- Sweden

- /

- Diversified Financial

- /

- OM:LUND B

L E Lundbergföretagen (OM:LUND B): Evaluating Valuation After Strong Earnings Growth for Q3 and Year-to-Date

Reviewed by Simply Wall St

L E Lundbergföretagen (OM:LUND B) announced earnings with net income and basic earnings per share noticeably higher for both the third quarter and first nine months of 2025 compared to last year. Investors are paying attention.

See our latest analysis for L E Lundbergföretagen.

This positive earnings momentum comes as L E Lundbergföretagen’s share price has gained 6.4% over the past 90 days, which suggests growing optimism among investors. Still, its total shareholder return over the last year sits at -5.2%, which reflects some lingering caution despite the stronger quarterly performance.

If the company’s latest results have you thinking more broadly about market movers, it might be time to broaden your search and discover fast growing stocks with high insider ownership

With earnings moving sharply higher and shares ticking up, the question remains: Are these gains still leaving L E Lundbergföretagen undervalued, or is the market already factoring in the company’s future growth prospects?

Price-to-Earnings of 16.4x: Is it justified?

L E Lundbergföretagen trades at a price-to-earnings (P/E) ratio of 16.4x, notably below the average for its peer group but above the industry standard. With a last close price of SEK502, the low P/E relative to Swedish market averages may suggest shares offer value for those focused on current earnings power.

The price-to-earnings ratio compares the company’s share price with its earnings per share, serving as a yardstick for how much investors are willing to pay for a unit of current profits. In industries undergoing change or with inconsistent profit trends, the multiple can reflect both opportunity and risk.

For L E Lundbergföretagen, the 16.4x P/E is attractive when measured against the peer group average of 58.4x. This implies the market does not price in significant future profit gains. However, this multiple is expensive compared to the broader European Diversified Financials industry, where the average P/E is 13.9x. This difference suggests the market is applying a modest premium, possibly reflecting perceived stability or defensiveness, but not the aggressive growth rewarded elsewhere.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 16.4x (ABOUT RIGHT)

However, future share gains could be limited if market uncertainty persists or if sector-wide earnings momentum slows in the coming months.

Find out about the key risks to this L E Lundbergföretagen narrative.

Another View: Discounted Cash Flow Model

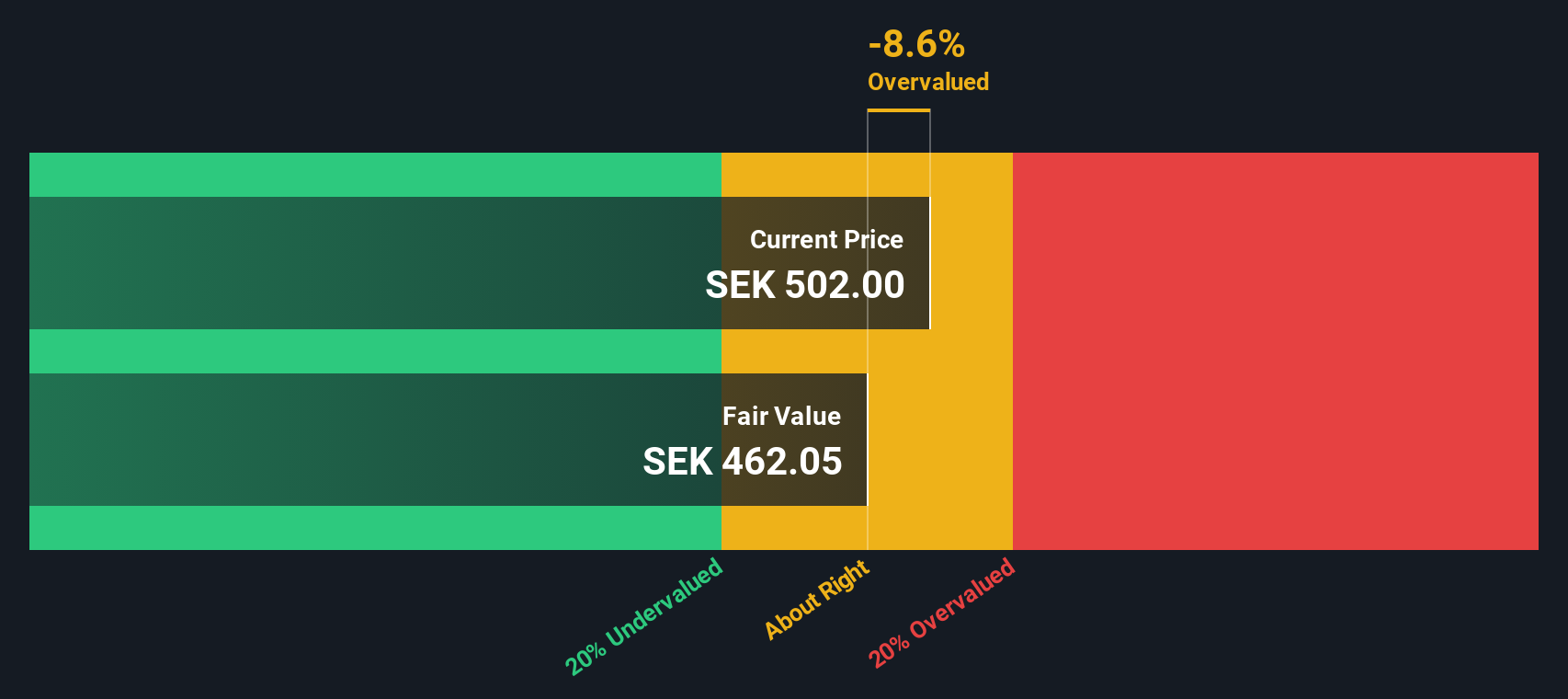

The SWS DCF model presents a different perspective. According to this method, L E Lundbergföretagen shares are trading above an estimated fair value, coming in at SEK502 compared to our model's figure of SEK462. This indicates shares may be slightly overvalued based on long-term cash flows. Does the DCF method reveal something the market is missing, or is it overlooking other key factors that drive price?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out L E Lundbergföretagen for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own L E Lundbergföretagen Narrative

If you have a different perspective or want to investigate the figures for yourself, you can quickly craft your own view. Do it your way

A great starting point for your L E Lundbergföretagen research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock the full potential of your portfolio by zeroing in on opportunities that others might overlook. Simply Wall Street’s screener makes it easier to find your next move.

- Pinpoint strong yields and steady income opportunities with these 15 dividend stocks with yields > 3%, offering dividend stocks that consistently reward shareholders.

- Tap into next-generation growth as you examine these 28 quantum computing stocks with breakthroughs in quantum computing and transformative technologies.

- Jump ahead of market trends and seek untapped value with these 913 undervalued stocks based on cash flows, showcasing stocks priced lower than their true potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:LUND B

L E Lundbergföretagen

Engages in the manufacture and sale of paperboard, paper, and sawn timber products worldwide.

Mediocre balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026