- Sweden

- /

- Capital Markets

- /

- OM:SAVE

How Investors Are Reacting To Nordnet (OM:SAVE) Surpassing 2.3 Million Customers Amid Strong October Results

Reviewed by Sasha Jovanovic

- Nordnet AB (publ) reported that in October 2025, customers made 6,545,900 trades, net savings totaled SEK 7.7 billion, and the total savings capital reached SEK 1,176 billion.

- A key insight is the company's annual customer growth rate of 12.9%, bringing its customer base to over 2.31 million by the end of October.

- Given Nordnet's recent robust customer growth, we will examine how this positive momentum impacts the company's investment narrative and outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Nordnet Investment Narrative Recap

To be a shareholder in Nordnet, you need to believe ongoing digital adoption and customer growth will translate into sustainable earnings and defendable market share, even if competitive fee pressure persists. The upbeat operating results for October reinforce the importance of active customer addition as a short-term catalyst; however, this does not materially alter the main risk that flat trading fee revenue or intensified price competition could squeeze margins in the near term.

Of the recent announcements, the Q3 earnings release stands out, confirming steady growth in net income and earnings per share amid robust new customer inflows. This continuity between monthly statistics and quarterly results underlines the centrality of user growth and engagement to Nordnet’s current investment case, while also highlighting persistent risks from fee compression or cost escalation.

By contrast, the question remains whether Nordnet can maintain growth without running into the challenge of...

Read the full narrative on Nordnet (it's free!)

Nordnet's outlook projects SEK 6.6 billion in revenue and SEK 3.7 billion in earnings by 2028. This scenario assumes 3.6% annual revenue growth and a SEK 0.9 billion earnings increase from the current SEK 2.8 billion.

Uncover how Nordnet's forecasts yield a SEK277.89 fair value, in line with its current price.

Exploring Other Perspectives

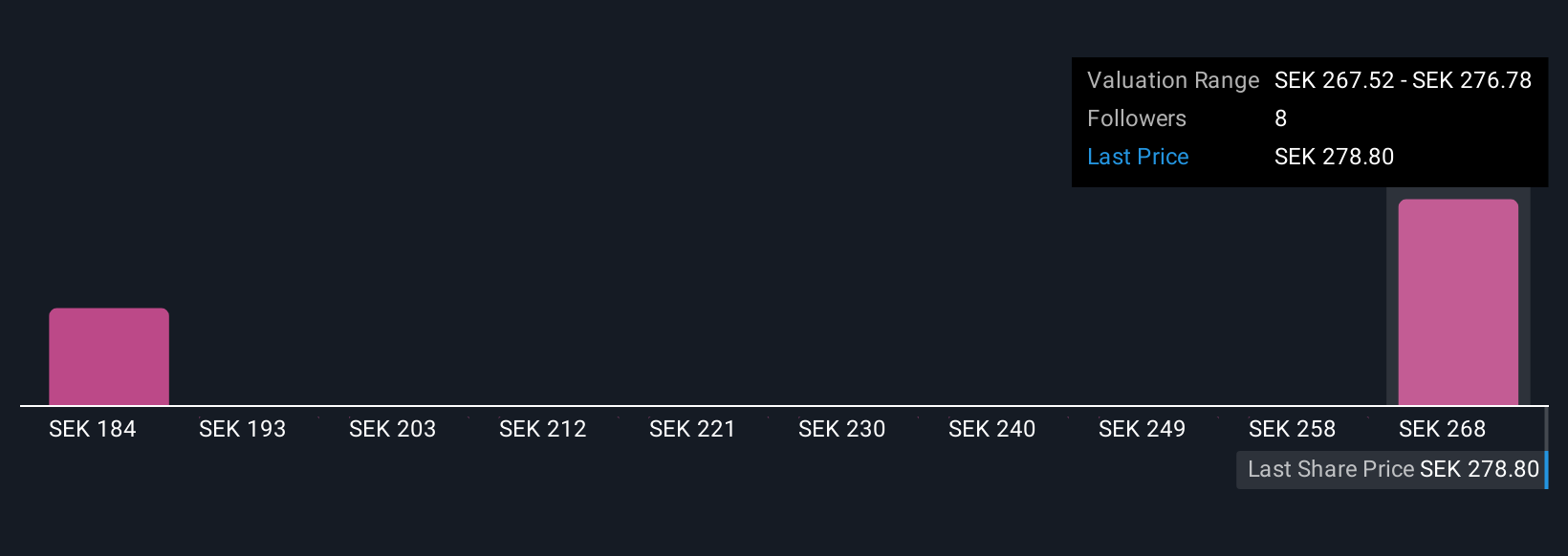

Simply Wall St Community members value Nordnet between SEK186 and SEK277, with just two unique estimates before this month’s update. With customer growth as a key business driver, consider how contrasting opinions might reflect broader uncertainty about long-term profitability and price competition.

Explore 2 other fair value estimates on Nordnet - why the stock might be worth 32% less than the current price!

Build Your Own Nordnet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nordnet research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nordnet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nordnet's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordnet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SAVE

Nordnet

Operates a digital platform for savings and investments in Sweden, Norway, Denmark, and Finland.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives