with the rest of the industry off the back of its recent three-year revenue being in line with the wider industry forecast too. Right now shareholders are comfortable with the P/S as they seem confident future revenue won't throw up any further unpleasant surprises. However, we're slightly cautious about the company's ability to stay its recent medium-term course and resist further pain to its business from the broader industry turmoil. If the company's performance remains relatively stable, it's likely that the current share price will continue to find support.

You need to take note of risks, for example - Lohilo Foods has 4 warning signs (and 3 which are significant) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:LOHILO

Undervalued with high growth potential.

Market Insights

Community Narratives