European Market Insights: 3 Penny Stocks With Market Caps Over €30M

Reviewed by Simply Wall St

As the European market navigates a period of mixed signals, with major stock indexes showing varied performances and trade talks in focus, investors are on the lookout for unique opportunities. Penny stocks, though often overlooked due to their seemingly antiquated label, continue to offer intriguing possibilities for those seeking growth potential at accessible price points. By focusing on companies with strong financial foundations and solid fundamentals, this article explores three penny stocks that could present hidden value within the European market landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Lucisano Media Group (BIT:LMG) | €0.95 | €14.11M | ✅ 3 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.43 | €45.56M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.498 | RON16.84M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €2.87 | €60.53M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.99 | €18.66M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.40 | PLN11.86M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK3.24 | SEK3.1B | ✅ 4 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.125 | €293.39M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.976 | €32.91M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 335 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

Digital Workforce Services Oyj (HLSE:DWF)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Digital Workforce Services Oyj, along with its subsidiaries, offers business process automation services and technology solutions across Finland, Sweden, Norway, Denmark, Poland, the rest of the European Union, and internationally with a market cap of €39.34 million.

Operations: Digital Workforce Services Oyj has not reported specific revenue segments.

Market Cap: €39.34M

Digital Workforce Services Oyj, with a market cap of €39.34 million, is trading at 40.8% below its estimated fair value and has more cash than debt, suggesting financial resilience. The company is unprofitable but has reduced losses over the past five years by 52.4% annually and maintains a cash runway exceeding three years based on current free cash flow. Recent earnings showed slight sales growth to €7.21 million in Q2 2025, though net income remains modest at €0.221 million. Strategic moves include appointing a new CFO and initiating share repurchases to support potential acquisitions or incentive schemes.

- Jump into the full analysis health report here for a deeper understanding of Digital Workforce Services Oyj.

- Explore Digital Workforce Services Oyj's analyst forecasts in our growth report.

Nordic Asia Investment Group 1987 (OM:NAIG B)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nordic Asia Investment Group 1987 AB (publ) is a principal investment firm focusing on long-term strategic and growth equity investments in Chinese companies targeting the internal consumer market, with a market cap of SEK75.11 million.

Operations: The company does not currently have any classified revenue segments in its financial reporting.

Market Cap: SEK75.11M

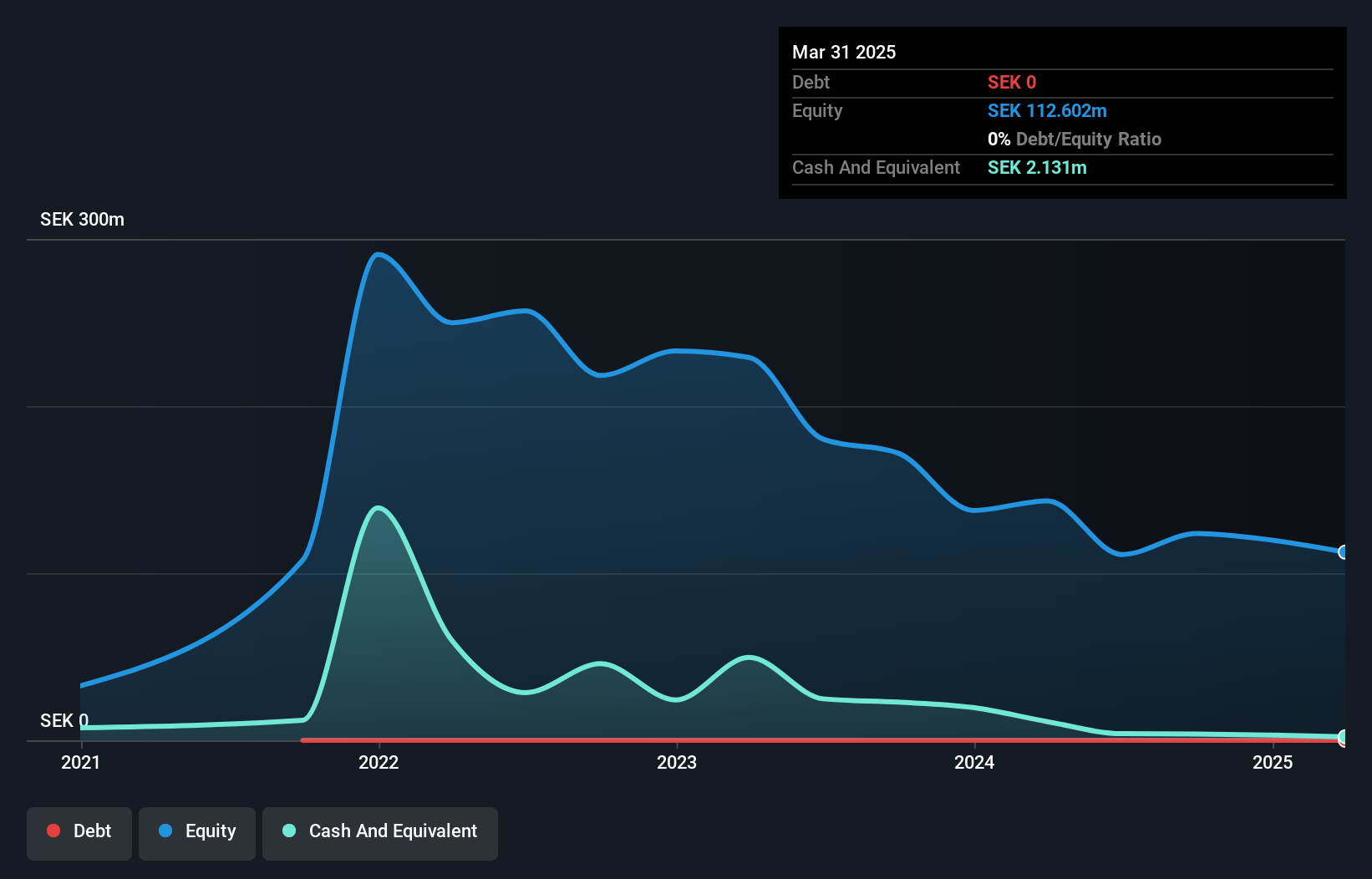

Nordic Asia Investment Group 1987 AB (publ), with a market cap of SEK75.11 million, focuses on long-term investments in Chinese consumer markets but remains pre-revenue, reflecting its strategic positioning rather than immediate profitability. The company recently reported a net loss of SEK7.02 million for Q1 2025, contrasting with last year's profit, and offers dividends despite insufficient earnings coverage. Although debt-free and possessing more short-term assets than liabilities, its cash runway is limited to under a year if cash flow trends persist. The board's lack of experience may impact strategic execution amid the company's volatile weekly returns stability at 7%.

- Take a closer look at Nordic Asia Investment Group 1987's potential here in our financial health report.

- Explore historical data to track Nordic Asia Investment Group 1987's performance over time in our past results report.

H&R GmbH KGaA (XTRA:2HRA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: H&R GmbH & Co. KGaA is involved in the production and distribution of chemical-pharmaceutical raw materials and injection molded precision plastic parts across Europe, Africa, Asia, and globally, with a market cap of €185.36 million.

Operations: The company's revenue is primarily derived from Chemical and Pharmaceutical Raw Materials - ChemPharm - Refining at €828.06 million, followed by Chemical-Pharmaceutical Raw Materials Sales at €493.41 million, and Plastics at €45.25 million.

Market Cap: €185.36M

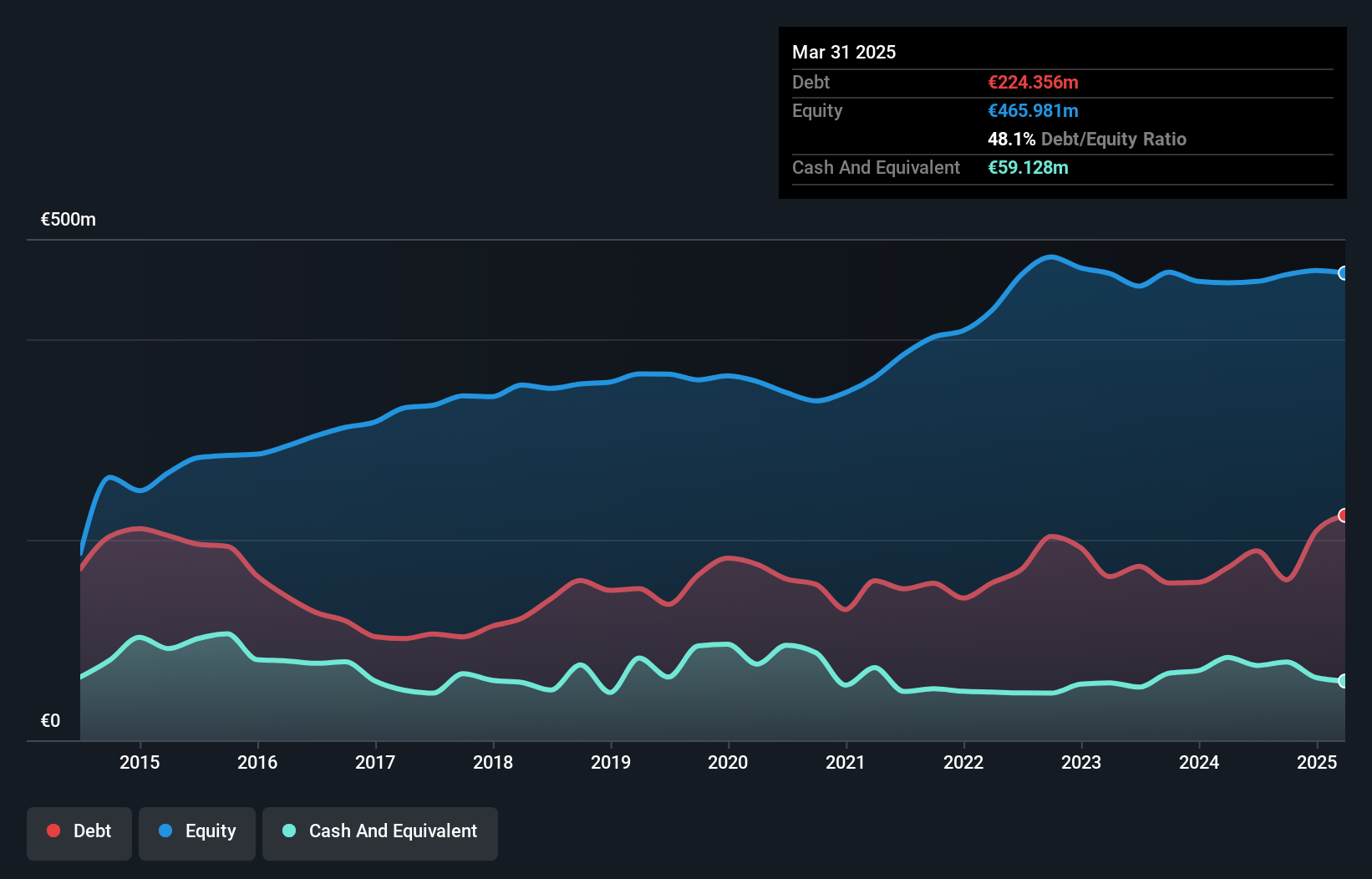

H&R GmbH & Co. KGaA, with a market cap of €185.36 million, has faced challenges with negative earnings growth over the past year, contrasting with the chemicals industry average. Despite this, its financial structure is robust with short-term assets exceeding liabilities and satisfactory debt levels. The company’s net profit margin has slightly declined to 0.8%, and its dividend history remains unstable. Recent developments include Nils Hansen's proposal to acquire the remaining stake in H&R for €73 million, potentially leading to a delisting offer or squeeze-out by Q3 2025 after regulatory approval was granted in June 2025.

- Navigate through the intricacies of H&R GmbH KGaA with our comprehensive balance sheet health report here.

- Evaluate H&R GmbH KGaA's prospects by accessing our earnings growth report.

Make It Happen

- Get an in-depth perspective on all 335 European Penny Stocks by using our screener here.

- Looking For Alternative Opportunities? Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:DWF

Digital Workforce Services Oyj

Provides business process automation services and technology solutions in Finland, Sweden, Norway, Denmark, Poland, rest of the European Union, and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives