- Sweden

- /

- Capital Markets

- /

- OM:EQT

3 Stocks Estimated To Be Trading Up To 15.1% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate a mixed economic landscape with fluctuating consumer confidence and varied performance across regions, investors are increasingly on the lookout for opportunities that might be undervalued. In this context, identifying stocks trading below their intrinsic value can offer potential advantages, especially when market conditions present both challenges and openings for strategic investment decisions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Globetronics Technology Bhd (KLSE:GTRONIC) | MYR0.585 | MYR1.17 | 49.8% |

| Wasion Holdings (SEHK:3393) | HK$7.13 | HK$14.19 | 49.7% |

| First Solar (NasdaqGS:FSLR) | US$176.24 | US$350.71 | 49.7% |

| Strike CompanyLimited (TSE:6196) | ¥3655.00 | ¥7309.53 | 50% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| Charter Hall Group (ASX:CHC) | A$14.35 | A$28.70 | 50% |

| Cettire (ASX:CTT) | A$1.51 | A$3.02 | 49.9% |

| Medley (TSE:4480) | ¥3835.00 | ¥7652.96 | 49.9% |

| Ally Financial (NYSE:ALLY) | US$36.01 | US$71.71 | 49.8% |

| ASMPT (SEHK:522) | HK$74.90 | HK$149.66 | 50% |

Let's dive into some prime choices out of the screener.

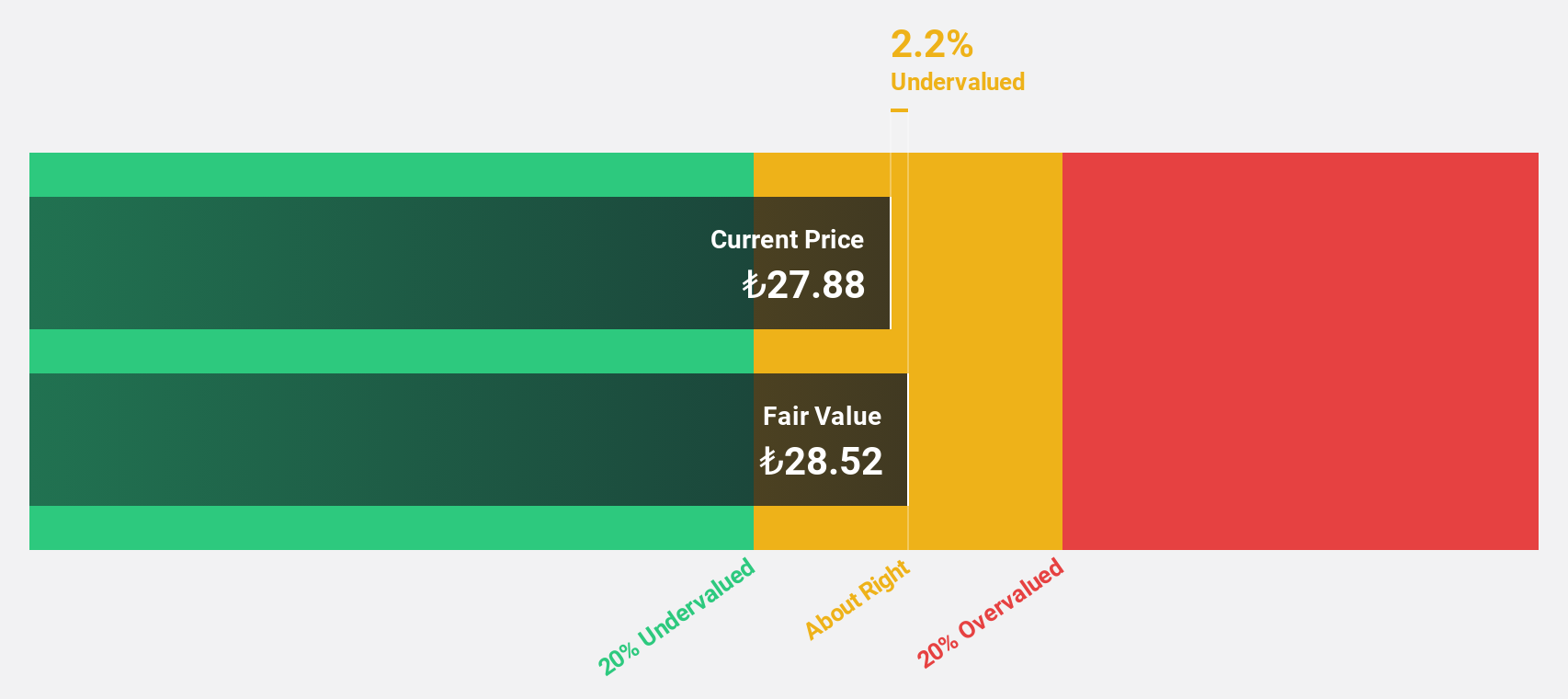

Yapi ve Kredi Bankasi (IBSE:YKBNK)

Overview: Yapi ve Kredi Bankasi A.S., along with its subsidiaries, offers a range of banking products and services in Turkey and internationally, with a market cap of TRY258.65 billion.

Operations: The company's revenue is derived from several segments, including Retail Banking (Incl. Private Banking and Wealth Management) at TRY80.12 billion, Commercial and SME Banking at TRY51.26 billion, Corporate Banking at TRY13.81 billion, Other Domestic Operations at TRY12.60 billion, and Other Foreign Operations contributing TRY4.95 billion.

Estimated Discount To Fair Value: 14.0%

Yapi ve Kredi Bankasi is trading at TRY30.62, below its estimated fair value of TRY35.61, with analysts expecting a 20.4% price rise. Despite a drop in net income from TRY48.70 billion to TRY22.41 billion over the past year, earnings are forecast to grow significantly at 44% annually, outpacing the Turkish market's growth rate of 34.9%. However, profit margins have decreased and non-performing loans remain high at 3%.

- Our comprehensive growth report raises the possibility that Yapi ve Kredi Bankasi is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Yapi ve Kredi Bankasi's balance sheet health report.

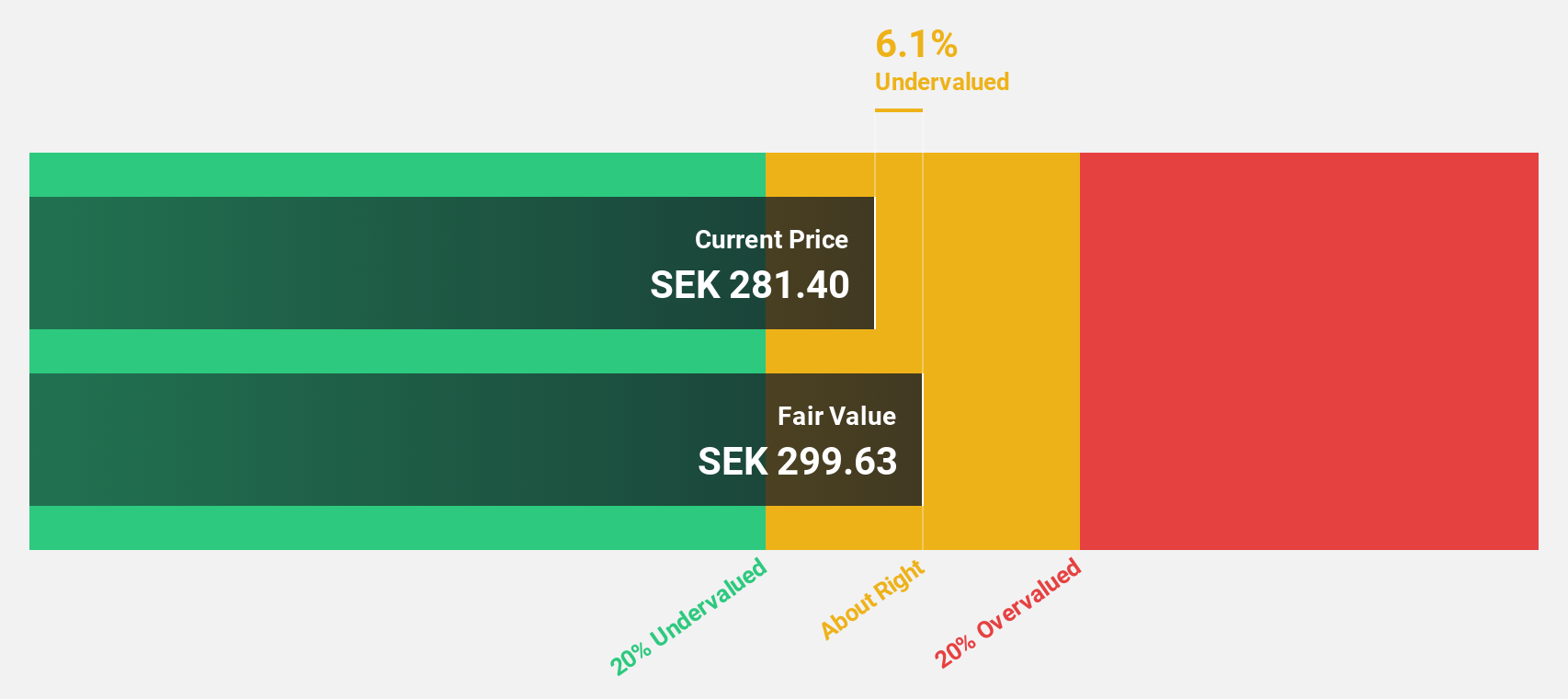

EQT (OM:EQT)

Overview: EQT AB (publ) is a global private equity firm focusing on private capital and real asset segments, with a market cap of approximately SEK361.61 billion.

Operations: The company's revenue is primarily derived from its Private Capital segment (€1.28 billion) and Real Assets segment (€878.70 million), with an additional contribution from the Central segment (€37.20 million).

Estimated Discount To Fair Value: 15.1%

EQT is trading at SEK306.1, slightly below its fair value estimate of SEK360.35, with earnings expected to grow significantly at 33.3% annually, outpacing the Swedish market's growth rate of 14.8%. Despite recent insider selling and large one-off items affecting results, EQT's revenue is projected to grow faster than the market at 15.1% per year. Ongoing M&A activities could influence future cash flow dynamics and valuation assessments.

- According our earnings growth report, there's an indication that EQT might be ready to expand.

- Unlock comprehensive insights into our analysis of EQT stock in this financial health report.

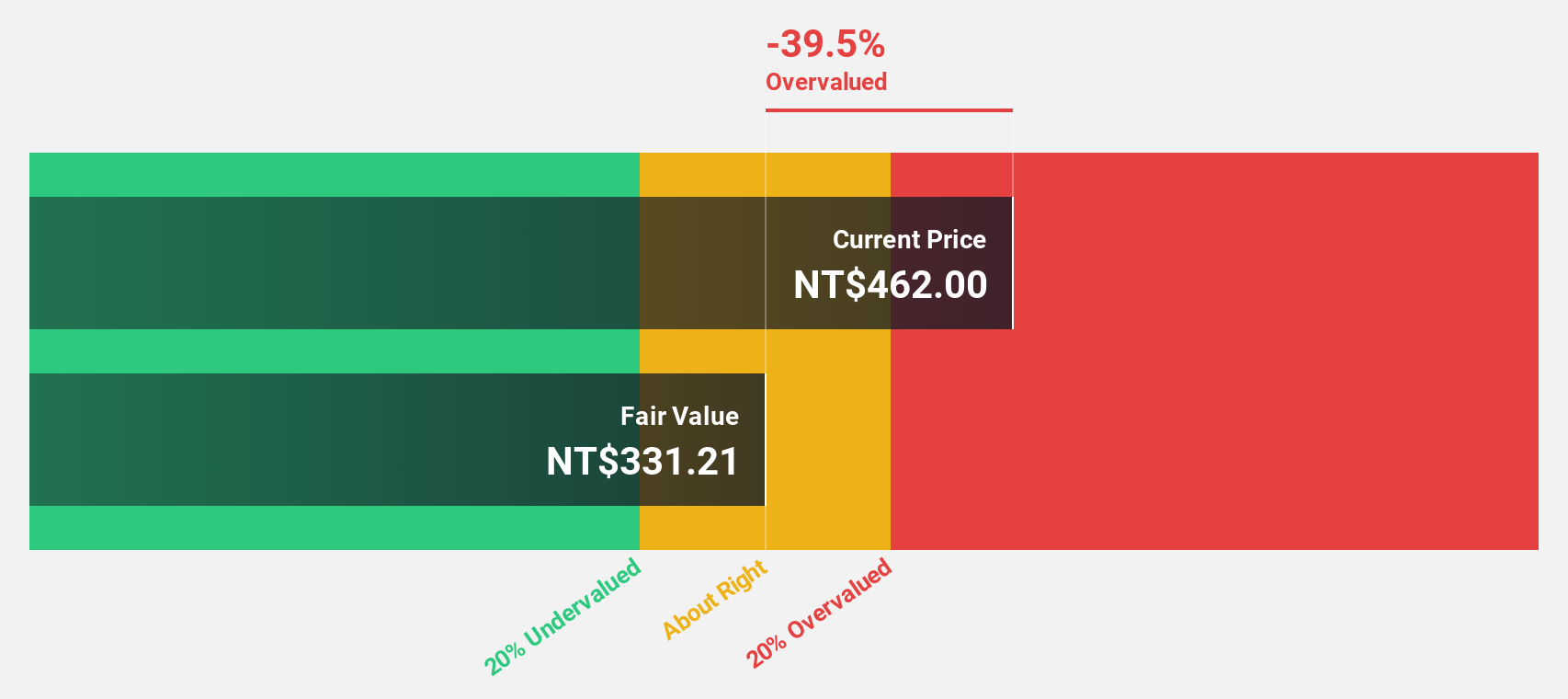

Fortune Electric (TWSE:1519)

Overview: Fortune Electric Co., Ltd. manufactures, processes, and sells transformers, inverters, power distribution boards, and high-low voltage switches both in Taiwan and internationally with a market cap of NT$161.67 billion.

Operations: The company's revenue segments include NT$1.69 billion from General Contracting and NT$16.96 billion from Mechanical and Electrical operations.

Estimated Discount To Fair Value: 11.2%

Fortune Electric, trading at NT$563, is undervalued relative to its fair value estimate of NT$633.83. Recent earnings growth of 97.8% and a forecasted annual profit increase of 32.1% highlight strong cash flow potential, exceeding Taiwan's market average growth rate of 19%. Despite high share price volatility, the company’s expansion plans with a new factory construction worth TWD 773.95 million suggest strategic capacity enhancements to support future revenue growth surpassing 24% annually.

- The analysis detailed in our Fortune Electric growth report hints at robust future financial performance.

- Click here to discover the nuances of Fortune Electric with our detailed financial health report.

Summing It All Up

- Reveal the 872 hidden gems among our Undervalued Stocks Based On Cash Flows screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if EQT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EQT

EQT

A global private equity & venture capital firm specializing in private capital and real asset segments.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)