- Sweden

- /

- Capital Markets

- /

- OM:EQT

Evaluating EQT (OM:EQT): Is There Value Left After Recent Share Price Gains?

Reviewed by Kshitija Bhandaru

EQT (OM:EQT) shares have seen some movement lately, drawing curiosity from investors watching recent price trends. With a year-to-date gain of 10% and strong multi-year returns, there is ongoing interest in how valuation compares to growth.

See our latest analysis for EQT.

Momentum in EQT’s share price has been quietly building, supported by solid year-to-date gains and long-term total shareholder returns that continue to outpace the broader market. While recent daily moves have been modest, investors appear to be responding to the company’s steady growth profile and strengthening fundamentals. This has supported confidence in EQT’s outlook.

If you want to expand your search for dynamic companies, now’s an excellent time to discover fast growing stocks with high insider ownership

With impressive returns over the past several years, the question now is whether EQT shares are trading below their true value or if the market has already factored in the company’s expected growth. Is there a buying opportunity, or is future upside already reflected in the price?

Most Popular Narrative: 7.4% Undervalued

Compared to EQT’s last close of SEK340.3, the most widely followed narrative points to a fair value of SEK367.61. The market price sits below this consensus, setting the scene for expectations of future upside, which are supported by expansion into growing markets and a step change in profitability.

The firm's global diversification, especially its push into fast-growing Asian markets (for example, India and Japan) and the U.S., positions it to benefit as more capital is funneled into private assets in these regions, supporting sustained AUM growth and higher future earnings.

Want to see what really drives this bullish price target? The heart of this narrative is a bold bet on international growth, profit margin expansion, and a future earnings goal that is anything but conservative. Eager to uncover which numbers have analysts projecting an ambitious fair value for EQT? Click to decode the projections and the provocative growth story behind them.

Result: Fair Value of SEK367.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower fundraising or execution challenges during rapid expansion could test EQT’s ambitious growth outlook and undermine the current valuation narrative.

Find out about the key risks to this EQT narrative.

Another View: Price-to-Earnings Tells a Different Story

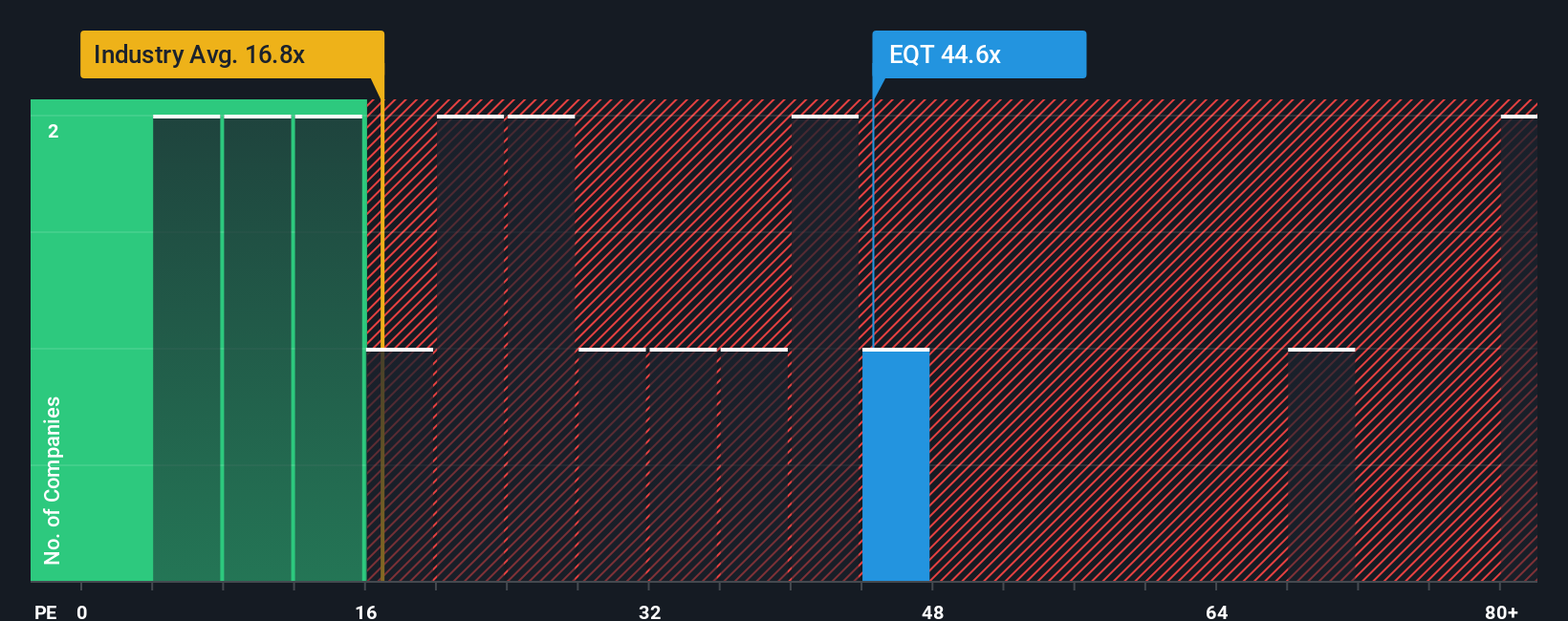

Looking from a price-to-earnings angle, EQT’s ratio is 43.2x, which is much higher than both the peer average of 25x and the European Capital Markets industry’s 15.9x. Even compared to its fair ratio of 33.8x, EQT appears expensive, raising questions about valuation risk if growth expectations stumble. Could this premium signal a crowded trade, or is the market willing to pay more for EQT’s global ambitions?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EQT Narrative

If you see things differently, or want to run the numbers yourself, you can build and share your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding EQT.

Ready for More Winning Ideas?

If you’re serious about elevating your returns, don’t let limited research hold you back. The right screener can put untapped opportunities within your reach. Stay ahead of the market and find your next standout investment today.

- Spot undervalued growth by searching for true bargains among these 901 undervalued stocks based on cash flows, where future cash flows could unlock substantial upside.

- Target reliable income streams and amplify your portfolio with these 19 dividend stocks with yields > 3% delivering yields above 3%.

- Uncover powerful tech opportunities primed to disrupt entire industries with these 24 AI penny stocks at the leading edge of innovation and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EQT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EQT

EQT

A global private equity & venture capital firm specializing in private capital and real asset segments.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026