- Sweden

- /

- Consumer Finance

- /

- OM:HOFI

Exploring 3 Undiscovered Gems In Sweden With Strong Potential

Reviewed by Simply Wall St

Amid the global market's reaction to the Federal Reserve's recent rate cut, smaller-cap indexes have shown notable resilience, even though they remain below their previous peaks. This environment presents an intriguing backdrop for exploring lesser-known stocks with strong potential in Sweden. In this article, we will highlight three undiscovered gems in Sweden that demonstrate qualities of a good stock: solid fundamentals, growth potential, and resilience amid broader economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Duni | 29.33% | 10.78% | 22.98% | ★★★★★★ |

| Bahnhof | NA | 9.02% | 15.02% | ★★★★★★ |

| Firefly | NA | 16.04% | 32.29% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| Creades | NA | -28.54% | -27.09% | ★★★★★★ |

| Svolder | NA | -22.68% | -24.17% | ★★★★★★ |

| Byggmästare Anders J Ahlström Holding | NA | 30.31% | -9.00% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

| Solid Försäkringsaktiebolag | NA | 7.64% | 28.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Clas Ohlson (OM:CLAS B)

Simply Wall St Value Rating: ★★★★★★

Overview: Clas Ohlson AB (publ) is a retail company that sells hardware, electrical, multimedia, home, and leisure products in Sweden, Norway, Finland, and internationally with a market cap of SEK10.58 billion.

Operations: Clas Ohlson AB (publ) generates revenue primarily through its retail segment, amounting to SEK10.66 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

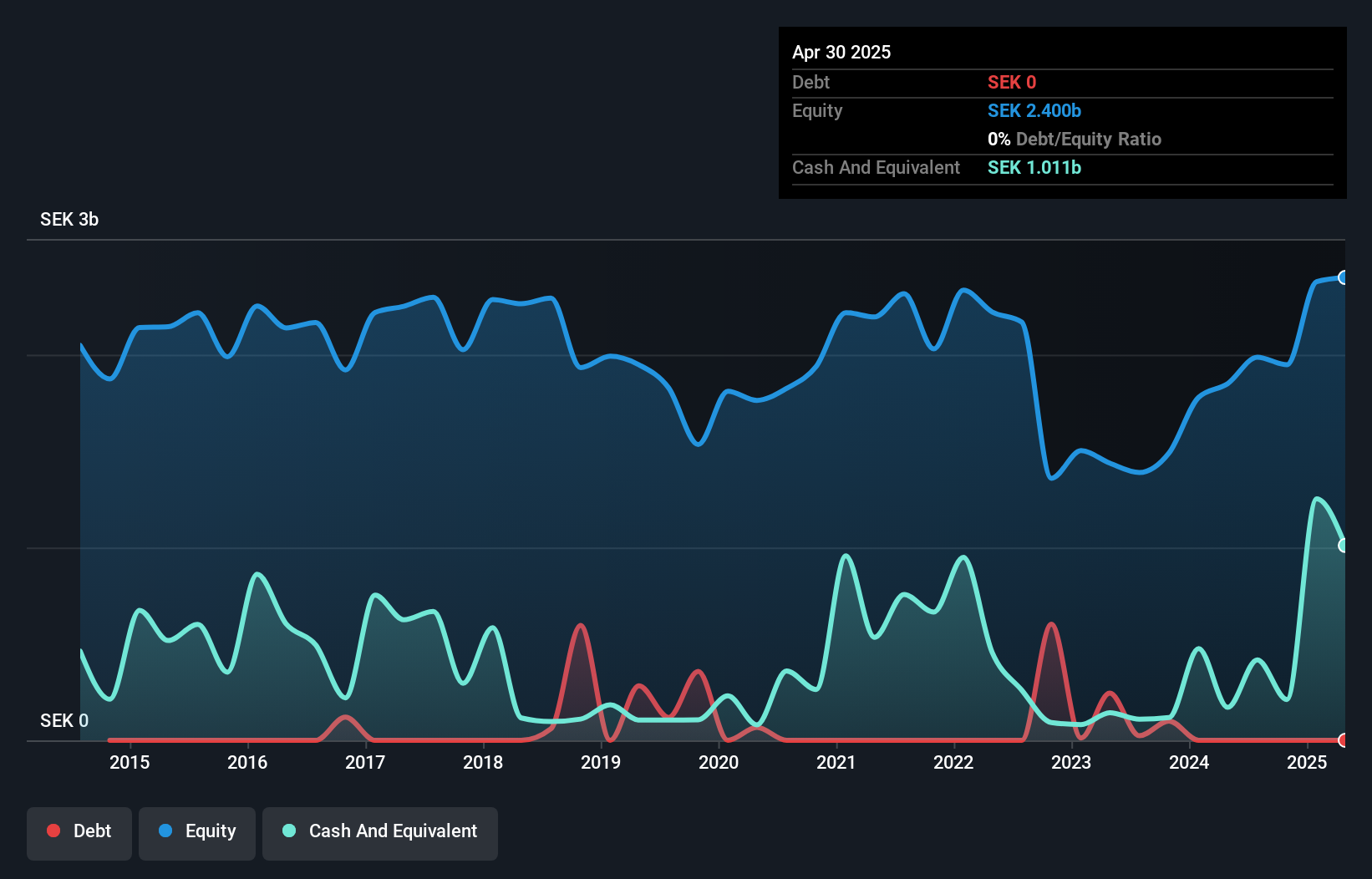

Clas Ohlson, a Swedish retailer, has shown impressive financial health with no debt compared to five years ago when its debt-to-equity ratio was 6.5%. The company reported first-quarter sales of SEK 2.62 billion and net income of SEK 145.8 million, up from a loss of SEK 26.4 million last year. Its earnings growth over the past year was an astounding 281.8%, significantly outpacing the specialty retail industry’s average growth rate of 21%.

- Navigate through the intricacies of Clas Ohlson with our comprehensive health report here.

Gain insights into Clas Ohlson's historical performance by reviewing our past performance report.

engcon (OM:ENGCON B)

Simply Wall St Value Rating: ★★★★★☆

Overview: engcon AB (publ) designs, produces, and sells excavator tools globally with a market cap of SEK17.94 billion.

Operations: engcon AB (publ) generates revenue primarily from the construction machinery and equipment segment, amounting to SEK1.54 billion. The company's net profit margin is denoted in percentage (%).

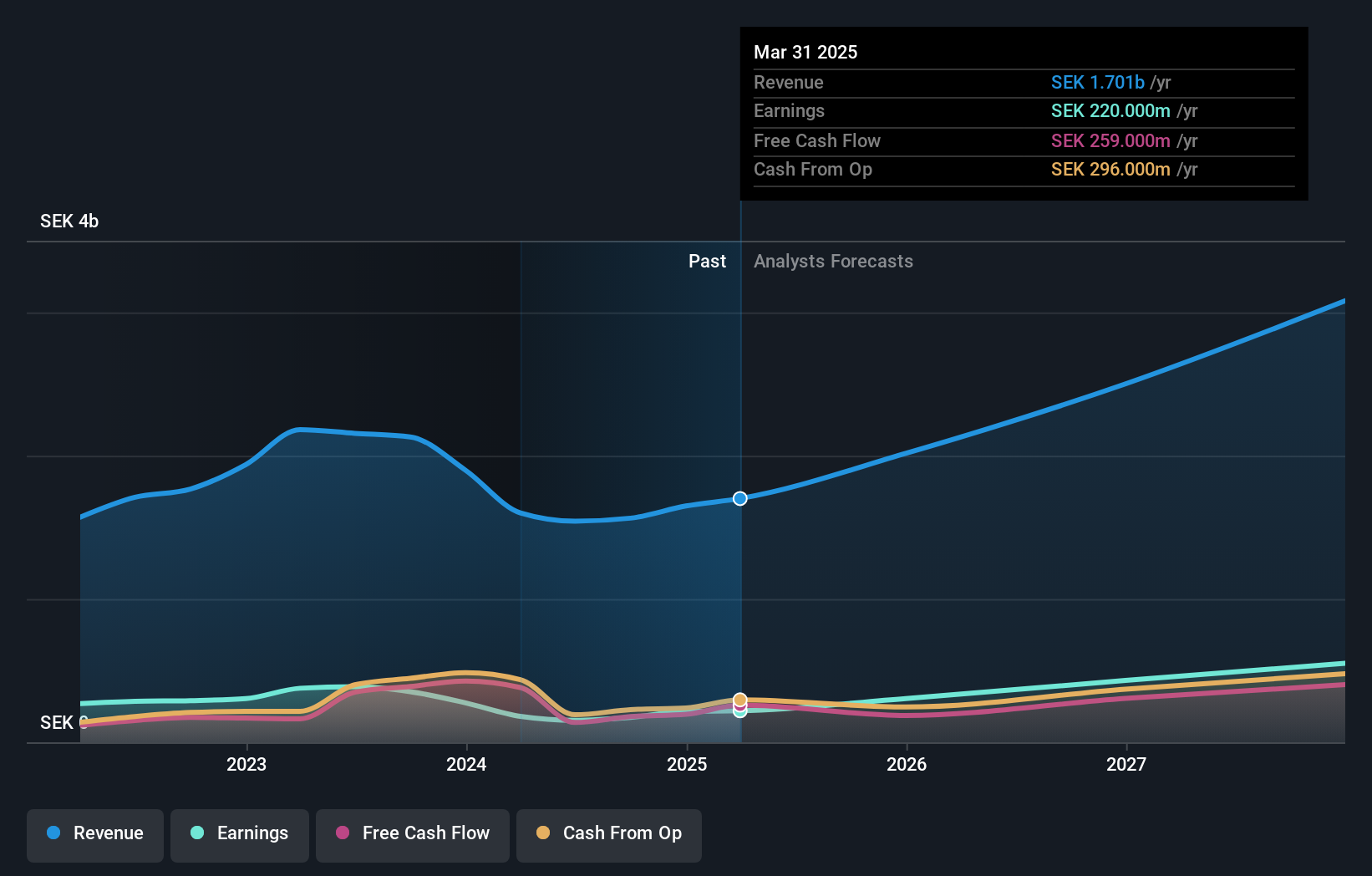

Engcon, a notable player in Sweden's machinery sector, has faced some challenges recently. Sales for the second quarter of 2024 were SEK 450 million, down from SEK 508 million the previous year. Net income also dropped to SEK 55 million from SEK 83 million. Despite these setbacks, Engcon’s net debt to equity ratio stands at a satisfactory 8.5%, and its interest payments are well covered with EBIT at 20.4x coverage. Profit margins have decreased to 9.9% from last year's 18%.

- Click to explore a detailed breakdown of our findings in engcon's health report.

Understand engcon's track record by examining our Past report.

Hoist Finance (OM:HOFI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hoist Finance AB (publ) is a credit market company that focuses on loan acquisition and management operations across Europe, with a market cap of approximately SEK7.72 billion.

Operations: Hoist Finance generates revenue primarily from its loan acquisition and management operations, with SEK2.86 billion coming from unsecured loans and SEK821 million from secured loans. Group items contribute an additional SEK255 million to the total revenue.

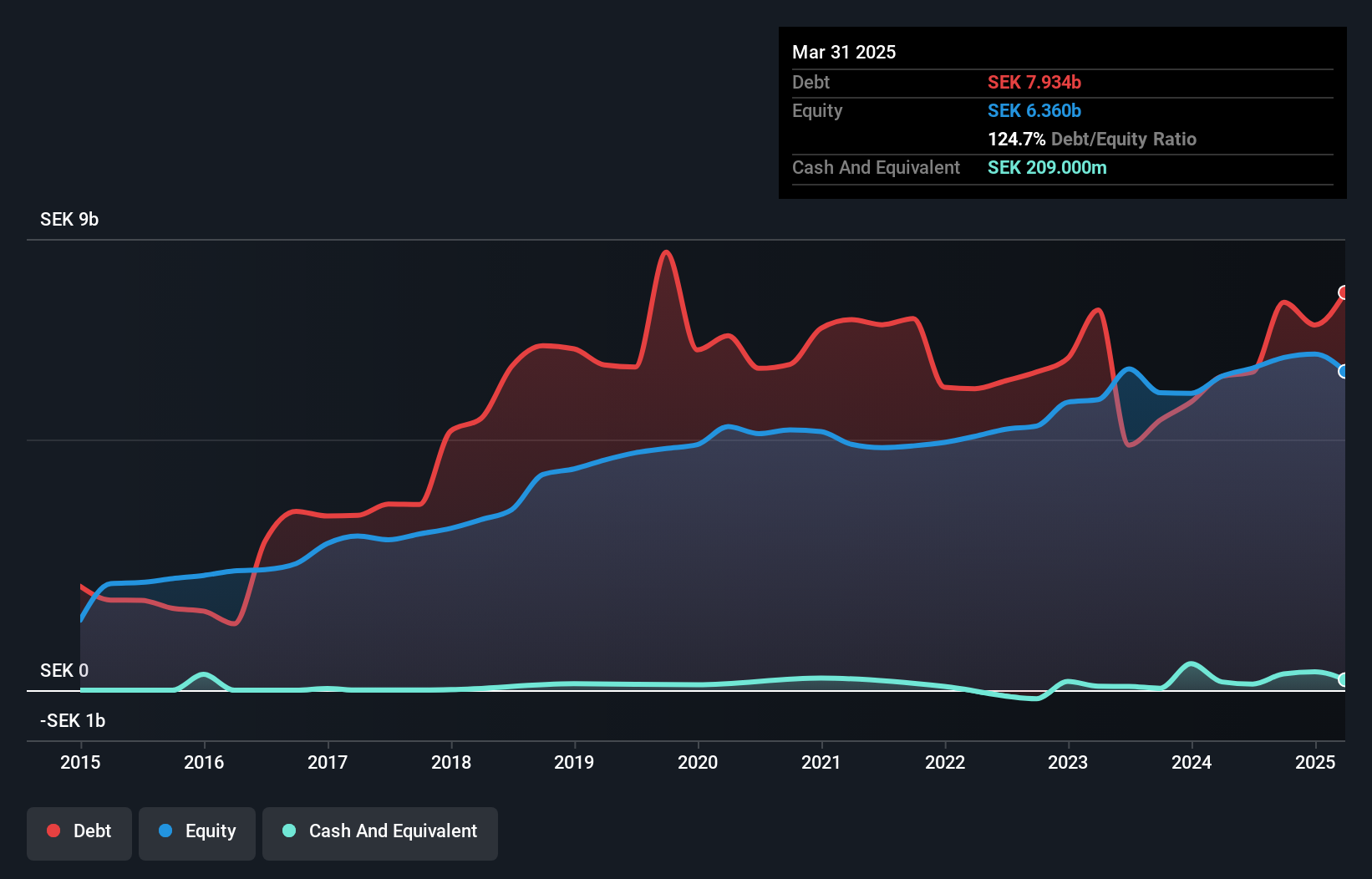

Hoist Finance, a notable player in Sweden's financial sector, has shown impressive earnings growth of 210.8% over the past year, significantly outpacing the Consumer Finance industry. With a price-to-earnings ratio of 9.3x, it stands below the Swedish market average of 23.8x, indicating potential undervaluation. The net debt to equity ratio has improved from 136.1% to 98.7% over five years but remains high at 96.8%. Recent bond issuances totaling SEK 1 billion further diversify its funding sources and enhance liquidity management strategies.

- Dive into the specifics of Hoist Finance here with our thorough health report.

Assess Hoist Finance's past performance with our detailed historical performance reports.

Taking Advantage

- Click here to access our complete index of 59 Swedish Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hoist Finance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HOFI

Hoist Finance

A credit market company, engages in the loan acquisition and management operations in Europe.

Solid track record with adequate balance sheet.