- Sweden

- /

- Capital Markets

- /

- OM:EQT

Should You Hold EQT After Its 10% Rally and Bullish Energy Sector News?

Reviewed by Bailey Pemberton

If you find yourself pondering whether to stick with EQT after its recent run or to look for stronger growth elsewhere, you are not alone. EQT’s stock has certainly been catching eyes with its 10.1% year-to-date return and a five-year performance that sits at an impressive 107.7%. Those numbers speak volumes about the company’s ability to reward patient investors over the long haul. In the past week alone, shares gained 4.0% as market sentiment around the energy sector improved and investors continued to reevaluate long-term demand for natural gas. Yet, when market excitement cools, the real question is always the same: how much value remains in the price?

Despite these upbeat stats, EQT’s current valuation score is 0 out of 6, meaning by our usual six-point checklist, it is not showing signs of being undervalued in any category right now. That might sound like a reason for caution, but it is only part of the story. Next, we will dig into the tools and checks used to assess EQT’s valuation, and hint at a smarter, more holistic way to judge whether this stock deserves a spot in your portfolio for the long run.

EQT scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: EQT Excess Returns Analysis

The Excess Returns model is designed to measure how much value a company generates above its cost of equity. This method places less emphasis on traditional earnings and instead examines whether the capital deployed by EQT is generating sufficient excess profit for shareholders.

Considering the core components, EQT has:

- Book Value: SEK6.21 per share

- Stable EPS: SEK1.52 per share, based on weighted future Return on Equity estimates from 8 analysts

- Cost of Equity: SEK0.46 per share

- Excess Return: SEK1.06 per share

- Average Return on Equity: 20.81%

- Stable Book Value: SEK7.31 per share, based on weighted estimates by 5 analysts

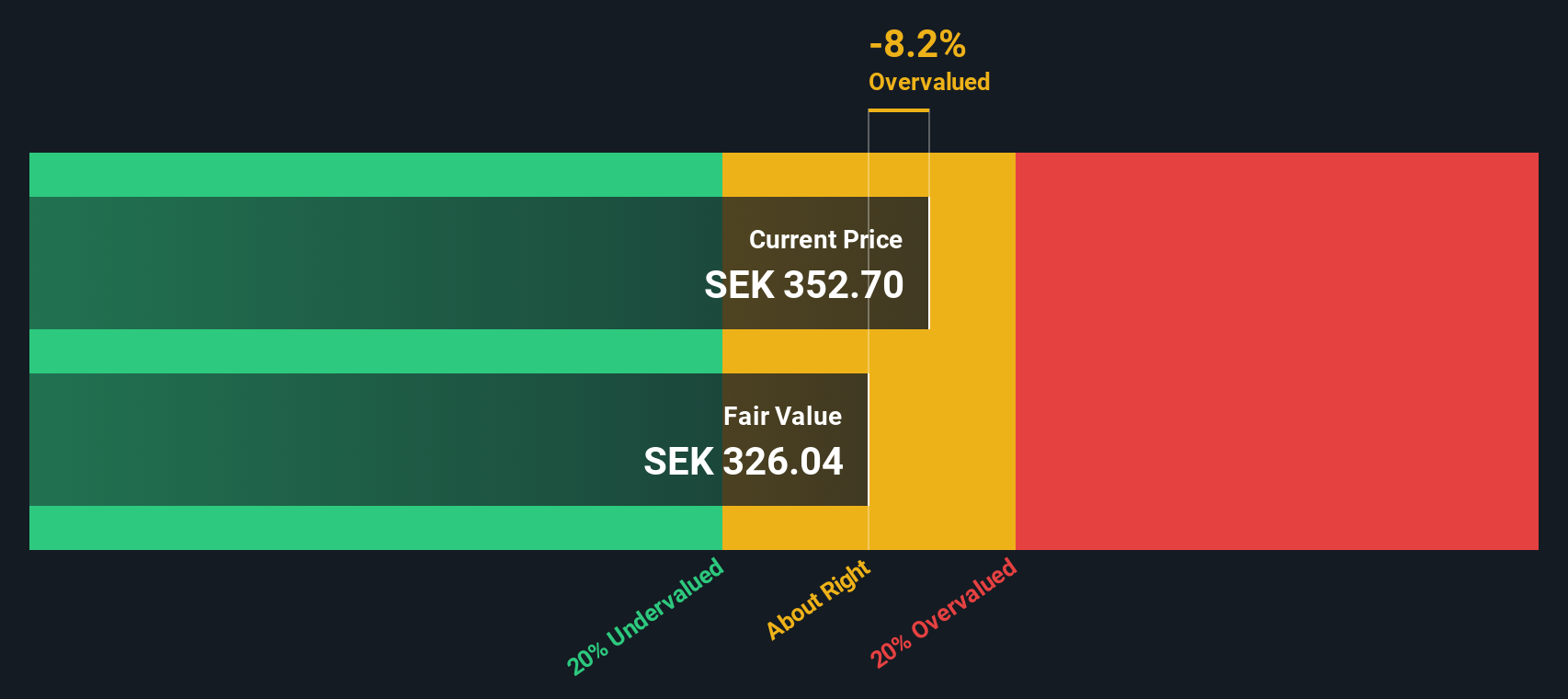

This model suggests EQT consistently earns returns on its investments well above its cost of equity, which usually signals efficient capital allocation. When comparing the calculated intrinsic value to the current market price, the analysis indicates EQT is trading at about 3.9% above its intrinsic worth.

While this is a slight premium, it remains within a margin where the stock can still be regarded as fairly valued by market standards.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out EQT's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: EQT Price vs Earnings

For companies like EQT that report strong and consistent profits, the Price-to-Earnings (PE) ratio is one of the most informative ways to assess valuation. PE ratios are widely used by investors because they help gauge how much the market is willing to pay for each unit of earnings, offering quick insights into market expectations about a company’s growth and risks.

It is important to note that what constitutes a “normal” or fair PE ratio is not fixed. Higher growth prospects and lower perceived risk tend to justify higher PE multiples, while more mature or riskier companies usually trade at lower ratios. This is why context matters so much when considering whether a company’s PE multiple is justified.

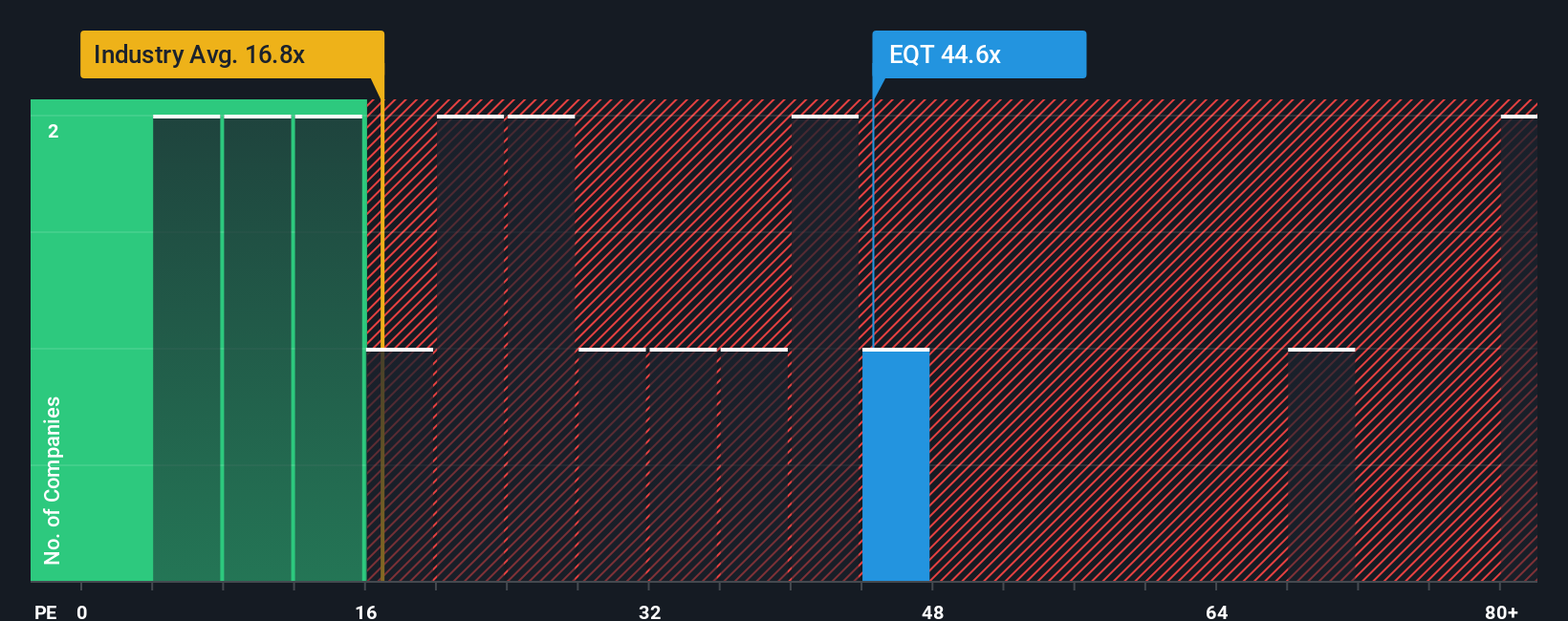

EQT currently trades at a PE of 43.1x. This stands well above the Capital Markets industry average of 19.6x and also exceeds the peer average of 27.1x. However, a simple comparison to industry or peer benchmarks does not always tell the full story, especially for companies with growth and profitability profiles that differ from the pack.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio for EQT is calculated at 33.8x, taking into account key factors like the company’s earnings growth, profit margins, size, industry characteristics, and even business risks. Unlike the blunt approach of comparing to peers or industry averages, the Fair Ratio adjusts for what makes EQT unique, offering a more nuanced sense of what is reasonable to pay.

Comparing EQT’s actual PE of 43.1x to its Fair Ratio of 33.8x shows that shares are trading at a premium to what fundamentals would suggest is fair. The gap is significant enough to indicate that the stock may be overvalued by this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your EQT Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, an approach that connects your view of a company's story with a financial forecast and an estimate of fair value.

A Narrative is your perspective on a company, explained in plain English and supported by your own assumptions for future revenue, earnings, and margins. It goes beyond the numbers to clearly state your reasoning behind what you think EQT is worth and why.

Narratives make complex analysis accessible, allowing you to easily link the story you believe in, such as global growth, new product launches, or margin expansion, to a dynamic financial model that adjusts automatically as news, earnings, and fresh data arrive.

This means that when something changes for EQT, your Narrative updates with it, giving you a constantly relevant view of whether the current price offers opportunity or risk, and helping you decide when to buy or sell based on your fair value compared to the market.

Millions of investors use Narratives on Simply Wall St’s Community page to see consensus views, debate the future, and sense-check their thinking against others.

For example, some investors believe EQT's expansion in the US and Asia will drive the share price as high as SEK405.55, while others are more cautious and see a fair value closer to SEK316.53. Both points of view are easily tracked and compared as Narratives on the platform.

Do you think there's more to the story for EQT? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EQT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EQT

EQT

A global private equity & venture capital firm specializing in private capital and real asset segments.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives