- Sweden

- /

- Capital Markets

- /

- OM:ROKO B

Röko (OM:ROKO B) Valuation Premium Tests Community Optimism as Earnings Growth Slows

Reviewed by Simply Wall St

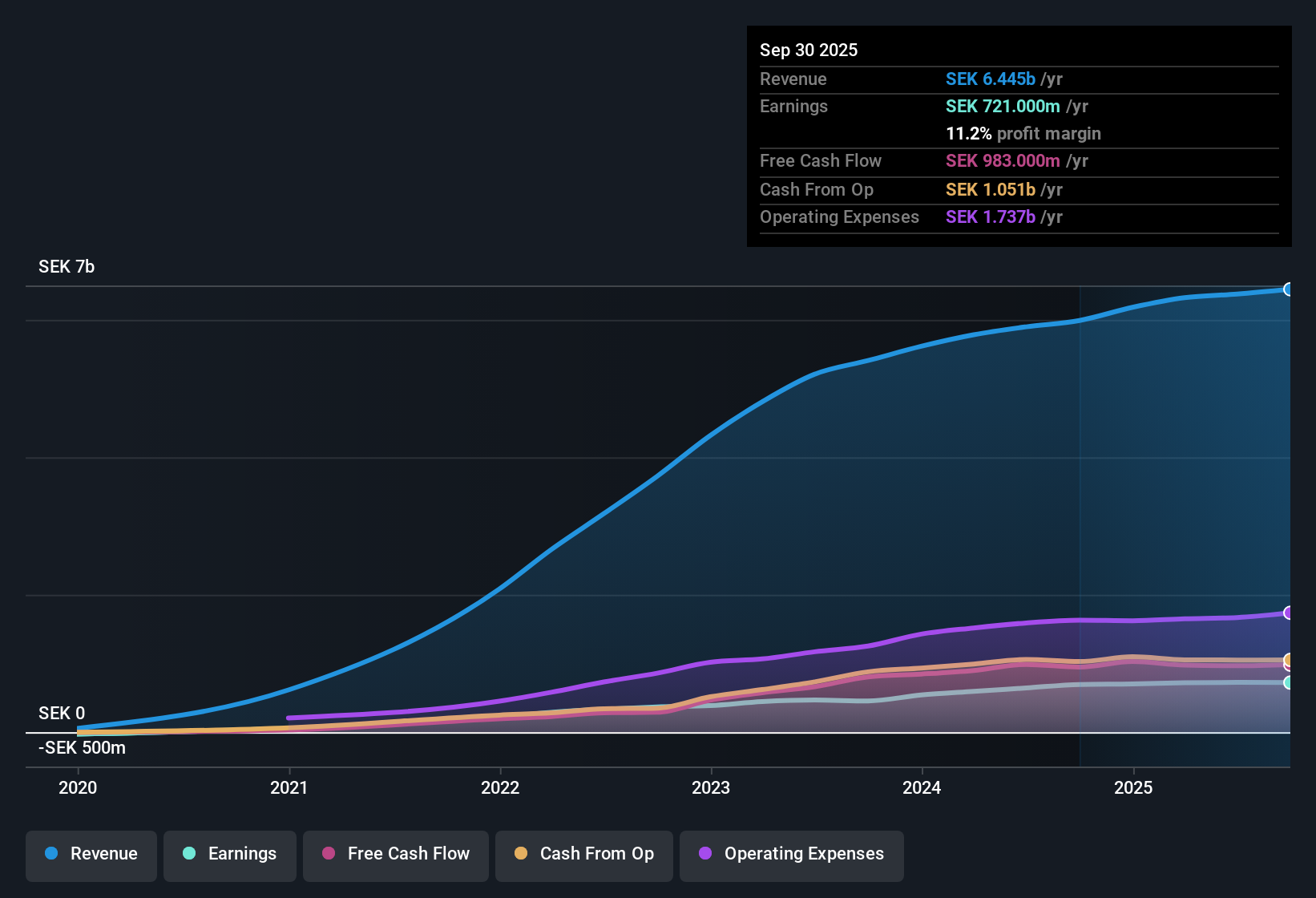

Röko (OM:ROKO B) posted earnings growth of 3.9% in its latest results, noticeably slower than its five-year average of 29.9% per year. Revenue is forecast to increase at 3.3% annually, underperforming the Swedish market’s expected 3.8%. Net profit margin edged down to 11.2% from last year’s 11.6%. Investors now have to balance Röko’s track record of consistent profit and revenue growth with a recent moderation in momentum and profit margins.

See our full analysis for Röko.Next, we will stack these results against the most-followed narratives surrounding Röko to see where expectations are met or put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Growth Forecast Slows Sharply

- While Röko averaged 29.9% annual earnings expansion over the past five years, the next few years are expected to see a much more modest 8.1% annual earnings growth rate. This confirms a clear slowdown.

- The AI-generated narrative highlights ongoing execution of Röko’s growth strategy. However, this steep downshift in expected profit growth suggests much of the "compounding" optimism must now contend with a new, slower baseline.

- Bulls argue that sector tailwinds and management’s track record still apply, but the company’s pace is now far below its own five-year history. Based on forecasts, it is unlikely to recapture those earlier highs soon.

- Forecasted annual revenue increases of 3.3% further illustrate the shift from past high growth to a more measured outlook, which could temper future share price momentum if not offset by new catalysts.

Profit Margins Lose Slight Ground

- Net profit margin dipped to 11.2% from 11.6% last year, narrowing by 0.4 percentage points while earnings growth slowed. This indicates that profitability, not just top-line expansion, is facing mild pressure.

- According to the prevailing market view, bulls often point to Röko’s consistent profit engine. However, this margin compression reveals that sustaining high-quality earnings could be tougher as growth decelerates.

- The combination of slower projected earnings expansion and tightening margins invites scrutiny. Historical quality cannot guarantee future resilience if trends continue.

- Investors who previously applauded stable margins now face the reality that even modest drops can matter more when growth is cooling, raising the bar for near-term operational improvement.

Valuation Multiple at a Substantial Premium

- Röko’s P/E ratio stands at 38.5x, almost double its peer average of 19.5x and well above the industry’s 16.2x. Its SEK1,900 share price trades at nearly twice its DCF fair value of SEK982.36.

- Challenging the bullish narrative’s faith in premium pricing, these valuation gaps test whether Röko’s fundamentals justify such a high bar, especially as profit growth moderates.

- Bulls may cite sector tailwinds and management quality as explanations for paying up, but in absolute terms, the stock’s price is outpacing both fair value and peer norms by a wide margin.

- Any future stumble, whether in earnings trends or margins, could prompt a sharp rerating given the already stretched multiples and the narrowing gap to growth leaders.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Röko's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Röko’s stretched valuation, together with slower expected profit growth and tightening margins, raises concerns about its ability to sustain recent premium prices.

If you want to sidestep these valuation hurdles, focus on these 877 undervalued stocks based on cash flows for equities where fundamentals still support bargain prices and future upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ROKO B

Röko

A private equity firm specializes in small- and medium-sized businesses.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives