Cheffelo (OM:CHEF) Net Margin Surges to 4.5%, Reinforcing Bullish Growth Narratives

Reviewed by Simply Wall St

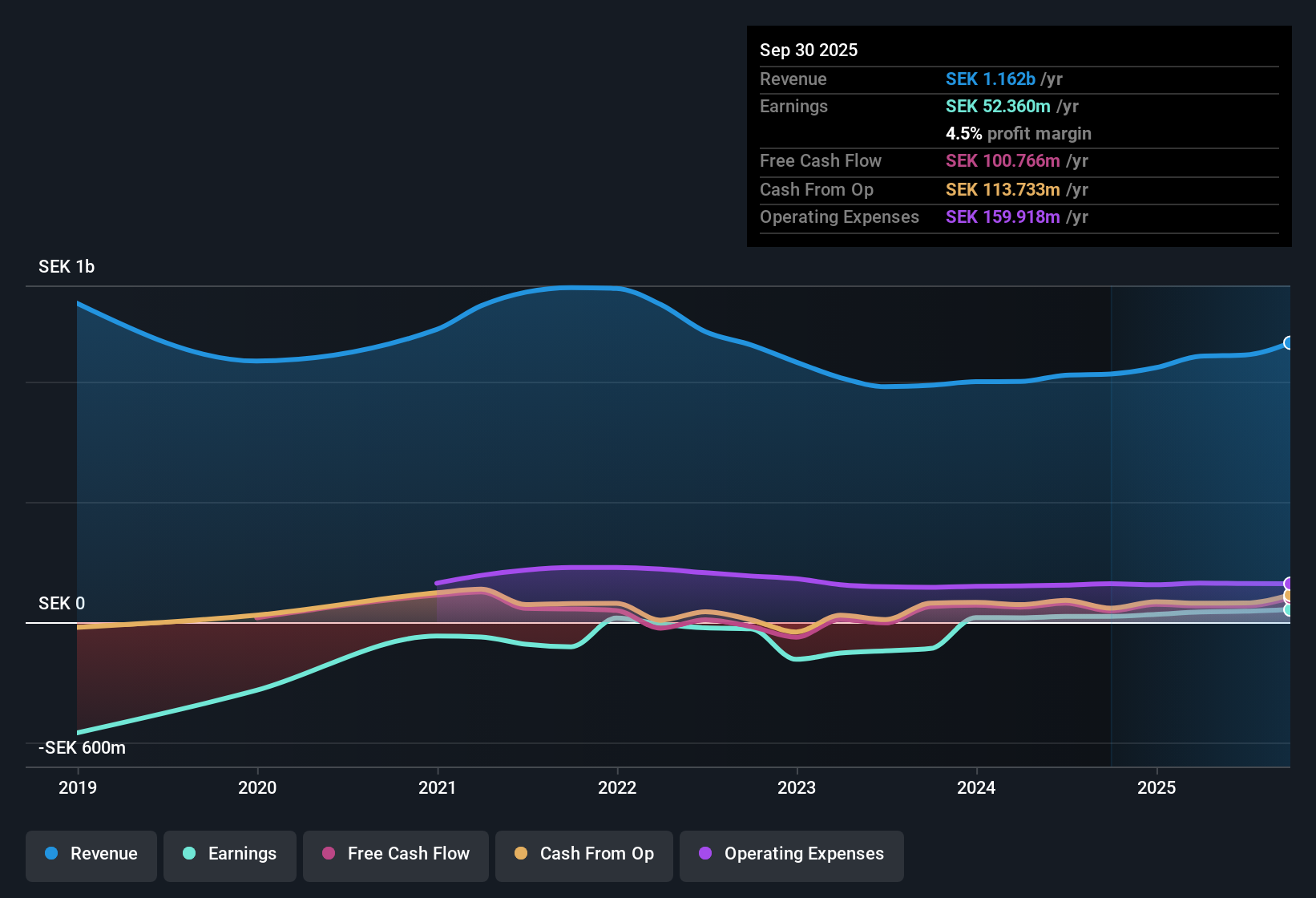

Cheffelo (OM:CHEF) posted a net profit margin of 4.5%, up from 2.4% last year, with annualized earnings growth of 45.2% over the past five years and a standout 115.8% jump in the most recent year. Looking ahead, analysts forecast annual profit growth of 22.2% and revenue growth of 7.6%, both ahead of Swedish market averages. Earnings are modeled to expand by more than 20% annually through the next three years. Investors are likely to weigh these rapid growth trends and high-quality reported earnings against valuation as well as minor risk considerations from recent share price stability, uncertainty around dividends, and insider selling activity.

See our full analysis for Cheffelo.Next, we will compare these headline numbers with the prevailing market and community narratives to reveal where the facts reinforce conventional wisdom and where they invite a reassessment.

See what the community is saying about Cheffelo

Profit Margins Move Above Industry Talks

- Cheffelo’s net profit margin sits at 4.5%, higher than last year and forecast to reach 4.7% within three years. This outpaces many European food peers.

- According to the analysts' consensus view, the company’s sharp profitability leverage is backed by strong operational efficiency and local market adaptations. However:

- Consensus notes that proprietary technology and upselling are key to maintaining this margin edge. These factors supplement the company’s steady expansion and help withstand cost pressures from rising input prices and growing Scandinavian competition.

- Analysts highlight, though, that a heavy focus on subscription meal kits makes Cheffelo dependent on evolving customer preferences. This reliance could eventually limit how much margins can expand if market tastes shift.

Curious what the analysts think? Dive into the balanced case and latest debates in the full Consensus Narrative. 📊 Read the full Cheffelo Consensus Narrative.

Topline Expansion Drives Long-Term Value

- Annual revenue growth is modeled at 7.6% over the next three years. New customer acquisition, upselling, and digital meal kit adoption are noted as main drivers.

- Consensus narrative notes that AI-driven personalization and scalable supply chains are expected to keep Cheffelo’s sales growing faster than the market average, especially as European meal kit adoption has yet to match adoption rates seen in the U.S. and Australia.

- They argue that ongoing investments in automation and recipe personalization should further fuel revenue and margin growth, reinforcing the long runway for capturing new market share.

- However, analysts caution that much of this depends on consumer appetite for convenience and whether Cheffelo can continue to stand out in an increasingly crowded space.

Valuation Gap Sparks Debate

- The current share price of SEK 81.7 remains below the DCF fair value estimate of SEK 290.71 but above the analyst consensus price target of SEK 92.33. This highlights a wide divergence in valuation methods.

- Consensus narrative underscores that Cheffelo trades at a PE ratio of 20.3x, which is above the industry average (15.5x) but below its peer group (26x). For analyst targets to be met, profits and margins must continue rising amid only modest risk from dividend and insider activity.

- What is surprising is that even with strong growth forecasts, both price targets and recent share price performance remain conservative compared to some of the bullish revenue and margin expectations.

- The consensus view encourages investors to sense-check their own assumptions against these figures, as differences in growth and pricing expectations could create further price volatility if sentiment shifts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Cheffelo on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the numbers? Put your perspective into action and craft your own narrative in just a few minutes. Do it your way

A great starting point for your Cheffelo research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite Cheffelo’s high earnings growth, uncertainty around dividends, recent insider selling, and valuation divergence could limit future share price upside.

If you want to avoid these concerns, search for better opportunities among these 836 undervalued stocks based on cash flows that offer more compelling valuations and clearer paths to value creation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CHEF

Cheffelo

Engages in the supply and delivery of meal kits to various customers in Sweden, Norway, and Denmark.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives