- Sweden

- /

- Capital Markets

- /

- OM:VO2

Even With A 35% Surge, Cautious Investors Are Not Rewarding Vo2 Cap Holding AB (publ)'s (STO:VO2) Performance Completely

Vo2 Cap Holding AB (publ) (STO:VO2) shares have had a really impressive month, gaining 35% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 23% in the last twelve months.

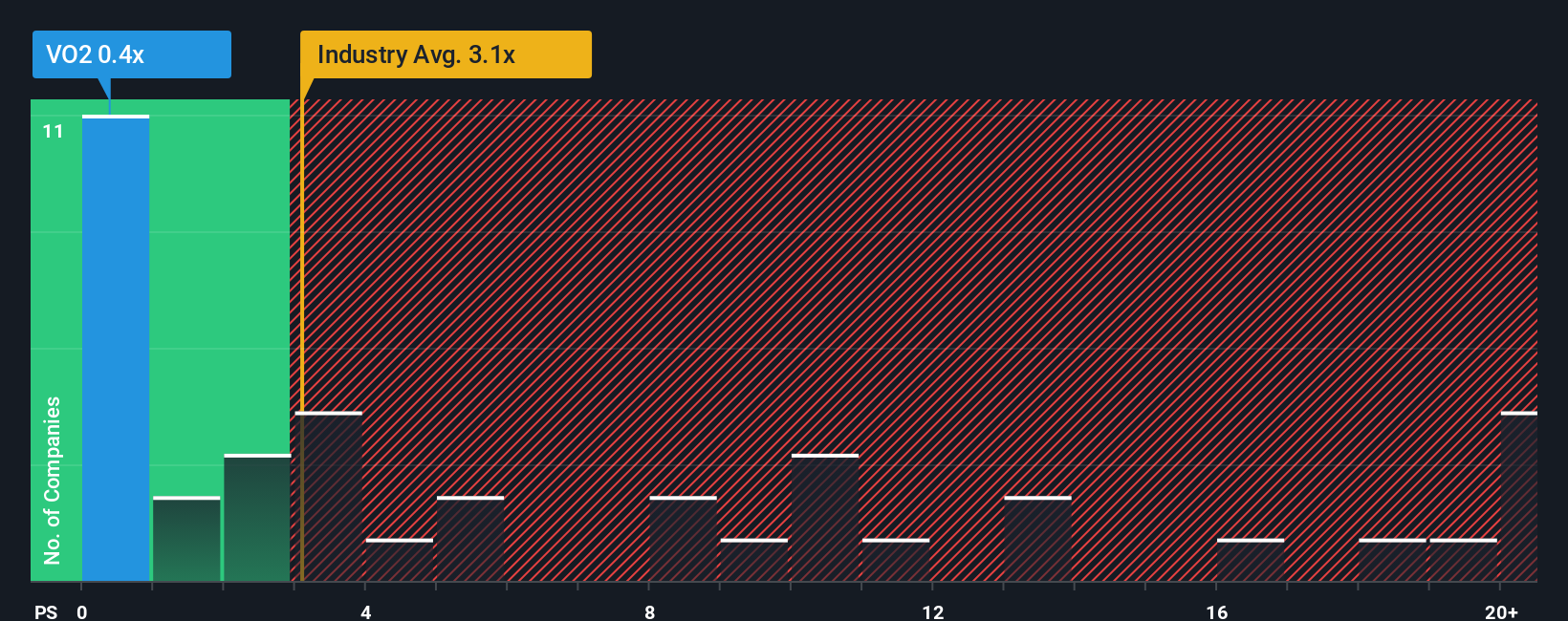

In spite of the firm bounce in price, Vo2 Cap Holding may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Capital Markets industry in Sweden have P/S ratios greater than 3.1x and even P/S higher than 12x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Vo2 Cap Holding

What Does Vo2 Cap Holding's P/S Mean For Shareholders?

Vo2 Cap Holding could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Vo2 Cap Holding.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Vo2 Cap Holding's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 2.7% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 10% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should demonstrate some strength in company's business, generating growth of 2.2% as estimated by the one analyst watching the company. This isn't typically strong growth, but with the rest of the industry predicted to shrink by 1.1%, that would be a solid result.

With this information, we find it very odd that Vo2 Cap Holding is trading at a P/S lower than the industry. It looks like most investors aren't convinced at all that the company can achieve positive future growth in the face of a shrinking broader industry.

What Does Vo2 Cap Holding's P/S Mean For Investors?

Vo2 Cap Holding's recent share price jump still sees fails to bring its P/S alongside the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Vo2 Cap Holding's analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't contributing to its P/S anywhere near as much as we would have predicted. When we see a superior revenue outlook with some actual growth, we can only assume investor uncertainty is what's been suppressing the P/S figures. Amidst challenging industry conditions, a key concern is whether the company can sustain its superior revenue growth trajectory. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Vo2 Cap Holding (1 makes us a bit uncomfortable) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:VO2

Adequate balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.