- Sweden

- /

- Capital Markets

- /

- OM:ROKO B

Röko AB (publ)'s (STO:ROKO B) Popularity With Investors Is Under Threat From Overpricing

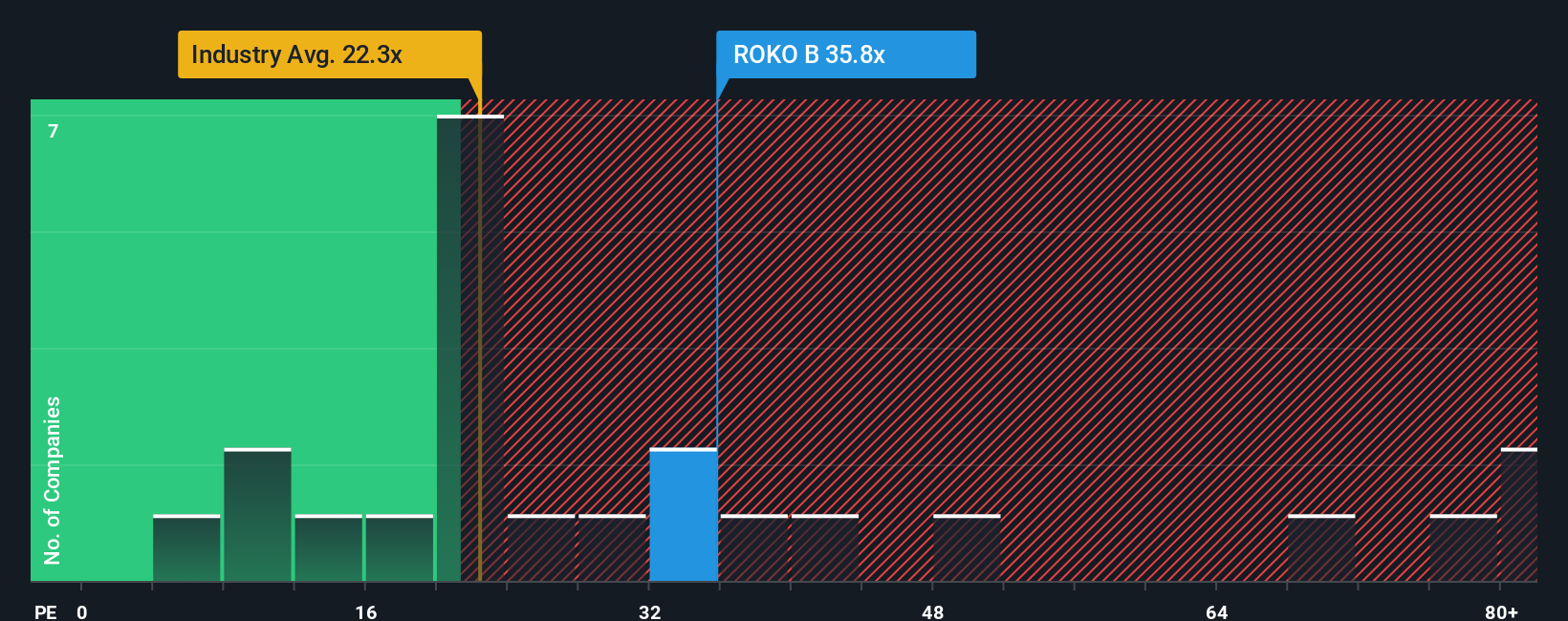

With a price-to-earnings (or "P/E") ratio of 35.8x Röko AB (publ) (STO:ROKO B) may be sending very bearish signals at the moment, given that almost half of all companies in Sweden have P/E ratios under 22x and even P/E's lower than 14x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent earnings growth for Röko has been in line with the market. One possibility is that the P/E is high because investors think this modest earnings performance will accelerate. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Röko

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Röko's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 5.0% last year. The latest three year period has also seen an excellent 81% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 14% over the next year. With the market predicted to deliver 30% growth , the company is positioned for a weaker earnings result.

With this information, we find it concerning that Röko is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Röko's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Röko's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Röko with six simple checks on some of these key factors.

Of course, you might also be able to find a better stock than Röko. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ROKO B

Röko

A private equity firm specializing in small- and medium-sized businesses.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026