- Sweden

- /

- Capital Markets

- /

- OM:SAVE

Do Nordnet’s (OM:SAVE) Growth Ambitions Justify Its Premium Valuation Amid Strategic Shifts?

Reviewed by Sasha Jovanovic

- In November 2025, Nordnet’s Board of Directors redeemed 1,501,077 outstanding class C shares held in treasury, decreasing both the total share count and the number of voting rights; as of November 28, 2025, Nordnet had 250,839,706 shares comprising both ordinary and class C shares, with only ordinary shares listed on Nasdaq Stockholm.

- BofA Securities initiated coverage of Nordnet with an Underperform rating, highlighting concerns over the company's premium valuation, ambitious customer growth targets, and a shift toward lower-margin products, while projecting both slower growth and higher costs than consensus estimates for 2025.

- We’ll consider how BofA’s caution regarding Nordnet’s ambitious customer expansion shapes the company’s investment narrative going forward.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Nordnet Investment Narrative Recap

To be a shareholder in Nordnet, you’ll need confidence in the company’s ability to convert strong customer and savings growth into sustained, profitable expansion, despite ongoing cost pressures and competitive pricing risks. The recent redemption of class C shares is not expected to shift near-term catalysts or risks in a material way, leaving the focus squarely on customer momentum and margin management amid competitors’ fee compression efforts. Short-term, the key risk remains operating cost growth outpacing revenues, with pressure from price competition requiring careful monitoring.

Of Nordnet’s recent announcements, BofA Securities’ initiation of coverage stands out, highlighting concerns about premium valuation and ambitious growth targets. This aligns closely with current investor attention on whether Nordnet can meet expansion goals without eroding margin, as high customer acquisition remains the company’s clearest route to offsetting slowing deposit growth and tighter industry conditions.

Yet, in contrast to the optimism around growing the customer base, investors should also be aware of...

Read the full narrative on Nordnet (it's free!)

Nordnet's narrative projects SEK6.6 billion revenue and SEK3.7 billion earnings by 2028. This requires 3.6% yearly revenue growth and a SEK0.9 billion earnings increase from SEK2.8 billion today.

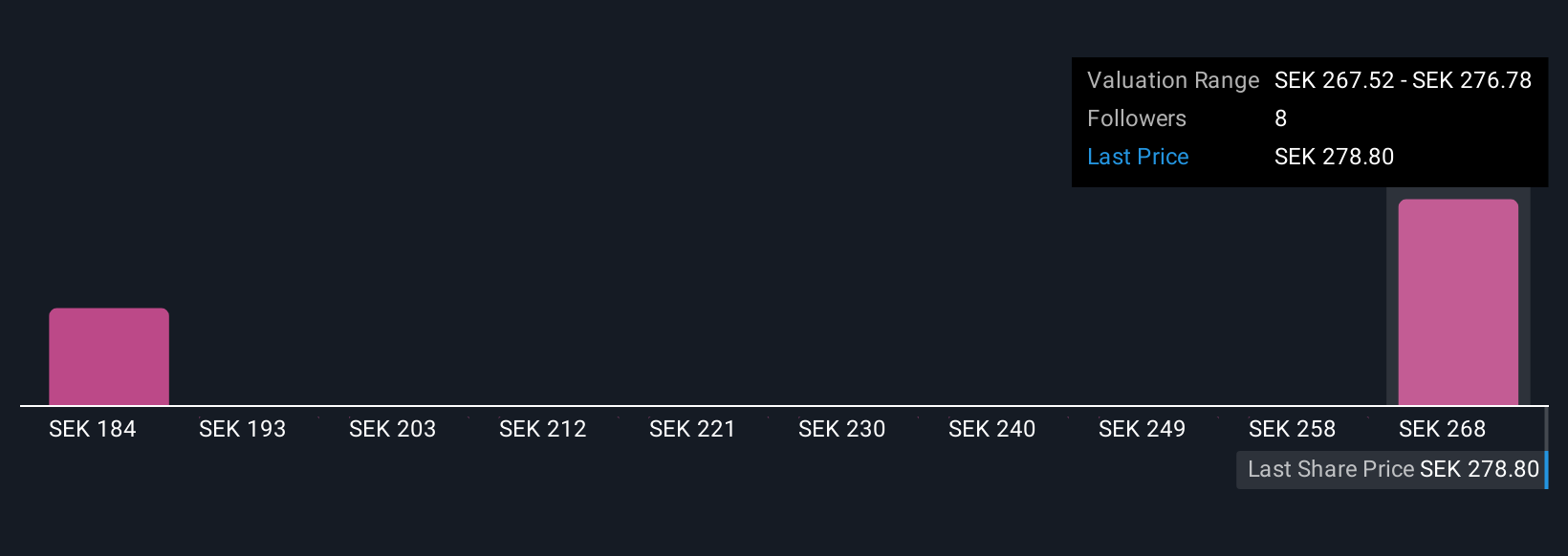

Uncover how Nordnet's forecasts yield a SEK277.89 fair value, a 3% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community offered 2 fair value estimates for Nordnet, stretching from SEK185.07 to SEK277.89. With ongoing price competition risks at play, expect varied opinions on the company’s ability to sustain current margins as industry conditions evolve.

Explore 2 other fair value estimates on Nordnet - why the stock might be worth 32% less than the current price!

Build Your Own Nordnet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nordnet research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nordnet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nordnet's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordnet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SAVE

Nordnet

Operates a digital platform for savings and investments in Sweden, Norway, Denmark, and Finland.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026