How Cloetta’s (OM:CLA B) Rising Profits Amid Flat Sales Could Shape Investor Expectations

Reviewed by Sasha Jovanovic

- Cloetta AB reported third-quarter 2025 earnings, revealing sales of SEK 2,177 million and a net income of SEK 189 million, both measured against the same period last year.

- Despite a slight year-on-year decrease in sales, the company's net income and earnings per share saw substantial growth for both the quarter and year-to-date.

- We'll explore how the strong profit increase amid stable sales shapes Cloetta's current investment narrative.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Cloetta's Investment Narrative?

For Cloetta shareholders, the investment story leans on the belief that stable sales, paired with notable net income growth, can be sustained even as sector forecasts point to a modest 1.6% revenue growth and a 1.8% annual decline in earnings over the next three years. The latest Q3 earnings showcased a sharp profit rise despite a slight sales dip, suggesting improved margins or cost controls may now play a bigger role in short-term performance than previously assumed. This may shift attention among investors to profit resilience and operational execution, rather than topline expansion. However, risks remain, including modest sales projections, dividend sustainability concerns, and execution around leadership changes. The Q3 results marginally strengthen the bull case by reinforcing profitability, but do little to remove questions over long-term top-line growth and the reliability of payouts. On the other hand, dividend consistency is still not assured and deserves a closer look.

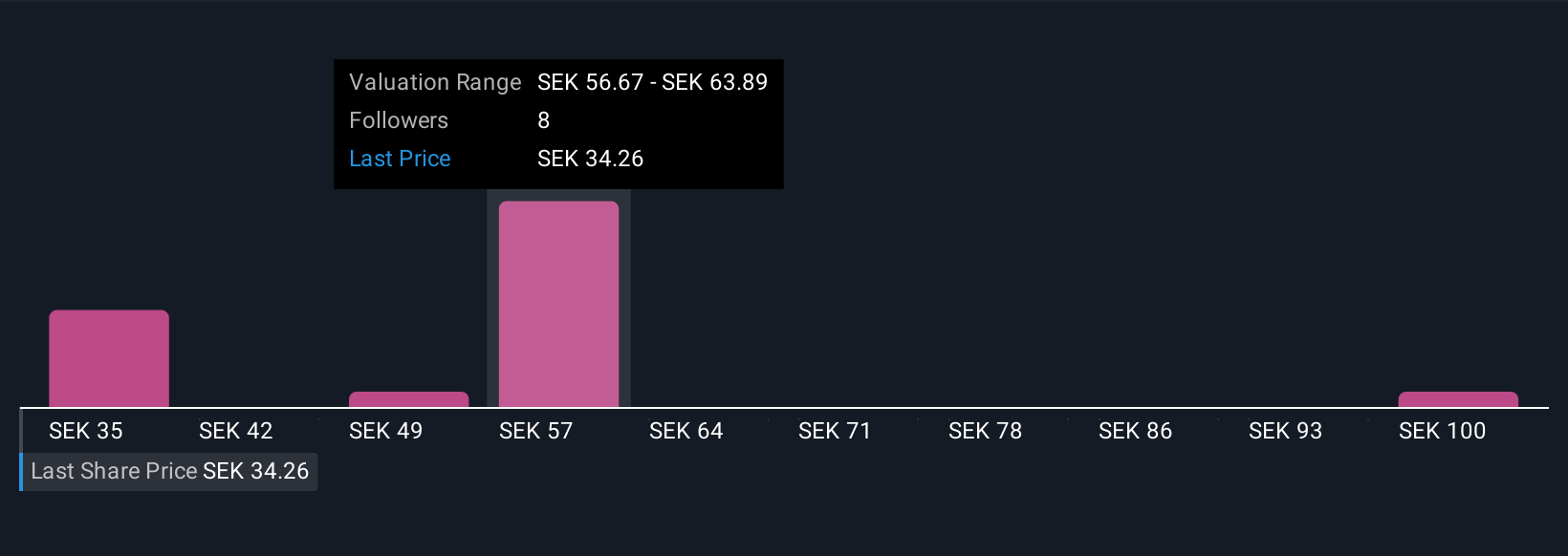

Cloetta's shares have been on the rise but are still potentially undervalued by 42%. Find out what it's worth.Exploring Other Perspectives

Explore 7 other fair value estimates on Cloetta - why the stock might be worth just SEK35.00!

Build Your Own Cloetta Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cloetta research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cloetta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cloetta's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CLA B

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives