- Sweden

- /

- Capital Markets

- /

- OM:K33

Market Might Still Lack Some Conviction On K33 AB (publ) (STO:K33) Even After 32% Share Price Boost

Those holding K33 AB (publ) (STO:K33) shares would be relieved that the share price has rebounded 32% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The annual gain comes to 144% following the latest surge, making investors sit up and take notice.

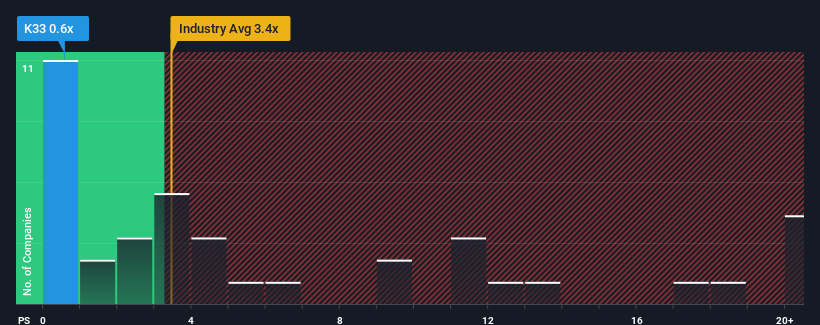

In spite of the firm bounce in price, K33 may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.6x, considering almost half of all companies in the Capital Markets industry in Sweden have P/S ratios greater than 3.4x and even P/S higher than 12x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Our free stock report includes 3 warning signs investors should be aware of before investing in K33. Read for free now.See our latest analysis for K33

How K33 Has Been Performing

K33 certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. Those who are bullish on K33 will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on K33 will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like K33's to be considered reasonable.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. The amazing performance means it was also able to grow revenue by 188% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

In contrast to the company, the rest of the industry is expected to decline by 1.3% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

In light of this, it's quite peculiar that K33's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

K33's recent share price jump still sees fails to bring its P/S alongside the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of K33 revealed that despite growing revenue over the medium-term in a shrinking industry, the P/S doesn't reflect this as it's lower than the industry average. There could be some major unobserved threats to revenue preventing the P/S ratio from matching this positive performance. Amidst challenging industry conditions, perhaps a key concern is whether the company can sustain its superior revenue growth trajectory. It appears many are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

Before you take the next step, you should know about the 3 warning signs for K33 (1 is a bit unpleasant!) that we have uncovered.

If you're unsure about the strength of K33's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if K33 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:K33

K33

Through its subsidiaries, invests in digital assets in Sweden and internationally.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives